[ad_1]

Xiaolu Chu

The Federal Reserve’s aggressive fee hikes to this point in 2022 have ended the period of free cash and uncovered a worrisome dynamic all through capital markets: Zombie shares.

These are firms with poor enterprise fashions which can be burning money at an alarming fee and are susceptible to seeing their inventory decline to $0 per share.

Whereas Tesla (NASDAQ:TSLA) shouldn’t be a zombie inventory because of Elon Musk’s potential to boost plenty of capital, it’s nonetheless a bellwether for all zombie shares, because it shares most of the traits of zombie firms, like an outrageous valuation and excessive money burn.

Traders are fed up with these sorts of firms, particularly amid this 12 months’s inventory market volatility. If traders begin to surrender on Tesla and take income on the inventory, which is up greater than 1,000% over the previous three years, that spells horrible information for all zombie shares that don’t have the cash-raising luxurious that Tesla has. We estimate that there are greater than 300 zombie shares throughout the market.

Our message to traders is to take income in Tesla and keep away from zombie shares in any respect prices. Don’t spend money on an organization that doesn’t make any cash – it’s that easy.

Although Tesla’s inventory has declined 49% year-to-date (YTD), the valuation stays nosebleed excessive as a result of the money move expectations baked into the inventory worth are unreasonably optimistic. We imagine the inventory is susceptible to falling by 88% to $25 per share.

First-Mover Benefit Misplaced Lengthy In the past

Tesla deserves credit score for accelerating the adoption of electrical automobiles (EVs) the world over. Whereas it as soon as was the unquestionable chief within the EV market for a few years, these days are clearly behind us.

This report is the most recent replace to an extended listing of experiences we’ve revealed on Tesla, which we first put within the Hazard Zone in August 2013.

Under, we assessment the numerous causes, together with mounting competitors, market share losses, and rising authorized troubles that specify why we see a lot draw back threat in Tesla’s inventory.

No Extra Vary Benefit

Tesla’s once-large vary benefit within the EV market has all however disappeared. The common mannequin vary for Tesla fashions was 237 miles in 2014, which was 2.7x the common vary of its opponents’ 10 longest vary fashions. In 2022, Tesla’s common EV mannequin vary of 360 miles is simply 6% better than the common vary of its opponents’ 10 longest vary fashions. Certainly, Lucid Group (LCID), not Tesla, boasts the longest-range mannequin for 2022 at 520 miles, or 28% better than Tesla’s longest-range mannequin, the Mannequin S.

Market Share Development Is Not a Buddy

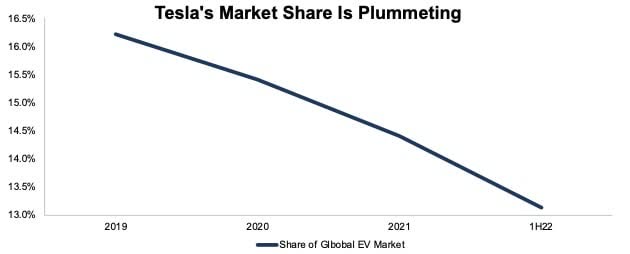

Whereas Tesla’s car gross sales have risen 204% since 2019, Tesla’s aggressive place out there has weakened as the worldwide EV market has grown at a good quicker fee. Per Determine 1, Tesla’s share of worldwide EV gross sales fell from 16% in 2019 to simply 13% in 1H22.

Determine 1: Tesla’s Share of World EV Gross sales: 2019 – 1H22

New Constructs, LLC

Market Share Losses are Steepest within the Most Mature EV Markets

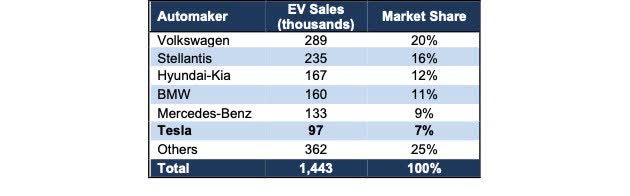

Tesla is mightily struggling to maintain up with the competitors on this planet’s two most mature EV markets: China and Europe. Particularly, Volkswagen, Stellantis, Hyundai-Kia, BMW Group, and Mercedes-Benz Group have every offered extra EVs than Tesla January 2022 via August 2022, per Determine 2. The highest 5 EV makers get pleasure from a mixed share of 68% of the European EV market in comparison with simply 7% for Tesla.

Determine 2: Share of European EV Gross sales: January 2022 via August 2022

New Constructs, LLC

Tesla isn’t having any extra success in China, both. Tesla’s share of the China EV market from January to August 2022 additionally was simply 7% in comparison with 28% for BYD and 9.1% from GM-backed SGMW. The quite a few new entrants within the Chinese language EV market and the federal government’s willingness to subsidize and even bailout failing EV makers make taking market share and rising profitability for outsider Tesla much more troublesome.

Competitors Is Simply Getting Began…

Tesla’s trailing-twelve-month – TTM – return on invested capital – ROIC – of 27% is way increased than the common TTM ROIC of seven% of incumbent friends[1]. In regular circumstances, a excessive ROIC signifies a robust and protracted aggressive moat. Nonetheless, we predict Tesla’s excessive profitability will likely be brief lived as competitors continues to enter the market in an enormous approach.

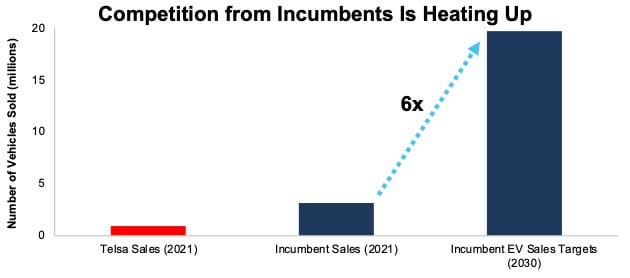

Now that Tesla has confirmed the marketplace for EVs, demand is massive sufficient (EVs accounted for 15% of worldwide car gross sales in August 2022) for the incumbents to mass produce EVs profitably. In consequence, the incumbents are leveraging their superior mass manufacturing and scale efficiencies to rapidly develop their presence within the EV market. The mixed gross sales targets for incumbent automakers totals 20 million EVs in 2030, or six occasions greater than incumbents offered in 2021, per Determine 3.

Determine 3: Precise & Focused EV Gross sales: Tesla Vs. Incumbents

New Constructs, LLC

…and Is Closely Armed

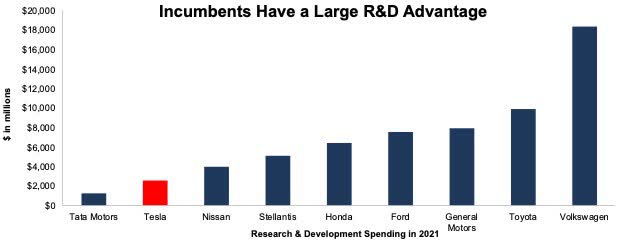

As we have now written, we anticipate incumbents to proceed to shut any remaining technological gaps that Tesla’s first-mover benefit afforded it. Maybe, one of the missed benefits for ICE car makers is their profit-generating legacy operations that may fund massive analysis and improvement (R&D) budgets. And, not like Tesla, which should proceed to develop know-how and add manufacturing capability from scratch on the identical time, incumbents can afford to give attention to growing know-how and enhancing product, whereas changing current crops to provide EVs.

Determine 4: Tesla’s R&D Spend Vs. Main Incumbent Rivals in 2021

New Constructs, LLC

Tesla Will Wrestle to Maintain Up With the Business Progress

The superior manufacturing and R&D scale accessible to incumbents spells long-term hassle for Tesla, which should proceed to spend billions to construct out comparable manufacturing capability and preserve a aggressive product.

Assuming that the EV market grows in step with incumbents’ 2030 manufacturing targets, Tesla would wish to spend a minimum of $25.4 billion[2] to construct the extra capability required to provide 6x extra automobiles than the corporate offered in 2021. On this situation, Tesla would triple its present put in manufacturing capability simply to take care of its present share of the EV market. Given the long-standing troubles Tesla has had with including new capability over time, we’re not very optimistic in regards to the firm’s potential to 6x capability over any time-frame.

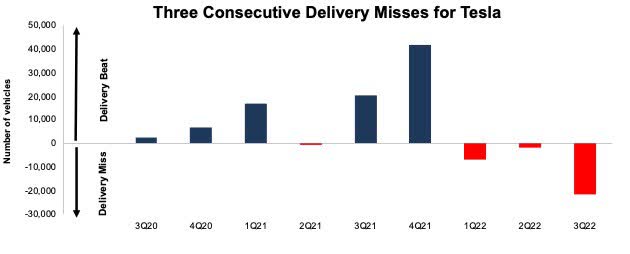

One other Supply Miss

Tesla set an organization document by delivering 343,000 automobiles in 3Q22. Regardless of a year-over-year (YoY) improve of 42%, Tesla’s deliveries missed the consensus estimate by 6% or 21,660 deliveries. The inventory is down 10% for the reason that comparatively massive miss. Most essential, 3Q22’s massive miss confirms the long-standing pattern that the corporate is struggling to execute on capability development. Per Determine 5, regardless of beating consensus supply expectations in 5 out of six quarters from 3Q20 to 4Q21, Tesla’s deliveries have are available beneath expectation in every of the previous three quarters. Previous to 2020, the corporate had a really lengthy streak of lacking its manufacturing estimates – a lot that Bloomberg created a Tesla’s Weekly Manufacturing Price vs Tesla’s Targets web site, which confirmed simply how a lot CEO Elon Musk overpromised deliveries.

This quarter’s massive supply disappointment underscores the hazard in proudly owning TSLA at present ranges. The expectations baked into the inventory are so excessive that the inventory is susceptible to main draw back even within the midst of sturdy YoY supply development. If Tesla continues to disappoint within the coming quarters, analysts will possible bitter on this much-loved inventory, and Tesla’s huge development story may collapse.

Determine 5: Tesla’s Quarterly Supply Beats & Misses: 3Q20 – 3Q22

New Constructs, LLC

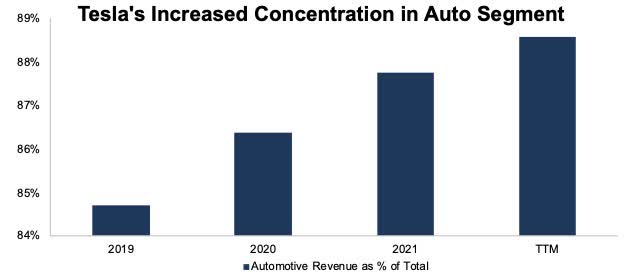

Different Enterprise Segments Aren’t Materials

Bulls have lengthy argued that Tesla isn’t simply an automaker, however relatively a know-how firm with a number of verticals resembling insurance coverage, solar energy, housing, and sure, robots. We’ve lengthy refuted these bull goals. Whatever the guarantees of growing a number of enterprise traces, Tesla’s enterprise is more and more concentrated in its auto phase. Auto income accounted for 89% of Tesla’s TTM income as of 2Q22, up from 85% in 2019, per Determine 6.

Determine 6: Tesla’s Auto Income as % of Complete: 2019 – TTM

New Constructs, LLC

Lagging Bot Expertise Isn’t the Reply, Both

In typical Tesla type, AI Day 2022 was stuffed with massive claims and little substance. Particularly, Tesla’s latest AI Day unveiled a brand new supercomputer, Dojo, and the demonstration of the beforehand teased Optimus robotic. Whereas Optimus did handle to stroll by itself unassisted, strolling robots are removed from revolutionary.

Nonetheless, Tesla claims it is going to leverage its self-driving AI and manufacturing capabilities to develop inexpensive, clever, and utilitarian robots. Nonetheless, different AI-driven firms resembling Apple (AAPL), Google (GOOG) (GOOGL), and even different automakers, are simply as properly positioned as Tesla with the AI and manufacturing capabilities to supply clever robots at scale.

An undifferentiated product in a extremely aggressive market isn’t a recipe for a highly-profitable enterprise line. Furthermore, the non-public robotic market will possible be much like at present’s heavily-commoditized family equipment or private pc markets, every of which provides machines with little or no differentiation and slim revenue margins. Even when Tesla is profitable in bringing low-cost, private robots to manufacturing at scale, the incremental worth of a robotic enterprise phase would possible be restricted, particularly in comparison with the corporate’s inflated valuation. For reference, equipment maker, Whirlpool (WHR), has a market cap of $7.9 billion (1% of Tesla’s market cap) and PC big HP Inc. (HPQ) has a market cap of $26.9 billion (4% of Tesla’s market cap).

Mounting Regulatory and Authorized Woes Add Threat

Tesla’s regulatory and authorized issues are an underappreciated threat to the inventory of an organization that has been in a position to get off scot-free for quite a few transgressions. We imagine the specter of high-priced litigation has, a minimum of partially, saved regulators and lawsuits at bay. Nonetheless, Tesla’s regulatory and authorized issues proceed to pile up. Under is a abstract of ongoing points that could possibly be expensive. And, if any certainly one of them is profitable, it would set up precedents for the success of many extra. Through which case, litigation may ship the corporate into chapter 11.

Alleged Misleading Promoting: Tesla is going through a class-action lawsuit over alleged deceptive statements involving the corporate’s Autopilot and Full-Self Driving (FSD) capabilities. Moreover, the California Division of Motor Automobiles has filed two complaints accusing Tesla of alleged false promoting its driver-assistance know-how. A big settlement or regulatory fines associated to those claims may divert Tesla’s money away from much-needed funding to scale the corporate’s operations and obtain its long-promised technological objectives.

Rising Security Considerations: The Nationwide Freeway Visitors Security Administration (NHTSA) launched an investigation in June 2022 into 35 crashes that resulted in 14 deaths involving Tesla’s Autopilot within the U.S. since 2016. The corporate’s alleged assisted driving woes may simply be starting. As soon as Tesla lastly caught NHTSA’s consideration, NHTSA rapidly expanded its investigation into FSD and Autopilot on over 830,000 Teslas offered within the U.S. We anticipate the enlargement to proceed contemplating that, in only one 12 months (July 2021 via June 2022), Tesla’s Autopilot was concerned in 273 crashes that resulted in 5 deaths.

If the NHTSA discovers defects in Autopilot or FSD, Tesla could possibly be on the hook to fund the bills of an enormous recall to not point out the liabilities associated to the deaths and accidents from the crashes. Moreover, any design flaws found within the investigation may go away Tesla open to extra class motion litigation.

Union Risk: The Nationwide Labor Relations Board not too long ago dominated Tesla violated staff’ rights by not permitting staff to put on pro-union t-shirts at work. Whereas the corporate’s gown code might not seem to be an enormous deal at face worth, the implications of this choice could possibly be profound. Tesla has efficiently prevented efforts to unionize its labor power up to now, which has positioned the corporate with a labor price benefit as the one automaker within the U.S. with no unionized labor. Ought to the corporate fail to maintain unions away, labor prices would go up, and Tesla’s backside line would take a direct hit.

Don’t Purchase What Musk Is Promoting

Misplaced in all the excitement round Elon Musk shopping for Twitter (TWTR) is the truth that Musk retains dumping shares of Tesla. Musk offered $16.4 billion value of Tesla inventory in November and December of 2021. Then, within the title of funding his proposed Twitter takeover, Musk offered $8.5 billion value of inventory in April 2022 and one other $6.9 billion value of inventory in August 2022. Altogether, Musk offered ~$31.8 billion value of inventory (4% of present market cap) in lower than a 12 months with out inflicting a lot of a stir amongst traders.

Whereas CEOs promoting shares of the corporate they handle is nothing new, a lot of the bull case for proudly owning Tesla resides in belief in Musk’s artistic talents and perception in his massive claims and guarantees. Musk promoting such a big stake within the firm because it enters, maybe, its most difficult period is a crimson flag that traders shouldn’t ignore. Ought to the Twitter deal finalize, Musk may find yourself promoting as much as $30-plus billion of inventory in an organization that the market expects to turn into extra worthwhile than Apple (see particulars beneath) to spend money on a struggling social media platform. Maybe, traders ought to contemplate that Musk truly believes Twitter is the higher funding at this level.

Twitter Tussle Provides to Tesla’s Credit score Threat

Traders ought to be aware of the large quantity of time and money that Musk has devoted to Twitter, particularly after Tesla missed consensus supply expectations in every of the primary three quarters of 2022.

Make no mistake, the Twitter tussle has damage Tesla traders. Since Twitter agreed to Musk’s acquisition provide on April 25, 2022, Tesla’s inventory has fallen 28% – together with a 12% drop the day after the deal’s announcement – in comparison with only a 12% decline for the S&P 500 over the identical time.

Musk’s shenanigans are forcing banks that dedicated to the Twitter deal six months in the past to comply with via with financing $12.5 billion in a market with a lot much less liquidity than in April. Tesla could possibly be pressured to pay increased borrowing prices if lenders start to cost within the extra credit score threat Musk brings to the desk.

TSLA’s Valuation Makes No Sense

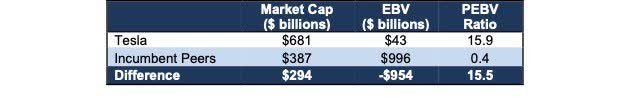

Tesla’s inventory is priced for extraordinary revenue development, whereas incumbents are priced for a 60% revenue decline.

Aside from Tata Motors, all of Tesla’s incumbent friends in our protection universe have a optimistic price-to-economic e book worth (PEBV) ratio over the TTM. Regardless of their advances in EV know-how and plans for speedy EV manufacturing development via 2030, the mixture incumbent peer group PEBV ratio is simply 0.4, which means the market expects income for these legacy makers to completely decline to 60% beneath TTM ranges. However, Tesla’s PEBV ratio of 15.9 implies the market expects its income to develop 1,590%.

Although Tesla’s market cap is almost 2x the mixed market cap of incumbents, the corporate’s financial e book worth is simply 4% the mixed incumbent EBV of $992 billion. See Determine 7.

Determine 7: Tesla’s Valuation In comparison with Incumbent Friends*: TTM

New Constructs, LLC

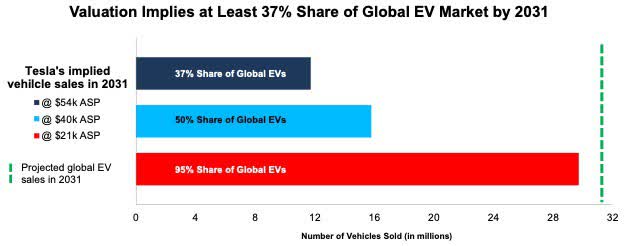

Reverse DCF Math: Valuation Implies Tesla Will Personal 37%+ of the World Passenger EV Market

Tesla promoting 1.2 million automobiles over the TTM is not any small feat. Nonetheless, that quantity is minuscule in comparison with the variety of automobiles Tesla should promote to justify its inventory worth – anyplace from 12 million to upwards of 30 million relying on common promoting worth – ASP – assumptions. For reference, Toyota (TM), the world’s largest automaker, offered 10.2 million automobiles over the TTM ended 6/30/22.

We use our reverse discounted money move mannequin to offer extra clear, mathematical proof that Tesla’s valuation is simply too excessive and provides unattractive threat/reward. At its present common promoting worth per car of ~$54k, Tesla’s inventory worth at $205/share implies the corporate will promote 12 million automobiles in 2031 vs. 1.2 million over the TTM. 12 million gross sales in 2031 would symbolize 40% of the anticipated world EV passenger car market in 2031. At decrease ASPs, implied car gross sales look much more unrealistic. Particulars beneath.

As a way to justify its present share worth, Tesla would wish to:

- instantly obtain a 13% web working revenue after-tax (NOPAT) margin (1.5x Toyota’s TTM margin, in comparison with Tesla’s TTM margin of 12%)

- develop income by 30% compounded yearly and

- develop invested capital at a 14% CAGR (vs. 50% CAGR from 2010–2021) to satisfy capability necessities for the following decade

On this situation, Tesla would generate $712 billion in income in 2031, which is 1.1x the mixed revenues of Toyota, Basic Motors, Ford (F), Honda Motor Co. (HMC), and Stellantis (STLA) over the TTM.

On this situation, Tesla would obtain a NOPAT margin that is 1.4x increased than the very best margin achieved by any incumbent peer over the previous 5 years and would generate $88.9 billion in web working revenue after-tax (NOPAT) in 2031. At $88.9 billion, Tesla’s NOPAT could be 1.4x all incumbent friends’ TTM NOPAT and 87% of Apple’s (AAPL) TTM NOPAT, which, at $102 billion, is the very best of all firms we cowl.

$205/share additionally implies that, in 2031, Tesla will promote the next variety of automobiles primarily based on these ASP benchmarks:

- 12 million automobiles – present ASP of $54k

- 16 million automobiles – ASP of $40k (equal to Basic Motors in 2Q22)

- 30 million automobiles – ASP of $21k (equal to Toyota in fiscal 1Q23)

Given the issue in forecasting the high-growth EV market, we analyze implied market share primarily based on a base-case situation from S&P World and a best-case situation from the Worldwide Power Company (IEA) for the potential measurement of the market in 2031.

Base-Case Situation (EV gross sales attain 31 million in 2031[3]): If we assume the base-case situation for world passenger EVs and Tesla achieves the above-mentioned EV gross sales, the implied market share for the corporate could be:

- 37% for 12 million automobiles

- 50% for 16 million automobiles

- 95% for 30 million automobiles

Finest-Case Situation (EV gross sales attain 84 million gross sales in 2031[4]): If we assume an unlikely, however best-case situation for world passenger EV from the IEA, the car gross sales famous above would symbolize:

- 14% for 12 million automobiles

- 19% for 16 million automobiles

- 35% for 30 million automobiles

The chance of reaching any of the above-mentioned market share situations is extraordinarily unlikely in such a aggressive business. For reference, Toyota’s and Volkswagen’s share of the worldwide passenger car market as of 1H22 was 12% and 10%, respectively.

Determine 8: Tesla’s Implied Automobile Gross sales in 2031 to Justify $205/Share

New Constructs, LLC

TSLA Has 56% Draw back If Tesla Turns into the World’s Largest Automaker

If we assume Tesla sells 9% extra automobiles than Toyota, the world’s largest automaker, offered over the TTM, Tesla has 56%-plus draw back. On this situation, Tesla would promote 11.1 million automobiles in 2031 (which means a 35% share of the worldwide passenger EV market in 2031), at an ASP of $40k (vs. Toyota’s fiscal 1Q23 ASP of $21k). In different phrases, if we assume Tesla’s:

- NOPAT margin is 12% in 2022 and falls to 9% (equal to Stellantis’ TTM margin) in 2023–2031,

- income grows at consensus estimate CAGR of 40% from 2022 to 2024

- income grows 19% compounded yearly from 2025 to 2031, and

- invested capital grows at a 13% CAGR from 2022 to 2031, then

our mannequin reveals the inventory is value simply $90/share at present – 60% draw back to the present worth. See the mathematics behind this reverse DCF situation. On this situation, Tesla grows NOPAT to $44.0 billion, or 5.5x its TTM NOPAT and a pair of.2x Toyota’s TTM NOPAT.

TSLA Has 88%-Plus If Tesla Grows Gross sales Quantity by 4x

If we estimate extra cheap (however nonetheless very optimistic) margins and market share achievements for Tesla, the inventory is value simply $25/share. Right here’s the mathematics, assuming Tesla’s:

- NOPAT margin is 12% in 2022 and falls to eight% (equal to Toyota’s TTM margin) in 2023–2031

- income grows 58% in 2022

- income grows 8% a 12 months from 2023–2031, and

- invested capital grows at a 5% CAGR from 2023-2031, then

our mannequin reveals the inventory is value simply $25/share at present – an 88% draw back to the present worth.

On this situation, Tesla sells 3.9 million automobiles (12% of the worldwide passenger EV market in 2031) in 2031 at an ASP of $40k. Given the required enlargement of plant/manufacturing capabilities and formidable competitors, we predict Tesla will likely be fortunate to maintain a margin as excessive as 8% from 2022-2031. If Tesla fails to satisfy these expectations, then the inventory is value lower than $25/share.

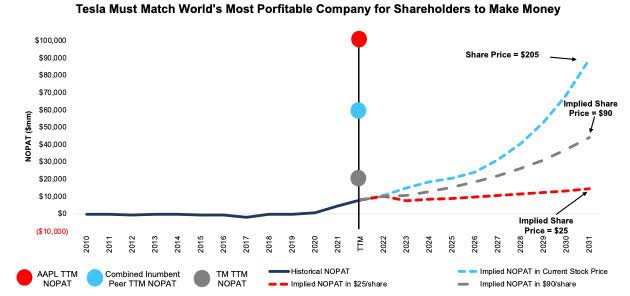

Determine 9 compares the agency’s historic NOPAT to the NOPAT implied within the above situations for example simply how excessive the expectations baked into Tesla’s inventory worth stay. For extra context, we present Apple’s, Toyota’s, and the mixed incumbent friends’ TTM NOPAT.

Determine 9: Tesla’s Historic and Implied NOPAT: DCF Valuation Situations

New Constructs, LLC

Sources: New Constructs, LLC and firm filings

Every of the above situations assumes Tesla’s invested capital grows simply sufficient to match the required capability enlargement necessities implied within the share worth. For reference, Tesla’s invested capital grew 50% compounded yearly from 2010-2021. Invested capital on the finish of 2Q22 grew 31% year-over-year (YoY). Tesla’s property, plant, and gear has grown even quicker, at 59% compounded yearly, since 2010.

In different phrases, we goal to offer inarguably best-case situations for assessing the expectations for future market share and income mirrored in Tesla’s inventory market valuation. Even doing so, we discover that Tesla is considerably overvalued.

$560+ Billion Fall of the Evening King Would Come at Nice Price to Many

@Watuzzi summed up the potential systemic threat of a collapse in Tesla’s inventory with this latest tweet:

“Though I’m brief $TSLA, that is going to be considerably painful to observe. I’ve by no means seen a inventory with so many individuals so closely concentrated in it and depending on it to rise in worth.”

We agree. Tesla is the Evening King of speculative belongings and, given the large draw back on this extremely popular inventory, the autumn of the Evening King may have widespread penalties. We warned in December 2020 of the danger that the inclusion of Tesla within the S&P 500 poses to indexers. Tesla traders are susceptible to dropping a mixed $560+ billion if the inventory drops to $25/share. That a lot worth destruction may have contagion results and drive promoting in different speculative belongings, like crypto currencies and Zombie Shares, which have a mixed market cap of $172 billion and are all susceptible to going to $0/share.

This text initially revealed on Oct. 14, 2022.

Disclosure: David Coach, Kyle Guske II, and Matt Shuler obtain no compensation to jot down about any particular inventory, sector, fashion, or theme.

[1] Incumbent friends underneath protection embrace Toyota (TM), Basic Motors (GM), Ford (F), Stellantis (STLA), Honda (HMC), Tata Motors (TTM), and Nissan (OTCPK:NSANY).

[2] Assuming Tesla expands capability on the identical dollar-per-vehicle-of-added-capacity fee spent on Shanghai, Austin, and Berlin factories. Tesla spent ~$8.6 billion to construct its factories in Shanghai, Austin, and Berlin which added a mixed capability of 1.3 million automobiles per 12 months.

[3] We use the worldwide mild obligation EV market’s projected CAGR from 2021 to 2030 to estimate the market’s worth in 2031

[4] We use the IEA’s Web Zero Situation’s projected EV gross sales CAGR from 2021 to 2030 to estimate the market’s worth in 2031

[ad_2]

Supply hyperlink