[ad_1]

Gazing out at an expansive new itemizing in southern Dallas, ranch dealer to the celebrities Bernard “Bernie” Uechtritz narrates how the land turns into rolling hills at roughly this very level in Texas, in contrast to the flatlands within the extremely developed area north of town.

“I see a polo subject,” he says, surveying a part of the 6,000-acre property. The tempo of melodic hills had given strategy to a spacious, broad expanse of pristine grass cowl, a local Texas-sized prairie grass pasture. Such a big ranch close to the lure of Dallas is a part of the way forward for land, as Uechtritz (pronounced you-tridge) portends it to be.

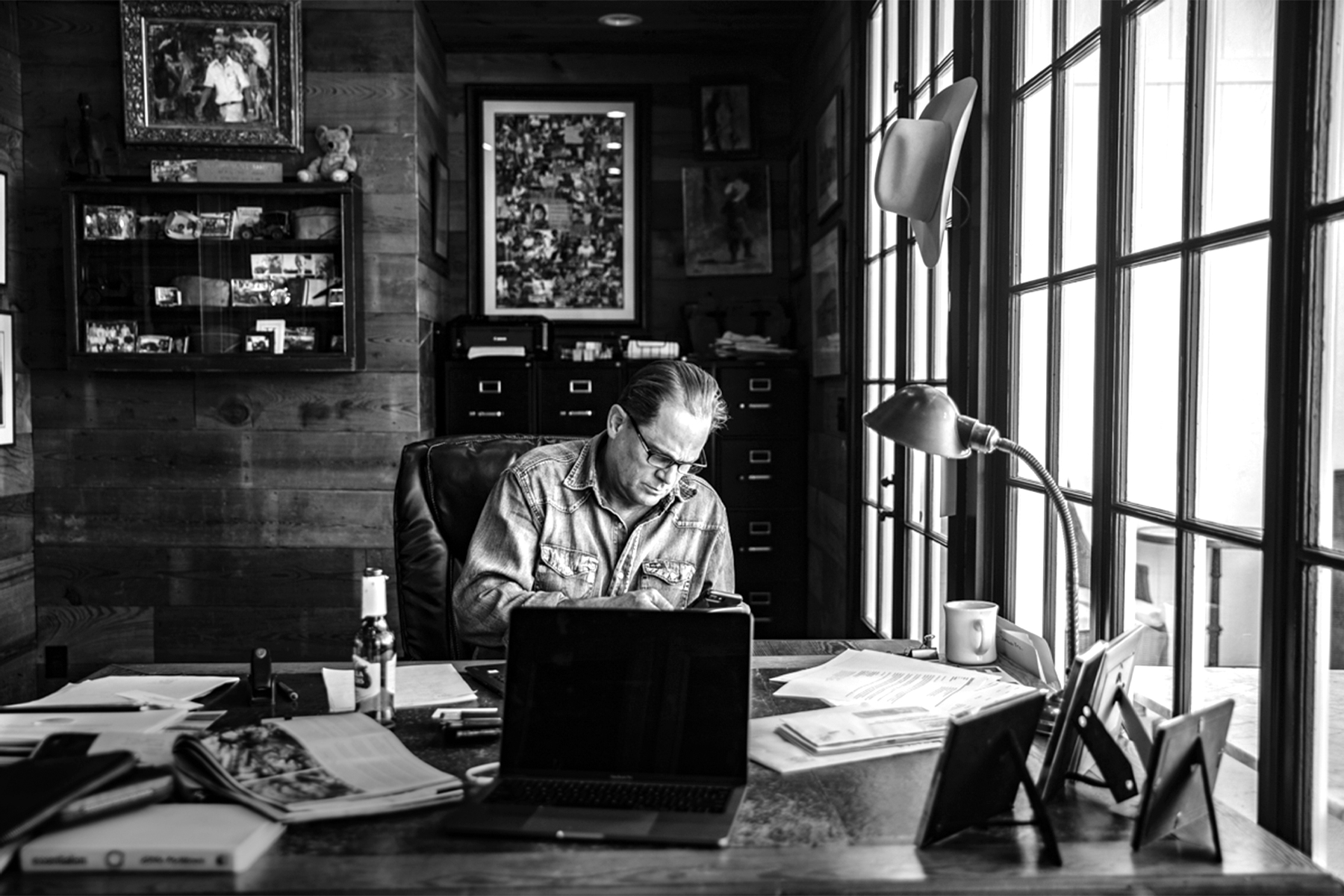

The 57-year-old has earned the correct to forecast the way forward for actual property. His story is rare however not totally distinctive to entrepreneurs who consistently innovate and adapt. His firm, Dallas-based Icon International, markets high-end, iconic actual property; as named, so delivered. His is the high-octane world of huge ranches, complicated offers, secrecy, and a discovered method that generates gross sales at costs not often seen.

Uechtritz’s story started in Rockhampton, Australia, a city recognized for sugar cane, rum, and cattle. Off the jap a part of Queensland, it sits north of Brisbane and the Gold Coast. He was largely raised in Papua New Guinea, with a number of stints at boarding colleges in New Zealand and Australia. Because the age of three, he was talking an older model of Pidgin English, a creolized language spoken by native New Guineans. By age 16, he was managing a big plantation—one which was dwelling to cocoa and coconut manufacturing, 4,000 head of cattle, and 150 water buffalo. These early New Guinea days had a major affect on his life. It was 50 dusty miles to the closest city of Lae, roughly midway between the equator and the fifteenth parallel within the South Pacific Ocean, north of his Australian birthplace.

In managing the plantation, Uechtritz labored with as many as 500 New Guineans from a half-dozen tribes. They taught him fast decision-making and the obligation of main many individuals—tractor drivers, plantation staff, cowboys, and the like. “I needed to be a health care provider, lawyer, marriage counselor, and peacekeeper,” he says. “It was an ideal duty and character-building, requiring an abundance of communications abilities.” He was primarily a sheriff who had to make use of farm administration abilities. The expertise additionally launched him to land transactions; the love of the deal took root in New Guinea.

However america was beckoning. Uechtritz was “consciously enamored with all issues America,” he says. The eighth of 11 youngsters, he spent a lot time alongside his father, rebuilding U.S. Military Jeeps and exploring miles of steep, marshy New Guinean kunai plains, mountains, and valleys, searching for conflict relics. The villagers’ storytelling in Pidgin English was at all times about heroic U.S. troopers who got here and saved their nation, saying, “Ol hap man tru ya, dispela line bilong America,” a phrase imprinted in Uechtritz’s thoughts. He interprets to me, “The People have been legendary, robust, and courageous troopers—bigger than life.”

Saturday treks to Lae to look at matinees of John Wayne as a marine within the morning, then True Grit within the afternoon, additional sealed the deal. At a German-American Missionary boarding faculty within the primitive, mountainous goldmining city of Wau, he grew to become much more enamored with the concept of transferring to the states.

A distinction of opinion with a boss in New Guinea compelled him to enterprise to Kentucky in 1986. He arrived with a saddle, six polocrosse racquets, and $800. He joined a landscaping crew, incomes the state wage of $4.83 per hour. “I survived in Kentucky and broke by way of the blueblood veil once I started enjoying polo,” he says. The technique of making alternative exterior of borders, throughout the cracks, would resurface when he based Icon International.

Horses and polocrosse have been a thread in Uechtritz’s life since he was younger. As a young person, his seriousness in regards to the sport led to worldwide excursions. In America, he was decided to assist polocrosse acquire wider attraction. “So far as I used to be involved, I used to be going to transform the entire world [to polocrosse],” he says. From Kentucky, he traveled round and fashioned polocrosse golf equipment throughout the nation and in Uruguay and Eire, lots of which exist right now.

Within the early Nineteen Nineties, Uechtritz left Kentucky to hunt his fortune in actual property in Los Angeles. Along with his lack of actually related expertise, moving into the market was initially intimidating. However Uechtritz has by no means been one to let worry get in the way in which, and he quickly realized the enterprise wasn’t that difficult. “It was nearer to buying and selling horses,” he says. He lower his enamel on the headwinds of a recession, the Malibu wildfires, and the most expensive earthquake on document in 1994.

Uechtritz discovered his area of interest by specializing in properties others didn’t need to contact. This led him to one among his early breakout offers—the infamous Menendez property—constructing his portfolio of offers after which shopping for an actual property franchise. “I used to be disrupting that a part of the trade,” he says. “Whereas others have been dodging the repo man, I wanted to go in the other way, embrace the market, and determine find out how to promote stuff.”

Throughout this time, he grew to become mates with Peter Radd, a New Zealander who was additionally working in actual property. Radd was amused—and impressed—by Uechtritz’s ingenuity. “Bernie would get these distressed properties, stay in them, and construction fairness offers with the proprietor with a 75/25 cut up. He was the 75 p.c portion, the proprietor, 25.”

The technique labored, and Uechtritz quickly had a whole bunch of brokers working for him. His purview stretched from Beverly Hills to Malibu, Hidden Hills to Calabasas. Celebrities and different energy brokers grew to become his shoppers and a part of his black guide—an elaborate community he’d proceed to construct later in Texas. He offered his agency, FrontGate Properties, within the early 2000s, liberating him to beat the Lone Star State. Radd sums issues up: “Armed with movie star names, tales of Los Angeles, and his brush with Hollywood, Bernie parlayed that for his Texas endeavors.”

Uechtritz’s unconventional type was appreciated by the colourful entrepreneurs that Texas breeds, and his timing for concentrating on the state couldn’t have been higher. It was changing into floor zero for one of the necessary developments in fashionable power historical past—the shale oil and fuel revolution. His ranch area of interest would properly complement the land rush and rising power growth and, ultimately, the power transition.

Uechtritz says he finds bits of John Wayne in lots of his ultra-high internet value sellers and consumers. Via the years, he has discovered to establish and pair the very best steward to shepherd the legacy properties. Advertising the huge expanses of land requires each a scientific and suave method. “Considered one of my tenets is that each property has a narrative to inform, and my job is to inform these tales,” Uechtritz says. “In my place, I’m coping with substantial property for an proprietor, heirs, beneficiaries, or conglomerates. It’s an ideal duty.”

Alongside growing Icon International, he suggested Sotheby’s Worldwide on forming a worldwide ranch division. Then got here the historic W.T. Waggoner Ranch, a 535,000-acre property that sprawls throughout six Texas counties. After gaining management of the itemizing, Uechtritz saved it from being auctioned off or carved up. The Waggoner had been below “steady litigation for 25 years,” says Kelly Hart lawyer Glen Johnson, who represented the property’s majority-interest proprietor, Bucky Wharton.

Uechtritz was decided to look previous that drama and concentrate on the land and its story. The ranch was established in Sensible County in 1849 by 21-year-old Dan Waggoner for his six horses and 242 head of Longhorn cattle. He and his son, W.T. Waggoner, aggressively expanded through the years to the purpose that it grew to become bigger than the boundaries of Los Angeles and New York Metropolis mixed. The pot was sweetened once they found oil on the property.

Uechtritz got here up with a list worth of $725 million—greater than double what others have been suggesting—and located a purchaser in billionaire Stan Kroenke, whose skilled sports activities holdings embody the Los Angeles Rams and Denver Nuggets.

After the watershed sale, expectations of sellers that adopted have been ridiculously excessive, Uechtritz says. He and Icon International had captured “the high-risk, high-reward area that nobody had aggregated, whether or not it was the Menendez property, W.T. Waggoner, or all the pieces in between.”

Bernard Uechtritz and Icon International

Bernard Uechtritz and Icon International

As his checklist of high-profile “offered” properties amassed—the Moodys’ Rio Bonito, the Fortson/Carter household’s KB Carter Ranch, Kyle Bass’ Barefoot Ranch—new alternatives have been rising. In late 2015, world agency Alcoa tasked Icon International with promoting 31,000 acres of Texas farmland and industrial property, together with one of many world’s largest decommissioned aluminum smelters. Rebranded by Uechtritz as Sandow Lakes Ranch, it was in the end offered for $240 million in November 2021 after a six-year advertising and marketing odyssey. The pure reconstruction of the property—14 lakes, tens of hundreds of acres of pastoral grasses, sandy loam soils, and its huge water assets—was a part of its metamorphosis. Sandow Lakes Ranch was a pioneering deal that went past a ranch to incorporate industrial. Uechtritz calls it a hybrid, crossover ranch area.

A latest vital deal for his consumer ExxonMobil additionally illuminates the complexities of coping with giant transactions. It requires a singular talent set that entails “understanding the property themselves to representing conglomerates’ limitless departments and approvals, committees, and sign-offs,” Uechtritz says. “An preliminary Zoom name included roughly 30 individuals.”

The super-broker’s star is rising at a time when the worth of land is receiving extra consideration, with the COVID pandemic, local weather change issues, the reckoning from greater than a decade of straightforward financial insurance policies, inflation, and the ripple results of Russia’s invasion of Ukraine. “There’s an aggressive awakening and appreciation for the asset class as an funding to a classy, even scientific, monetary set,” Uechtritz says, noting that the way forward for power and the meals chain are each depending on land—infrastructure growth, too. “[Buyers] are now not a Ted Turner, wanting to purchase a cowboy hat, a lambskin coat, and funky boots, with a herd of buffalo. They’re shopping for to extract oil and fuel, sequester carbon, seize water, and for renewables. The hybrid area is an important class of actual property sooner or later.”

Icon International’s large-scale offers and listings make headlines, a latest instance being the $200 million Turkey Observe Ranch within the Texas panhandle. However ranches within the $5 million to $10 million and as much as $50 million markets are equally on-the-money for Uechtritz, together with the hybrid $200 million+ quasi-industrial properties. These offers usually are not fairly a ranch however now not a mining web site (as with Sandow Lakes, for instance). Assume wind, photo voltaic, water, and fiber.

To remain forward of the sport, Uechtritz not too long ago enlisted the help of property and local weather tech agency Landgate. Patrons, sellers, and traders can study in regards to the highest and greatest makes use of of a bit of property from the corporate’s land assets information. CEO Craig Kaiser notes that Uechtritz “has been trying on the entire layers of [land’s potential] for a while—the due diligence {that a} enterprise capital, personal fairness, or power firm would provoke for transacting.”

In keeping with Uechtritz, his trade is approaching obsolescence and beckoning disruption. He has spent the final 5 – 6 years working to crack the code. “The ranch brokerage enterprise is about to get a kick within the ass as a result of it wants it; it’s archaic, defunct, and lengthy f—ing overdue.” Essentially the most profitable brokers going ahead “shall be half marketer, have boots-on-the-ground, and be half scientist,” he provides. They may have the very best probability of succeeding in a “historic market acceleration.”

Breaking by way of the established order has at all times been Uechtritz’s method. And he continues to evolve. It’s now not about closing the largest offers, he says. His focus is on high quality, not amount, and worth to the client, tradition, and society. And the three management methods he values most? “Integrity, straight discuss, and spine,” he says.

Trying forward, Uechtritz says he goals to ship worth on a special scale below a brand new agenda—one which much more deeply displays the significance of the properties he brokers. “On the finish of the day, beneath all of it is the land,” he says. “It doesn’t matter what form of apocalypse the world encounters, it should nonetheless rely upon life-giving land. If we begin growing the moon, it’s nonetheless going to be land—it’s simply moon land.”

In relation to ranch gross sales, Bernie Uechtritz smokes the competitors.

Final yr, privately held Sotheby’s Worldwide Realty highlighted its high deal—a Florida property that offered for $99 million. Publicly traded Compass showcased its highest sale, a Jackson Gap ranch that offered for $65 million. Icon International soundly trumped them each with the $240 million sale of Sandow Lakes Ranch, augmented by a sequence of offers within the $100 million to $150 million class. “I promote ranches very well,” Uechtritz says matter-of-factly.

Icon International’s Bernie Uechtritz has grow to be a go-to ranch dealer by promoting landmark properties in Texas and past. Right here’s a take a look at a few of his largest transactions.

Creator

[ad_2]

Supply hyperlink