[ad_1]

Justin Sullivan

funding thesis

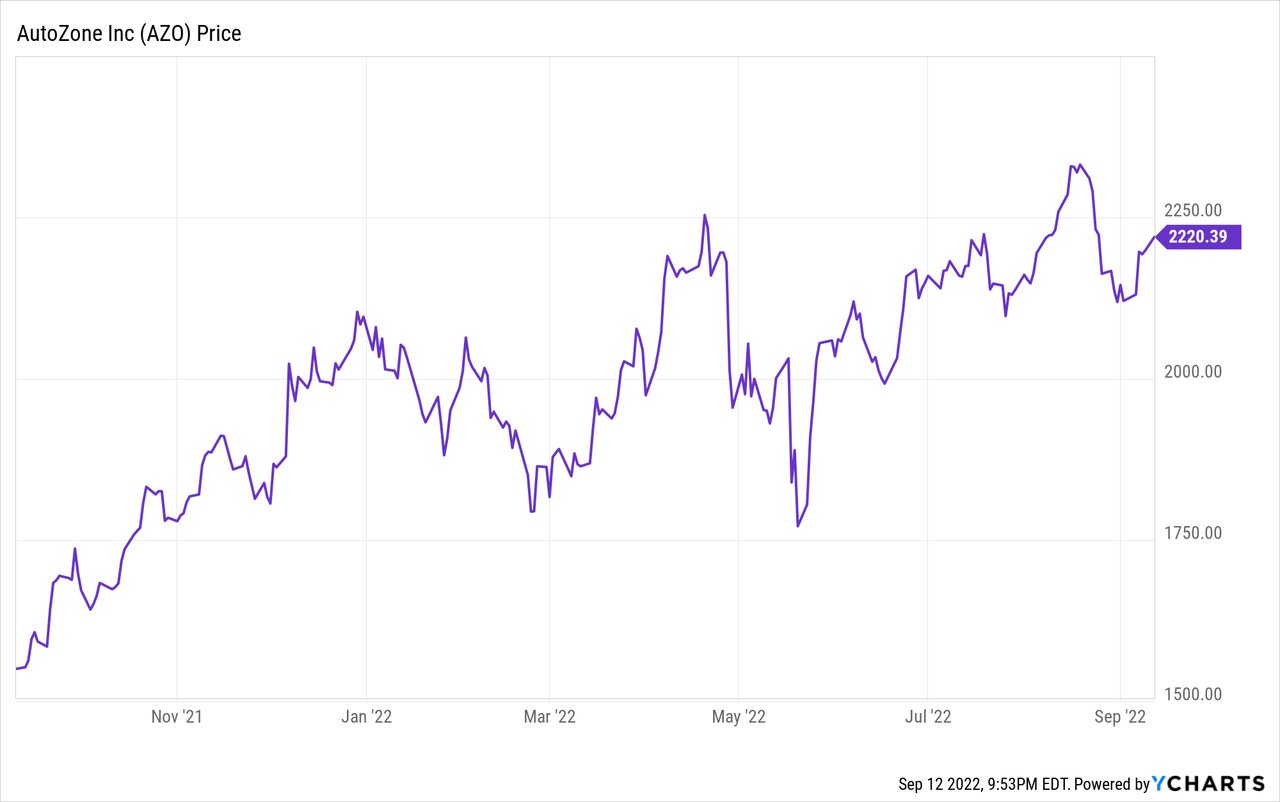

For the previous 12 months or two, I have been part of AutoZone, Inc. I’m contemplating taking a place. ,NYSE: AZO), a number one retailer of automotive substitute components and equipment. It is exhausting to not be attracted by AutoZone as a result of Its sturdy enterprise fundamentals and lengthy working historical past. AutoZone has grown Free Money Stream (“FCF”) at 11.5% CAGR and EPS at 17.2% CAGR. final 10 years, These are outstanding outcomes by any measure.

Moreover, automotive retailers akin to AutoZone, O’Reilly’s (ORLY), and Advance Auto Elements (AAP) are thought of considerably recession resistant. It is because shoppers in search of cash are much less possible to purchase new autos throughout robust financial instances, however they choose to restore and/or preserve their present autos to save cash. On condition that the US is presently on the verge of a recession or might already be in a single, this might be a catalyst for the autozone.

So why cannot I carry myself to purchase one? Reply – Electrical autos (“EVs”). Within the quick time period, AutoZone appears to be like like a winner, however in the long run, I am far much less positive. It is easy to see that EVs are the long run, and, like them or not, they’ve only a few transferring components, no engine oil, many with no transmission fluid, and so on… as soon as EVs are on the highway. Most autos characterize that, so I can not assist however imagine it should take an enormous reduce in AutoZone’s income and profitability.

As a lot as I really like the basics of AutoZone, I can not suggest shopping for it right here until you need to take the previous few puffs out of a cigar. With a recession on the horizon, AutoZone may gain advantage from the buyer’s financial woes, however past that, I like to recommend staying on the sidelines.

cigar butt technique

Should you’re unfamiliar with the cigar butt technique pioneered by Benjamin Graham and Warren Buffett, it makes an attempt to seek out firms which can be believed to have a bull run or two left sooner or later. Think about you are an avid cigar smoker strolling down the road, and you discover what seems to be a high quality cigar thrown into an ashtray. The cigar is barely smoked 3/4 and also you, being a deeply valued cigar fanatic, determine to take it for the previous few puffs. A bit of disgusting to think about, however a pleasant analogy for shares. On this article, I am going to discover the concept that AutoZone may characterize such a chance.

Rise of EVs

The writing is on the wall relating to the transition to EVs. It not appears a mere risk, however a necessity. The US has vowed to finish gross sales of gasoline-powered autos by 2035, and so they be part of six main automakers and 29 different nations in taking the pledge. That is nice for firms like Tesla (TSLA) and Ford (F), however I can not assist however imagine it is a main headwind for automotive retailers like AutoZone.

Sure, EVs ought to take a very long time (even a decade) to overhaul inner combustion engines (ICE), however waiting for the inventory market, I ponder how far into the long run it should see AutoZone’s shares worth. , How lengthy did it take for a blockbuster to go after Netflix (NFLX) got here on the scene? I do not suppose the impact shall be as intense or speedy on AutoZone, however it’s reminiscent.

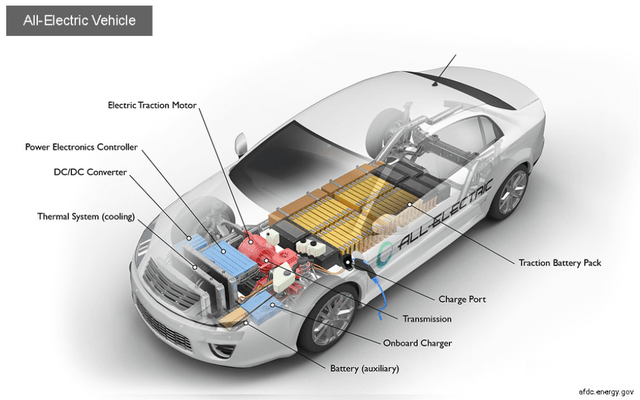

EVs require much less DIY upkeep

EVs are a risk to the AutoZone as a result of they’ve only a few transferring components. With fewer transferring components there are fewer alternatives for components to interrupt. EVs don’t have any valves or pistons that require commonplace motor oil, and many don’t comprise transmission fluid. I am not suggesting that EVs do not require upkeep, fluids, batteries, and so on… as a result of they do, however upkeep cycles are more likely to be way more intermittent than ICEs.

EV Diagram (US DOE)

Here’s a checklist of frequent upkeep objects for EVs:

- 7,500 miles: Verify fluids and examine techniques. Rotate the tire.

- 15,000 miles: Change wiper blades.

- 36,000 miles: Change cabin air filter.

- 75,000 miles: Change hood gasoline struts.

- Each 5 years: Fill car fluids and exchange brake fluid.

- Each 7 years: Change the air con desiccant.

Along with commonplace oil modifications and fluid replacements, here’s a checklist of upkeep objects relevant to ICEs, however to not EVs:

- exchange spark plug

- change gas filter

- drive belts swap

- exchange water pump

- carburetor flooding/points

- blown head gasket

- belt/hose substitute

- radiator downside

- put on ring and cylinder

- Bearings / Crankshaft / Camshaft

- exhaust system/pipe

In the end, I feel the transition to EVs means there shall be far fewer shoppers going to the autozone regularly. With gross sales of engine oil, miscellaneous transferring components, transmission fluid, and so on… probably deteriorating over the subsequent a number of years, I discover it tough to be optimistic about AutoZone’s future.

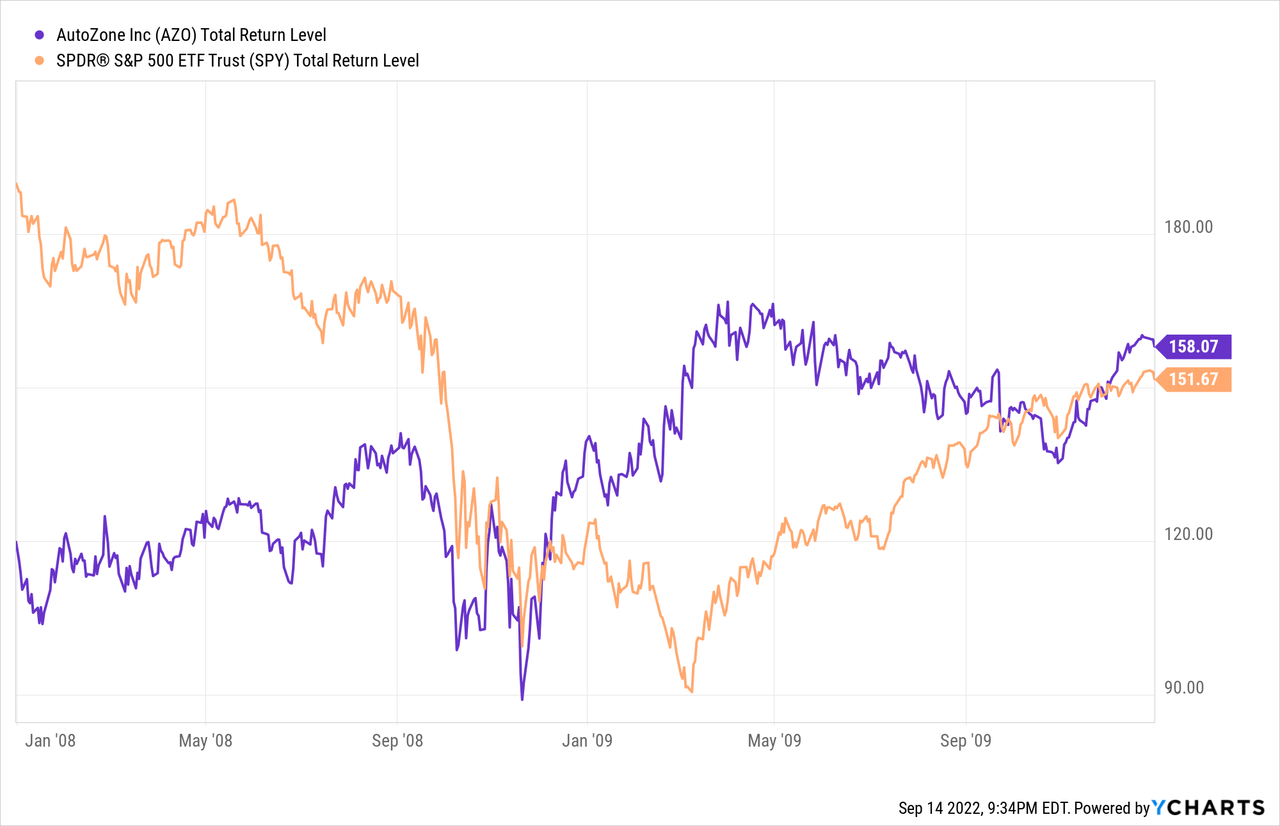

cigar butt in a stoop

The one brilliant spot I see is AutoZone might be a cigar butt story, on condition that the economic system is presently on the verge of recession. Automotive retailers akin to AutoZone have carried out effectively up to now recession with car house owners abandoning car upgrades and choosing upkeep and restore. For instance, through the Nice Recession of 2008, AutoZone elevated gross sales by 5.7% in 2008 and its inventory rose 20% whereas the S&P 500 declined 34%. It beats 54% of the index. With inflation rising to eight.3% after August’s CPI report, I can not assist however marvel if AutoZone is perhaps poised to outperform once more.

Analysis

AutoZone’s previous monetary efficiency has been pretty constant and predictable, so I really feel snug utilizing the P/E for analysis. Based on In search of Alpha, AutoZone’s 5YR common P/E is round 16.9. With a present P/E of 19, AutoZone seems to be round 10-15% overvalued from a historic perspective, however total, at $2,133, I imagine the shares to be considerably overvalued or barely overvalued goes. This does not shock me an excessive amount of, on condition that the market is trying ahead and may count on bearishness, which may lead to a premium for AutoZone or pricing outright.

My greater concern is the longer-term EPS story if EVs actually begin consuming into AutoZone’s income and earnings. I feel AutoZone’s EPS could also be on the verge of plateauing, with the potential to lower over time. Share buybacks can enhance the time earlier than the masks and/or EPS come down, however this makes it very tough to estimate the 5-7 12 months worth goal.

danger

The dangers of this funding thesis are a bit odd as I really feel the necessity to give my ideas if you’re trying to promote as a consequence of EV issues or if you’re trying to purchase to trip the bearish wave.

sellers

Should you had been to promote to AutoZone due to an EV concern, there is a risk I’ve escalated the priority they really characterize. Or it may take 50+ years for the EV transition to take impact and have an effect on the AutoZone. In the meantime, earnings in addition to its potential shares of AutoZone proceed to understand. If this occurs, buyers will miss out on the value hike.

Moreover, it’s potential that AutoZone might strike some type of cope with Tesla or Ford to provide specialised EV components to auto makers. This might be a significant catalyst for AutoZone, leading to continued progress in income and earnings.

purchaser

Should you’re trying to purchase AutoZone to get out of a recession, it is possible that it too succumbs to the woes of the economic system and tanks with it. There isn’t a assure that AutoZone shall be as recession-resistant throughout this or future recession because it was within the earlier recession. Additionally, if buyers need to maintain onto the autozone in a downturn and promote as soon as the economic system has a stable footing, market timing comes into play, which requires good luck. The timing is improper and all bearish good points have the potential to pay again.

conclusion

I am a fan of AutoZone and admire its monetary efficiency and enterprise fundamentals, however I feel its future is just too unsure to spend money on for the long run. As an alternative, buyers might think about taking positions or holding onto shares whereas the economic system is dealing with hostile situations as a consequence of inflation and rising rates of interest. If the previous is any predictor of the long run, AutoZone might be poised to outperform whereas the general market continues to say no. Nevertheless, as soon as financial adversities start to ease, this might be alternative to promote with energy, then sit on the sidelines till AutoZone’s future turns into a bit clearer. Take one final puff of the cigar, then park it within the ashtray and wait.

[ad_2]

Supply hyperlink