[ad_1]

Whirlpool Company WHR manufactures and markets house home equipment and associated merchandise globally. The corporate’s flagship merchandise embrace fridges, freezers, ice makers, water filters, laundry tools and dishwasher tools. WHR distributes its merchandise below well-known manufacturers resembling Maytag, KitchenAid, Whirlpool, Everydrop and Royalstar manufacturers. The corporate sells its merchandise to retailers, distributors, sellers, builders and on to shoppers.

jacques rundown

WHR has been performing poorly available in the market since final one 12 months. Jacques Rank #5 (Sturdy Promoting) Inventory, WHR skilled a climax in Could final 12 months and has since declined in worth. The inventory is hitting a collection of 52-week lows and represents a tempting quick alternative because the market continues its unstable begin to the 12 months.

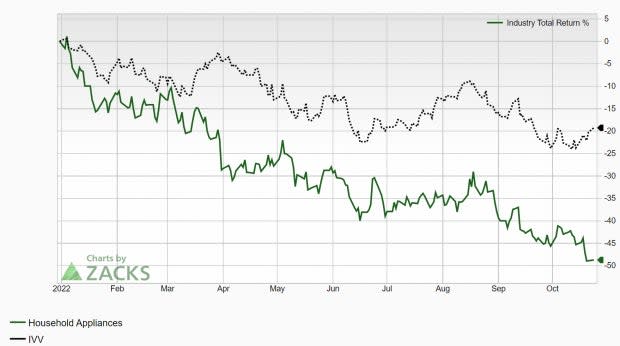

Whirlpool is a part of the Jax house equipment business conglomerate, which is at present down 9% out of about 250 industries. Since this business is ranked within the backside half of all jack ranked industries, we anticipate it to underperform the market within the subsequent 3 to six months. The business is down about 49% this 12 months, outperforming the market broadly:

Picture Supply : Jacques Funding Analysis

Whereas particular person shares have the potential to outperform even when poorly performing industries are concerned, their business affiliation serves as a headwind to any potential rallies. Additionally notice the unfavorable traits of this group beneath:

Picture Supply : Jacques Funding Analysis

Weak basis: Earnings hunch and deteriorating forecast

The earnings loss has been a tragic place for WHR these days. The house home equipment firm just lately reported Q3 earnings outcomes final week of $4.49/share, a -19.68% miss versus the $5.59 consensus estimate. Income of $4.78 billion additionally missed -8.62%, and WHR missed income estimates for the previous 5 quarters. Persistently lacking expectations by a large margin is a recipe for a inventory’s worth underperformance.

Analysts final week lower fourth-quarter earnings estimates by -8.81%. The Zacks consensus estimate is now at $5.38 per share, reflecting destructive progress of -12.38% relative to the identical quarter final 12 months. Income is seen slipping -6.98% to $5.41 billion. These are the sorts of destructive developments that bears love to observe.

Picture Supply : Jacques Funding Analysis

Technical Outlook

WHR inventory has been falling steadily since final 12 months and has now established a properly outlined downtrend. Discover how each the 50-day (blue line) and 200-day (purple line) transferring averages are sloping down. Shares are down about 40% over the previous 12 months, and the inventory continues to commerce beneath each transferring averages.

Picture Supply: Stockcharts

Whereas not essentially the most correct indicator, the WHR makes use of what is named a ‘dying cross’ through which a inventory’s 50-day transferring common crosses beneath its 200-day transferring common. WHR must take a critical upward transfer and present rising earnings forecast revisions to take any lengthy positions within the inventory. The inventory is forming a collection of decrease ranges – one other good signal for the bears.

ultimate ideas

The deteriorating elementary and technical background means that the inventory doesn’t deserve a spot within the home portfolio. The truth that WHR is included in one of many worst-performing business teams offers one other headwind to a protracted listing of issues. Falling projections of future earnings will function a cover for any potential rallies, which can nurture the inventory’s downtrend.

WHR is rated ‘C’ in our Jacques Fashion Rating Development class, indicating additional weak spot. Potential traders could wish to put this inventory on maintain, or maybe embrace it as a part of a brief or hedge technique.

Need the newest suggestions from Zacks Funding Analysis? At this time, you’ll be able to obtain 7 finest shares for subsequent 30 days. Click on to get this free report

Whirlpool Company (WHR) : Free Inventory Evaluation Report

Click on right here to learn this text on Zacks.com.

Jax Funding Analysis

[ad_2]

Supply hyperlink