[ad_1]

Goldman Sachs downgraded Shell on Monday as overvaluation in comparison with its supermajor friends.

The European Union’s giant oilfield, SXEP, referred to Goldman Sachs as having “sturdy” free money circulate of $44.8 billion in the newest quarter, but Shell’s “outperformance” resulted in “comparatively expensive valuations versus friends”. Has occurred.

In a analysis report, Goldman Sachs downgraded Shell from “purchase” to “impartial,” citing “above-average” valuations in comparison with opponents.

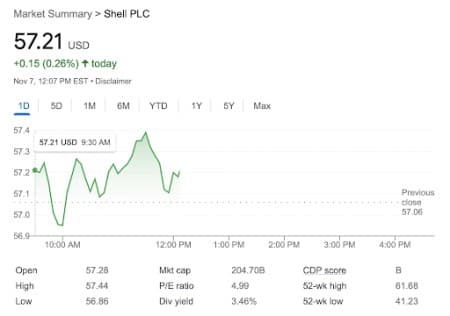

Shell (SHEL) noticed its share worth drop 2% on Monday, shortly after the downgrade, earlier than settling losses for a 0.26% acquire on the day of 12:08 EST.

Goldman Sachs’ Michele della Vigna’s new 12-month worth goal for Shell is now 38 euros, down from 40 euros.

Nonetheless, the downgrade and drop in worth targets do not take away from the truth that Goldman Sachs nonetheless considers Shell “very favorable” for the yr, particularly with its dividend mixed with a large $18.5 billion buyback. In gentle of the programme.

Goldman Sachs estimates that Shell’s shareholders will see an 8.7% enhance in complete returns this yr in dividends and buybacks. In comparison with Shell’s friends, that quantity is much less spectacular when the common is 11.6%.

“On this context, we discover the extra engaging mixture of dividends and buybacks in our protection,” market inspection The report cited della Vigna as saying that decrease costs, sudden CAPEX will increase and any unexpected modifications in offshore restoration charges may end in additional scores assessments.

By Charles Kennedy for Oilprice.com

Learn extra from Oilprice.com:

[ad_2]

Supply hyperlink