[ad_1]

Evgenii Mitroshin

The worldwide crude oil Brent worth has pulled again sharply over current months to $95 per barrel (on the time of writing) after hovering to a multiyear excessive of $130 per barrel in early March 2022. Because the Kremlin’s February 2022 invasion of Ukraine, oil and pure gasoline costs have been extraordinarily risky. This was additional amplified by provide chain constraints attributable to the COVID-19 pandemic and fears of an financial arduous touchdown because the U.S: Federal Reserve aggressively hikes rates of interest to fight rampant inflation. If these headwinds weren’t sufficient to affect intermediate oil producers working in Colombia, there was the victory of former leftist guerilla and senator Gustavo Petro within the Andean county’s 2022 presidential election. Petro campaigned on a platform of ending contracting for hydrocarbon exploration and banning hydraulic fracturing in Colombia.

Intermediate Canadian driller Gran Tierra Power Inc. (NYSE:GTE) (TSX:GTE:CA), which was priced by the marketplace for chapter throughout the pandemic, has skilled appreciable volatility over the past yr. Gran Tierra’s market worth has soared by a formidable 52% over the past yr, exceeding the 36% improve within the worldwide Brent worth benchmark and outperforming its friends. The newest developments since I final wrote on Gran Tierra in Could 2022 point out that now could be the time to assessment the outlook for the corporate. In that article, revealed 31 Could 2022, I decided that Gran Tierra had an indicative honest worth of $3.14 per share primarily based on its 2P Internet Asset Worth, which is greater than double the driller’s market worth of $1.39 (on the time of writing).

Geopolitical dangers abound

Because the pandemic started, the geopolitical dangers confronted by vitality firms working in Colombia have ratcheted up considerably. This has occurred for a wide range of causes, notably a marked uptick in lawlessness, crime and violence, most of which is related to cocaine manufacturing. This has precipitated the safety atmosphere to deteriorate. Then there are the political and regulatory dangers related to the lately inaugurated President Gustavo Petro, who’s Colombia’s first-ever left-wing chief.

Deteriorating safety atmosphere

Lawlessness, crime and violence have exploded since 2019, with massacres now at ranges not seen in over a decade, whereas cocaine manufacturing continues to soar to new data. The UNODC lately introduced (Spanish) that cocaine manufacturing throughout 2021 reached a brand new excessive of an estimated 1,400 metric tons, which was 14% higher than the report 1,228 metric tons reported a yr earlier. The quantity of land getting used for coca cultivation additionally soared, reaching 500,000 acres or 43% greater than 2020. Cocaine manufacturing and the huge income it generates fuels a lot of Colombia’s civil battle and funds varied unlawful armed teams which might be liable for murdering and displacing civilians, sabotaging oil pipelines, and petroleum theft.

The escalating violence occurring within the Andean nation is said to hovering coca cultivation and cocaine manufacturing as unlawful armed teams vie for a higher share of the drug commerce and the huge income that it generates. That is impacting the operations of vitality firms within the Andean nation as a result of lots of Colombia’s oilfields, confirmed reserves and hydrocarbon wealthy areas for exploration are in prime coca-growing areas and battle zones. The central authorities in Bogota has historically had a weak presence in lots of these rural areas, additional amplifying violence and lawlessness in these areas.

Throughout late April to June 2021, large anti-government protests swept throughout Colombia as civil dissatisfaction with the hard-right authorities of President Ivan Duque reached boiling level. There have been many grievances driving the protests, the important thing being Duque’s proposed tax reform, rising poverty, spiraling value of residing, heightened corruption, rising lawlessness and institutional violence with the police killing unarmed protestors. These demonstrations ultimately morphed into neighborhood blockades of transport infrastructure and oilfields, inflicting Colombia’s oil manufacturing to plummet. Consequently, the month-to-month common June 2021 oil output fell to a multi-decade low of 694,151 barrels per day. The tensions driving the social discontent that manifested because the protests have but to be resolved, with them persevering with to simmer beneath the floor in lots of communities.

There has lengthy been appreciable home resistance to grease trade operations in lots of regional municipalities. The trade’s social license is in a gradual decline with it lengthy related to oppressive corrupt governments in Bogota with the earnings it generates spent on main cities fairly than within the infrastructure-poor area the place oil is extracted. This has manifested itself in incidents of oilfield invasions, neighborhood blockades of fields and sabotage the sabotage of wellheads in addition to very important pipelines. Dissent in direction of Colombia’s vitality patch is creating highly effective opposition with a wide range of neighborhood and environmental teams usually protesting trade operations in addition to hydraulic fracturing. For these causes, protests which have the potential to interrupt oil trade operations stay a continuing risk.

Heightened political threat

That destructive neighborhood sentiment towards the oil trade which is a key driver of Petro’s plans to carry an finish to Colombia’s hydrocarbon sector. It’s the president’s plans to finish contracting for oil exploration in Colombia which sparked appreciable trepidation amongst trade members. This, together with the components mentioned earlier, is weighing closely in the marketplace worth of these oil firms working in Colombia. Throughout his presidential electoral marketing campaign, Petro made it clear that as a part of his plans to transition Colombia to wash vitality and cut back the nation’s financial dependence on extractive industries he’ll ban contracting for hydrocarbon exploration. The present administration has began implementing insurance policies designed to finish Colombia’s economically essential oil trade.

For these causes, intermediate drillers with important operations in Colombia like Gran Tierra, Frontera (OTCPK:FECCF, FEC:CA), Parex (PXT:CA), GeoPark (GPRK) and Canacol (OTCQX:CNNEF, CNE:CA) haven’t benefited from considerably larger oil costs like their U.S.-focused friends. Whereas this poses a direct risk to the long-term way forward for Colombia’s hydrocarbon sector and vitality safety, it’s going to probably have little short-term affect. Petro’s plan is to step by step wind-down trade operations. In a rustic which solely has confirmed oil reserves of simply over 2 billion barrels with a manufacturing life of seven.6 years and has not had a world-class hydrocarbon discovery in three a long time, there seems to be little long-term future for Colombia’s oil trade.

This makes it important to scale back the Andean nation’s financial dependence on oil, which is liable for round a 3rd of exports by worth, a fifth of presidency revenues and three% of GDP, and change it with extra sustainable industries. What the market fails to understand is that whereas Petro’s proposed insurance policies are alarming for Colombia’s hydrocarbon sector, he has dedicated to honoring (Spanish) the already current 330 oil exploration and manufacturing contracts which might be in place. Which means the implementation of this coverage could have little to no fast materials affect on upstream drillers like Gran Tierra.

Petro additionally intends to hike taxes for vitality firms working in Colombia. Basically, royalties will not be tax deductible and a surcharge tax might be utilized to grease income when the worldwide Brent worth exceeds the 20-year common. That surcharge might be utilized at increments of 5%, 10% and 15% though it’s but to be determined what worth threshold the surcharge might be levied. This can result in larger prices for Gran Tierra and different drillers in a rustic the place the after-tax breakeven worth is estimated at round $44 per barrel Brent. Whereas there are lots of geopolitical headwinds with the potential to sharply affect Gran Tierra’s operations the market is overstating the destructive fallout from these dangers and subsequently closely discounting the corporate’s inventory worth.

Operational replace

After being priced for chapter throughout 2020 as mushy crude oil costs, falling manufacturing and a particularly weak stability sheet weighed closely on Gran Tierra’s outlook the corporate has staged a formidable transformation. Gran Tierra reported stable third quarter 2022 manufacturing of 30,391 barrels per day, which bodes effectively for larger earnings and money stream in 1 / 4 the place Brent averaged $100.71 per barrel, effectively above the $95 per barrel budgeted. The driller lately said its fourth quarter 2022 up to now manufacturing is round 32,000 barrels per day. If that may be maintained, it’s going to give the fourth quarter 2022 earnings a wholesome bump, significantly with oil costs recovering. That may enhance earnings in addition to cashflows in an working atmosphere the place oil costs are anticipated to stay agency with OPEC tamping down on provide.

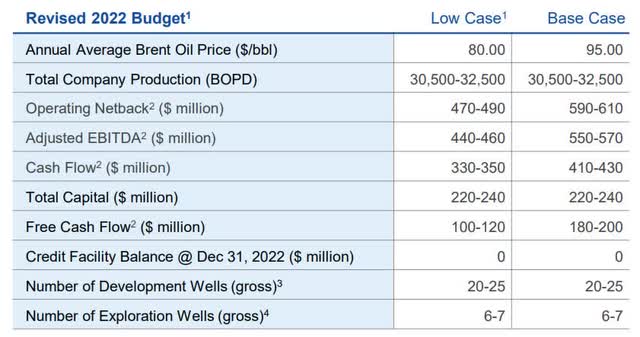

Gran Tierra’s 2022 price range for its base case depends upon a forecast common annual Brent worth of $95 per barrel, which is effectively beneath the common worth for the reason that begin of 2022 till 24 October 2022 of $104.09 a barrel. These developments bode effectively for Gran Tierra to realize its base case 2022 price range.

Gran Tierra

Adjusted EBITDA of $550 to $570 million, on the higher finish, is greater than 2.5 instances higher than the $217 million reported for 2021. Gran Tierra will probably obtain the higher finish of its steerage with Brent having averaged over $100 per barrel for the primary 10 months of 2022. The driller has targeted on decreasing its debt to manageable ranges thereby significantly decreasing the funding threat related to Gran Tierra.

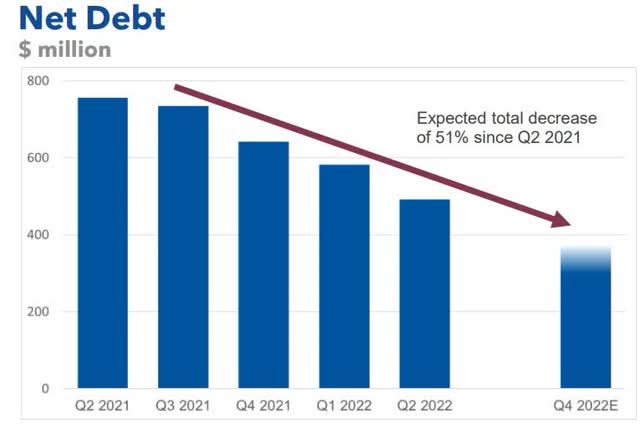

Because the chart beneath reveals, the driller’s web debt has fallen considerably and is anticipated to be lower than $400 million by the tip of the fourth quarter 2022.

Gran Tierra

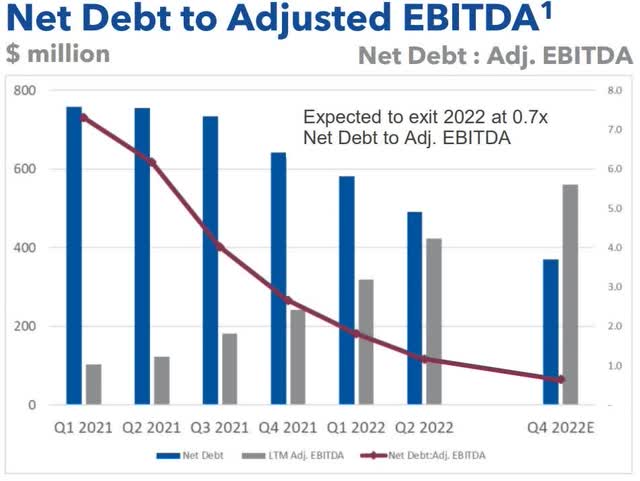

In keeping with Gran Tierra’s October 2022 replace, the corporate has $118 million of money on its stability sheet, web debt of $462 million, and an undrawn $150 million credit score facility. That gives the driller with ample liquidity to help its operations together with deliberate exploration and growth drilling. The power of Gran Tierra’s stability sheet is underscored by its steadily falling web debt to adjusted EBITDA ratio, proven by the chart beneath, which is anticipated to be a wholesome 0.7 instances by the tip of fourth quarter 2022.

Gran Tierra

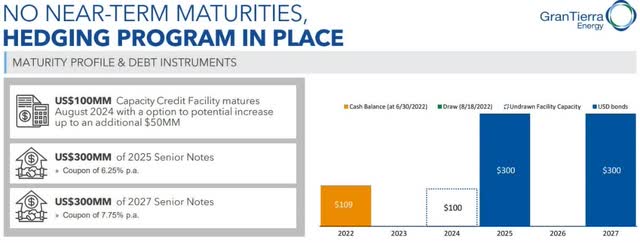

Gran Tierra additionally has a well-laddered debt profile with no fast or near-term debt maturities, because the chart beneath reveals. The primary maturity is $300 million of senior notes in 2025. The corporate bought $20 million of these notes, which is 6.7% of the excellent bonds and which have a coupon of 6.25%, and can save Gran Tierra $33 million of curiosity expense.

Gran Tierra

This additional demonstrates the appreciable work undertaken by Gran Tierra’s administration group to scale back debt and strengthen the driller’s monetary place.

These developments additional improve the attractiveness of investing in an organization which is well-positioned to climate one other sharp decline in oil costs whereas holding enough liquidity to fulfill its near-term wants.

Discovering the corporate’s honest worth

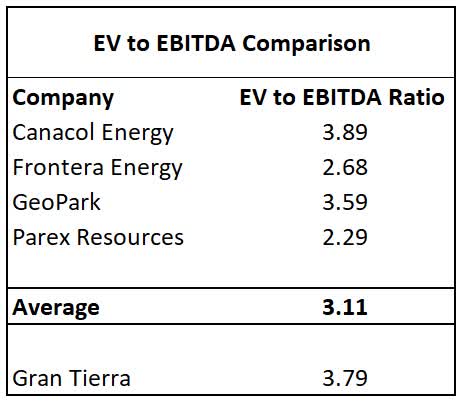

Lots of Gran Tierra’s friends working in Colombia seem cheaper primarily based on enterprise worth to EBITDA, because the chart beneath reveals.

Creator

Supply: Wall Avenue Journal

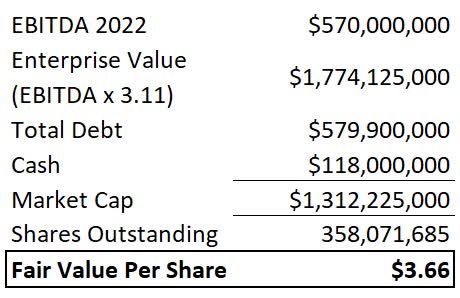

Utilizing the common EBITDA for Gran Tierra’s friends of three.11, the driller has an indicative honest worth of $3.66 per share because the desk beneath reveals.

Creator

Supply: Gran Tierra October 2022 Investor Presentation and Creator’s calculations.

*Whole Debt sourced from the October 2022 company presentation.

** Money sourced from Third Quarter 2022 Operational Replace.

***Shares Excellent supply from Third Quarter 2022 Operational Replace.

That worth is sort of double the $1.39 per share that Gran Tierra is buying and selling on the time of writing, indicating that for so long as Brent is buying and selling or above $95 per barrel, Gran Tierra is closely undervalued. One other technique to decide Gran Tierra’s indicative honest worth per share is by calculating the web asset worth of its oil reserves per share as per the chart beneath.

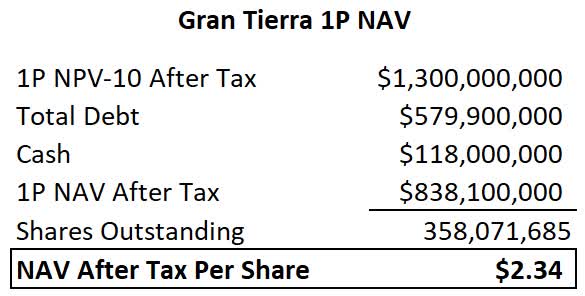

Creator

Supply: Gran Tierra October 2022 Company Presentation and Creator’s Calculations.

Primarily based on the web current worth with a ten% low cost charge utilized (NPV-10) as per trade methodology for Gran Tierra’s confirmed reserves (1P), the corporate has a web asset worth of $2.34 per share. That’s 72% larger than Gran Tierra’s market worth of $1.39 per share on the time of writing, indicating that the driller is closely undervalued and has a major margin of security. If that valuation is expanded to incorporate Gran Tierra’s confirmed and possible oil reserves, then, because the chart beneath demonstrates, the corporate’s indicative worth rises to $3.46 per share.

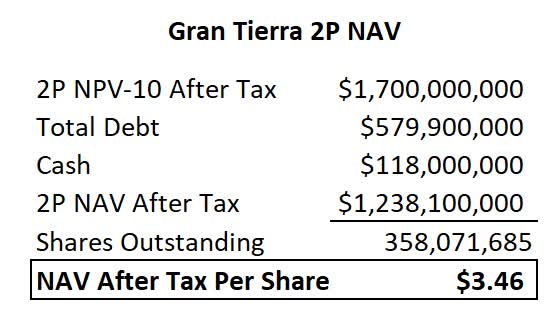

Creator

Supply: Gran Tierra October 2022 Company Presentation and Creator’s Calculations.

That offers Gran Tierra an indicative honest worth of $3.46 per share which is 2.5 instances higher than the corporate’s share worth on the time of writing, additional indicating that the driller is closely undervalued and provides appreciable upside.

Each NAV valuations are larger than my earlier Could 2022 article as a result of Gran Tierra has diminished each its debt and share rely, via a buyback, since that article was revealed. Usually, when valuing an upstream oil firm, the NPV-10 of its 2P reserves is used. It is very important word that each of Gran Tierra’s NAV valuations are depending on a mean Brent worth of $72.53 per barrel. Within the present atmosphere with Brent buying and selling at round $95 per barrel and having averaged over $100 per barrel for the reason that begin of 2022 Gran Tierra’s NAV per share might be lots larger. It’s because larger oil costs will trigger the worth of Gran Tierra’s reserves to understand resulting in a better NPV-10.

Conclusion

Gran Tierra is greatest by a spread of great headwinds probably the most worrying being Petro’s plans to finish contracting for hydrocarbon exploration. Whereas that together with deteriorating safety in Colombia and the erosion of the oil trade’s social license poses a direct risk to Gran Tierra’s operations, the affect of these occasions has been overcooked by the market.

The driller is closely undervalued, with it having an indicative honest worth of $2.34 to $3.66 per share. On the backside finish, that’s almost double Gran Tierra’s share worth of $1.38 on the time of writing and greater than 2.5 instances higher on the prime finish. That not solely signifies that there’s loads of upside forward for the driller however there may be additionally a major margin of security. When that’s coupled with the expectation that oil costs will stay elevated for the foreseeable future with Brent forecast to common $100 per barrel for 2022 and common $94 per throughout 2023, it makes now the time to purchase Gran Tierra.

[ad_2]

Supply hyperlink