[ad_1]

That is the newest from Harris Kupperman, founding father of Praetorian Capital, a hedge fund centered on utilizing macro tendencies to information inventory choice. Mr. Kupperman can be the chief adventurer at Adventures in Capitalism, a web site that particulars his investments and travels.

I printed current ideas from Harris simply days in the past, in a publish outlining his ideas on why the Fed has backed themselves right into a nook they’ll’t get out of.

Harris is considered one of my favourite Twitter follows and I discover his opinions – particularly on macro and commodities – to be extraordinarily resourceful. I’m sure my readers will discover the identical. I used to be excited when he supplied up his newest investor letter to Fringe Finance, which is printed partially beneath.

Harris On Markets and Macro

I’ve genuinely been stunned on the vigor with which the Federal Reserve has raised charges of their marketing campaign to quash inflation. For my complete investing profession, the Fed has been dovish, standing by and able to reassure speculators at each market gyration. For the primary time in my profession, they’re actively concentrating on the inventory market in an effort to create a recession and cut back the “wealth impact” with regards to shopper spending. This can be a terrifying coverage change that was surprising by most market observers—together with myself.

On the identical time, I really feel that they don’t have any actual coronary heart for this marketing campaign. As political animals, they’ll be compelled to pivot after they reach breaking one thing. Sadly, breaking one thing might result in scary outcomes within the shorter time period and we’ve stored our exposures at decreased ranges till it’s clear that they’re able to pivot. Once they do pivot, I imagine that vitality would be the major beneficiary as each oil and uranium presently exhibit structural deficits that might be troublesome to beat absent substantial will increase in capital spending.

The truth is, I believe that the magnitude of the actions in vitality pricing will stun people who find themselves accustomed to gradual modifications in commodity value regimes. If something, the volatility in European vitality costs must be a wake-up name for all market contributors. It could appear that with structural deficits and quickly rising demand, the foundations have adjusted, and plenty of buyers are unprepared for the change. To me, this creates alternative.

Sadly for the Fed, greater vitality costs will feed into greater structural inflation ranges and in some unspecified time in the future, the Fed must determine in the event that they need to proceed combating inflation (which is probably going unimaginable to quash exterior of a worldwide melancholy that dramatically reduces vitality demand) or in the event that they need to modify their mandate and settle for an elevated stage of inflation. Regardless of them clinging to their inflation-fighting mandate all 12 months, I imagine they don’t have any want to inflict a melancholy on voters. They’ll finally pivot and settle for dramatically greater inflation ranges, whereas persevering with to subsidize rates of interest to avert the melancholy that they appear fixated on creating. Consequently, now we have continued to extend our publicity to US housing on this pullback, as that might be a first-rate beneficiary of this set of macroeconomic outcomes.

Ideas On Portfolio Valuations

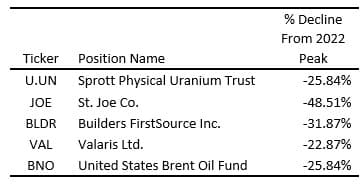

Regardless of solely experiencing a -2.87% web decline (efficiency web of charges) in our fund because the begin of the 12 months, lots of our largest positions have skilled much more dramatic declines and now characterize uncommon worth. As a manner of demonstrating the magnitude of the declines, as of the tip of the third quarter, these are our prime 5 positions and the declines skilled from their peak value factors throughout 2022.

Now, you need to be asking your self how it’s attainable that so many positions have declined dramatically, but the fund hasn’t carried out demonstrably worse. The reply can be a mix of continued beneficial properties from the Occasion-Pushed guide, realized beneficial properties on quite a few worthwhile investments and loss mitigation methods when buying and selling round core positions. Moreover, we didn’t personal BLDR or BNO at first of the 12 months, so they’re new additions, bought at depressed costs. Absent these components, our returns for the 12 months would have been a superb deal worse. Whereas the share decline from the height value in a 12 months, is a considerably arbitrary manner to consider a portfolio’s return, I believe you will need to level out that the portfolio itself is doing an entire lot higher than its bigger parts. Moreover, the magnitude of the declines from the height costs is probably going indicative of the relative worth inherent in our portfolio.

As an absolute efficiency automobile, I imagine {that a} benchmark can be a silly metric to make use of when referencing this fund’s efficiency. On the identical time, it’s laborious to disregard the truth that many world fairness and bond markets are down dramatically, and our fund is down a superb deal much less regardless of being greater than 100% web lengthy for many of the 12 months and barely using shorts or hedges. I imagine this is because of my fixed concentrate on sectors which can be positively inflecting with robust macro tailwinds. Historical past has proven that regardless of what occurs in world economics or geopolitics, there may be all the time a bull market someplace. The secret is to determine these bull markets after which discover the parts inside these markets that provide exponential upside with a decreased alternative for a everlasting lack of capital. Self-discipline on this regard typically trumps easy valuation, as low cost shares can all the time get cheaper. In the meantime, these with robust tailwinds hardly ever keep low cost for lengthy.

Because of specializing in inflecting tendencies, we’ve side-stepped a great deal of the carnage in world danger markets, whereas capturing returns from the Occasion-Pushed guide. Consequently, I believe that we’ve set ourselves up for the continuation of the varied tendencies that we’re most fixated on. Whereas historical past solely considerably repeats with regards to the markets, my expertise has been that robust tendencies typically battle to provide value constructive efficiency during times of total market weak spot. Then, when there’s a pause within the decline of the general market, these positions that declined the least with the broader market, have a tendency to steer the following cost greater. The general power of lots of our positions is indicative to me that we could also be organising for the same explosive transfer greater in our portfolio positions when the market finally bottoms.

Associated: Namibia May Be part of OPEC If Current Oil Discoveries Fulfill Potential

For now, my focus is on avoiding unforced errors, preserving publicity down and being ready to dramatically enhance our publicity to inflation belongings when the Fed lastly pauses in its charge cycle.

Russian Securities

Throughout final quarter’s letter, I gave an replace on our Russian securities positions and famous that we had moved them right into a side-pocket and marked all of them at zero. Nothing has modified relating to the side-pocket or the mark on the positions. Nevertheless, we did reach eradicating the GDR wrapper from 3 of our Russian positions and now personal Russian shares. Our fourth place is a Cypriot firm and to this point, now we have not been able to eradicating the GDR wrapper. Happily, it doesn’t seem like on the identical danger of disappearing if we don’t take away the wrapper.

Whereas it might require a while till we will liquidate these positions, we imagine that we’ll finally notice sizable beneficial properties on them.

Place Assessment (prime 5 place weightings at quarter finish from largest to smallest)

Uranium Basket (Entities holding bodily uranium together with manufacturing and exploration firms)

It might take a while nonetheless, however I imagine that society will finally decide on nuclear energy as a compromise resolution for baseload energy era. This may come at a time when there’s a deficit of uranium manufacturing, in contrast with rising demand. As aboveground shares are consumed, uranium costs ought to admire in direction of the marginal price of manufacturing. Moreover, there may be presently an entity named Sprott Bodily Uranium Belief (U-U – Canada) that’s aggressively issuing shares by means of an At-The-Market providing, or ATM, as a way to buy uranium (we’re lengthy this entity). I imagine that these uranium purchases will speed up the worth realization operate by sequestering a lot of the obtainable above-ground stockpile at a time when utilities have run down their inventories and wish substantial purchases to re-stock. The mixture of those components must result in a dramatic enhance within the value of uranium as it can take at the least two years for incremental provide to return on-line—even when the re-start determination have been made as we speak.

Whereas most of our publicity to bodily uranium is inside the Sprott belief, as a result of it permits us to specific this view with decreased danger, we additionally personal shares of Kazatomprom (KAP – UK). I’m nicely conscious that mining is likely one of the riskiest companies on the market, however Kazatomprom is the lowest-cost diversified producer globally, with unimaginable scale in what’s a highly-consolidated business. On the identical time, I acknowledge that we tackle sure dangers when proudly owning an organization engaged in mineral extraction, particularly in a rustic like Kazakhstan that may be politically unstable at occasions. That mentioned, I imagine that the current change in authorities will do little to affect the working atmosphere in Kazakhstan, although the tax charge might develop reasonably.

Paradoxically, uranium might be a first-rate beneficiary of sanctions on Russia as Russia is likely one of the world’s largest enrichers of uranium. Because the West is compelled to counterpoint extra of the uranium that finally goes into reactors, underfeeding of tails will flip to an overfeeding of tails. The web impact could possibly be wherever between 10% and 30% of the worldwide provide of uranium disappearing—which can dramatically speed up the timing of my thesis whereas rising the final word magnitude of the upward swing in uranium costs.

Vitality Providers Basket (Positions Not At the moment Disclosed)

In 2020 when oil traded beneath zero, drilling exercise floor to a halt and plenty of vitality service suppliers declared chapter. Many of those companies had teetered on the verge of chapter for years because of decreased demand and over-leveraged steadiness sheets. The bankruptcies led to consolidation and decreased future business capability, eradicating future competitors within the restoration.

With oil costs now at multi-year highs, I imagine that demand for drilling and different providers will get better. Whereas producers have been gradual to extend spending on exploration, regardless of dramatic recoveries in vitality costs, I imagine that this solely extends the timing on the thesis. Ultimately, the one option to cut back vitality costs is to see a dramatic enhance in world oilfield providers spending. Any postponement of this spending solely results in greater costs and extra wealth switch from the worldwide economic system to the oil producers, which can probably find yourself leading to a rise in spending on exploration and manufacturing.

We bought many of those positions at fractions of the gear’s substitute price, regardless of restored steadiness sheets and constructive working money movement. As spending within the sector recovers, I imagine that the potential for money movement will grow to be extra obvious and this gear will commerce as much as valuations nearer to substitute price.

Oil Futures, Futures and ETF Choices and Name Spreads

I imagine that years of decreased capital expenditures, together with ESG proscribing capital entry, mixed with Western governments which can be brazenly hostile to fossil fuels, have created an atmosphere for dramatically greater oil costs. Whereas we may buy oil producers, I really feel it’s much more conservative to easily personal the bodily commodity itself. We personal December 2025 oil futures, together with numerous futures calls and name spreads, an ETF and ETF name choices and name spreads. I imagine that this leveraged play on oil provides us essentially the most upside to grease and finally inflation, whereas exposing us to decreased danger when in comparison with producers.

St. Joe (JOE – USA)

JOE owns roughly 175,000 acres within the Florida Panhandle. It has been extensively recognized that JOE traded for a tiny fraction of its liquidation worth for years, however with no catalyst, it was all the time perceived to be “useless cash.”

Over the previous few years, the inhabitants of the Panhandle has hit a important mass the place the Panhandle now has a middle of gravity that’s attracting individuals who need to stay in one of many prettiest locations within the nation, with zero state revenue taxes and few of the issues of enormous cities.

The oddity of the present disdain for so-called “worth investments” is that lots of them are rising fairly quick. I imagine that JOE will develop income at 30% to 50% every year for the foreseeable future, with earnings rising at a a lot quicker clip. In the meantime, I imagine the shares commerce at a single-digit a number of on Adjusted Funds from Operations (AFFO) searching to 2024, whereas substantial asset worth is tossed in without cost.

In addition to the valuation, progress, and excessive Return on Invested Capital (ROIC) of the enterprise, why else do I like JOE? For starters, land tends to understand quickly during times of excessive inflation— notably an inflationary interval the place rates of interest are more likely to stay suppressed by the Federal Reserve. Extra importantly, I imagine we’re about to witness a large inhabitants migration as folks with means select to flee massive cities for someplace peaceable.

I think that each convulsion of city chaos and/or tax-the-rich scheming will launch JOE shares greater, and it’ll finally be seen as the way in which to “play” the stream of very rich refugees fleeing for someplace higher.

Builders FirstSource (BLDR – USA)

Builders FirstSource produces and distributes constructing supplies, primarily for the house constructing business. It trades at a low-single digit money movement a number of on current earnings and is utilizing that money movement to quickly repurchase shares. One may say that the low a number of is because of peak cyclical earnings. I take a distinct view and imagine that we’re within the early levels of a long-term housing increase brought on by migration to low tax states together with a catch-up section as house building charges have been beneath trendline over the previous decade.

I imagine that the US wants in extra of 1 million new single-family houses every year, simply to supply for inhabitants progress, ignoring the opposite components. Consequently, this enterprise doesn’t seem like at peak earnings; as an alternative, I imagine we’re seeing a brand new baseline for earnings—although the earnings might be fairly unstable—notably if rates of interest stay elevated or enhance additional.

Abstract

In abstract, through the third quarter of 2022, the fund skilled a pullback in lots of its core positions. I’ve used this pullback to reasonably enhance quite a few our positions, which has elevated our total publicity. Our publicity is a little more concentrated in inflation, notably in vitality, than I’d usually count on it to be, however these are additionally my favourite themes. We’ve expressed this view by means of devices like bodily uranium, long-dated oil futures and futures choices, vitality gear providers firms, and land performs, which I imagine ought to have a decreased danger of everlasting impairment.

I additionally imagine we’re within the early levels of this inflationary increase and whereas there might be sizable volatility going ahead, we’re positioned nicely.

Disclaimer on the backside of the unique article

By QTR’s Fringe Finance by way of Zerohedge.com

Extra High Reads From Oilprice.com:

[ad_2]

Supply hyperlink