[ad_1]

A high funding financial institution has claimed that inflation in Britain has peaked however it’s going to take a very long time to fall.

Based on Deutsche Financial institution, new information on Wednesday from the Nationwide Statistics Workplace will present a ten.9 % rise in costs in comparison with the earlier 12 months.

whereas above September’s studying of 10.1 % “Inflation will possible peak in October,” stated Sanjay Raja, an economist on the agency, and a 40-year excessive.

If his gambit materialises, it’s going to present a welcome respite from the steep rise in inflation over the previous 12 months or so.

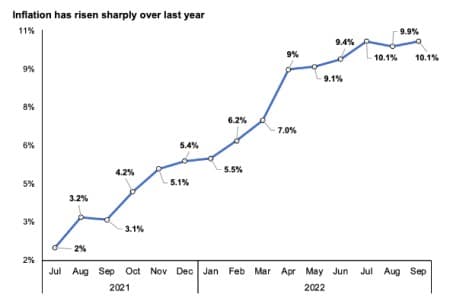

Inflation has been above the Financial institution of England’s two % goal because the summer time of 2021. It decreased barely in August, solely to extend once more in September.

Inflation has elevated quicker than final 12 months

Supply: ONS

Increased vitality costs, a spurt in provide chains after the COVID-19 unlocking, and a pointy rise in wages have pushed costs increased. Russia’s invasion of Ukraine has additionally fueled inflation by jolting worldwide vitality markets.

The king stated vitality regulator Ofgem’s value cap raised to £2,500 – stored beneath approach by the federal government on family vitality prices – drove October’s inflation.

Nevertheless, he warned that inflation would proceed to stay excessive.

“Rising second spherical results and a good labor market are prone to maintain value pressures in 2023, significantly with respect to providers inflation,” he added.

The Financial institution of England has raised rates of interest eight instances in a row to 3 per cent, together with a 75 foundation level improve earlier this month, the most important improve in 30 years.

The sequence of fee hikes are designed to make it dearer to borrow cash and extra enticing to save lots of, thereby curbing spending and, in concept, costs.

Central banks can not include the present value rise. As a substitute, they elevate rates of interest to forestall so-called “second spherical” results, during which employees demand wage will increase and companies quickly improve costs, creating an inflationary suggestions loop.

by Metropolis AM

[ad_2]

Supply hyperlink