[ad_1]

Banks globally are discovering that there are actually fewer company takeovers to finance, forcing lenders to give attention to a much less profitable enterprise: lending to companies to cowl rising bills amid excessive inflation.

article materials

(Bloomberg) — Banks globally are discovering that there are actually fewer company takeovers to finance, forcing lenders to give attention to a much less profitable enterprise: loans to companies to cowl rising bills amid excessive inflation. To present.

Advert 2

article materials

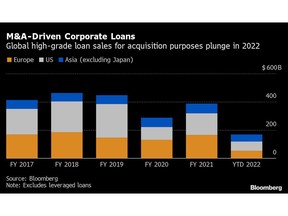

In accordance with knowledge compiled by Bloomberg, the worth of worldwide acquisitions has fallen by about 29% in comparison with the identical interval a 12 months in the past, amid widespread market volatility that leaves companies coping with rising rates of interest. This led to a drop in new enterprise for banks arranging high-end mortgage help offers, with a 55% year-on-year decline within the US and an analogous decline in Europe in comparison with the identical interval in 2021.

article materials

It provides to a worrying image for lenders, with Citigroup Inc lately warning that the dealmaking slowdown is right here to remain. Though banks are changing among the misplaced enterprise by arranging funds to cowl rising bills of firms as enter prices rise, that sort of transaction is way much less worthwhile than arranging loans. Which are sometimes massive M&A offers.

Advert 3

article materials

“The dearth of M&A-driven mortgage transactions could have a profound influence on the lending companies of banks and mortgage funds, stated Alexander Schilling, who advises on loans as a companion on the regulation agency Noir.” Basic Company Lending Because of their giant transaction measurement and better margins, M&A-driven loans are substantial for the profitability of the financial institution’s lending enterprise.”

The hit to banks’ investment-grade companies comes as their leveraged-loan desks battle with losses from committing buyout financing to promote them at a reduction or preserve them on their stability sheets. It’s because traders’ urge for food for riskier credit score has waned because the chance of an financial downturn will increase.

The US has seen the chance urge for food of the markets shattered as giant offers fail to satisfy anticipated demand. Citrix Methods Inc. The banks realized a lack of roughly $600 million after discontinuing financing commitments for the acquisition of Rs. Wall Road companies are set to fund the debt because of the leveraged buyout of Nielsen Holdings. A bunch led by Financial institution of America Corp and Barclays plc needed to cancel a $3.9 billion mortgage sale to buy an Apollo International Administration Inc.-backed telecommunications enterprise known as Brightspeed.

Advert 4

article materials

Funding-grade debt gross sales have not been completely quiet, although squeezed firms are looking for extra funding to cowl rising bills. Commodity buying and selling homes and energy producing firms are taking over extra debt amid rising vitality costs. In the meantime, Expo Holding AG, Mercuria Vitality Group Ltd and Trafigura Group have added extra loans this 12 months.

Reinhard Haas, head of syndicated finance at Commerzbank AG, stated: “The lacking hole in M&A-driven finance is generally fueled by supplementary liquidity necessities coming from the trade, to be able to address the upper buy costs.” “Particularly within the vitality sector and from commodity merchants, we see an elevated demand that interprets into new transactions.”

Advert 5

article materials

US Within the U.S., acquisition loans are nonetheless being made, albeit much less often. Oracle Corp. as an alternative of changing it with a brand new funding grade bond, Cerner Corp. opted to borrow extra funds from a time period mortgage to refinance the bridge mortgage borrowed to pay for the acquisition of Rs. Whirlpool Corp additionally raised $2.5 billion in time period loans in September.

In accordance with Lucie Campos Kersmel, head of EMEA company mortgage distribution with Credit score Agricole Company and Funding Financial institution, “stability and visibility” within the economic system, and “recoveries within the fairness and bond markets may assist the M&A market get better.”

Elsewhere within the credit score markets:

Of America

Three debtors seeking to promote bonds within the US investment-grade major market stood down on Tuesday.

Advert 6

article materials

- Banks revised the mortgage construction and formally sweetened pricing on a $2.25 billion mortgage provide for LATAM Airways Group SA after the corporate struggled to search out consumers to finance the chapter exit.

- JPMorgan Asset Administration’s outspoken chief funding officer Bob Mitchell warns: A relentless greenback may paved the way within the subsequent market turmoil

- Vitality drink maker Bang Vitality, besieged by lawsuits, filed for Chapter 11 safety in Florida on Monday and plans to reform its distribution mannequin.

- In IG Markets, company bond gross sales have gotten more and more tough to foretell amid volatility, with sellers pushing up volumes in 4 of the previous 9 months, in line with knowledge compiled by Bloomberg.

Advert 7

article materials

EMEA

Germany and the European Union led the motion in Europe’s major market on Tuesday, as seven extremely rated debtors priced round €20 billion value of bonds.

- EU raises €11 billion from a brand new 20-year providing in addition to a faucet of current notes

- Swedish energy agency Vattenfall AB bought a three-part take care of mounted and floating notes in its first syndicated providing within the foreign money since June 2021, in line with knowledge compiled by Bloomberg.

- In accordance with a Bloomberg Intelligence evaluation, the company hybrid bond market could possibly be headed for the next run charge of missed first-calls within the close to future, with Aroundtown, EDF, Naturagi and Balder all doubtless in danger over the subsequent six months.

Asia

A lone issuer crossed the trail of the worldwide bond market with a proposal to boost {dollars} on Tuesday. Oriental Capital is tapping its 7% 2025 bond, in line with an individual acquainted with the matter.

Advert 8

article materials

- Demand for brand new greenback bonds issued by debtors in Asia excluding Japan rose in September regardless of the intensification of the worldwide bond route. In accordance with Bloomberg-compiled knowledge of accessible deal knowledge, orders for such choices had been 4.41 occasions their issuance measurement, up from 3.43 occasions in August and the best since June.

- Moody’s has withdrawn the CA company household score of Casa Group Holdings Ltd and Evergrande, it stated in separate statements. It eliminated Evergrande attributable to “inadequate or in any other case inadequate info to help the upkeep of the score”.

(Provides additional particulars in paragraphs sixth and eight and updates the part on Credit score Markets Elsewhere within the Americas.)

commercial

[ad_2]

Supply hyperlink