[ad_1]

Justin Sullivan

To be sincere, I by no means thought there can be a day after I would purchase Fb from a enterprise standpoint. However in fact, after the shares of its mother or father firm, meta platform ,Nasdaq: Meta) Virtually fell After reporting 25% of the corporate’s monetary outcomes protecting the third quarter of fiscal 12 months 2022, I can not maintain again. Shares of the enterprise are down 70.5% up to now this 12 months. The autumn is pushed by elevated spending in sectors that traders have grow to be skeptical about. On the finish of the day although, I imagine the issues have been considerably outweighed. And given the place shares are priced immediately, I imagine a ‘robust purchase’ score is a should.

Why is it unsuitable available in the market

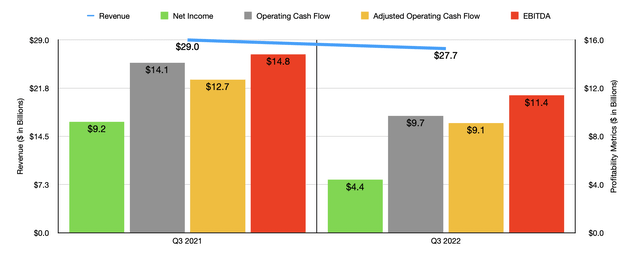

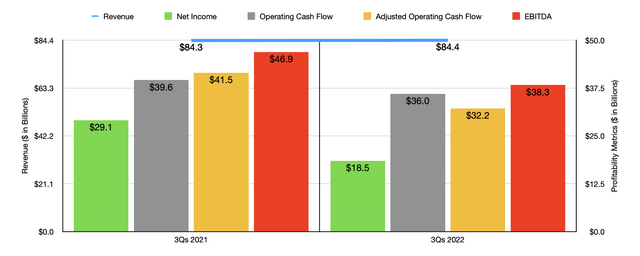

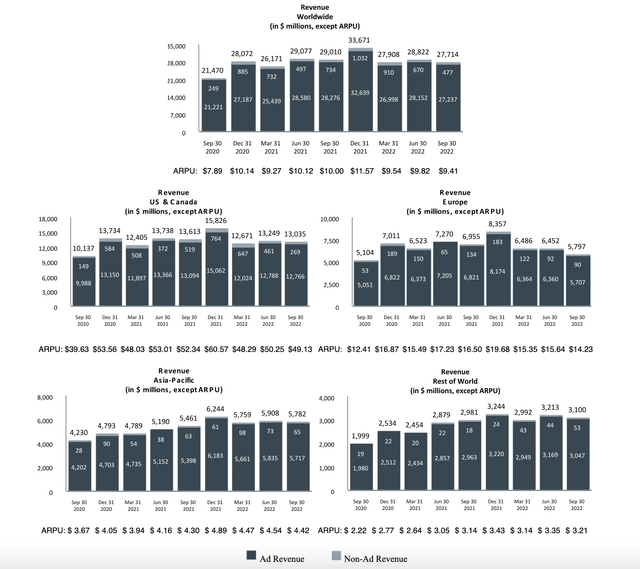

By the point this text is revealed, all main headline information associated to the meta platform has already been totally digested. Due to that, I will not offer you particulars about issues like its income and its earnings relative to what analysts expect for the quarter. As an alternative, I am going to dig into the meat of the dialog. The actual fact is that proper now traders are nervous concerning the deteriorating monetary place of the agency. For instance, income in the course of the third quarter of fiscal 12 months 2022 stood at $27.71 billion. This represents a decline of 4.5% in comparison with the $29.01 billion generated within the third quarter of 2021. Even worse has been the corporate’s backside line. Internet earnings decreased by $4.40 billion in comparison with $9.19 billion generated in the identical interval final 12 months. Working money movement fell from $14.09 billion to $9.69 billion. Even when we alter for adjustments in working capital, it should fall from $12.71 billion to $9.12 billion. On prime of this, EBITDA for the corporate additionally fell from $14.80 billion to $11.39 billion.

Creator – SEC Edgar Knowledge

We’ll get again to the income dialogue in a second. However in terms of profitability, there may be really a significant motive behind this ache. The corporate’s prices have soared throughout the board. The most important progress got here from analysis and improvement, which grew from 21.8% of gross sales within the third quarter of final 12 months to 33.1% of gross sales this 12 months. This $2.85 billion enhance was primarily pushed by increased payroll and associated bills on account of a 32% year-over-year enhance in worker headcount in engineering and different technical capabilities of the enterprise. Expertise improvement prices related to Actuality Labs, the corporate’s division targeted most of its Metaverse operations, additionally contributed to this progress. What I imply after I say ‘most’ is that administration claims that whereas all of its operations at the moment are targeted on the Metaverse, Actuality Labs if targeted on particular options like Horizon Worlds.

Creator – SEC Edgar Knowledge

Personally, I do not thoughts seeing earnings fall on account of analysis and improvement. It acts as an funding sooner or later. And, given the character of the meta platform, it could simply minimize into this class with none adverse experiences. Different areas the place the corporate noticed significant progress included advertising and marketing and gross sales, and basic and administrative. The primary of those elevated from 12.3% of income to 13.6%, whereas the second elevated from 10.2% of gross sales to 12.2%. Once more, lots of these value will increase look like associated to increased payroll prices as the corporate grows. For instance, in its advertising and marketing and gross sales capabilities, the corporate elevated its workforce by 14%, whereas within the basic and administrative capabilities the expansion was 30%.

meta platform

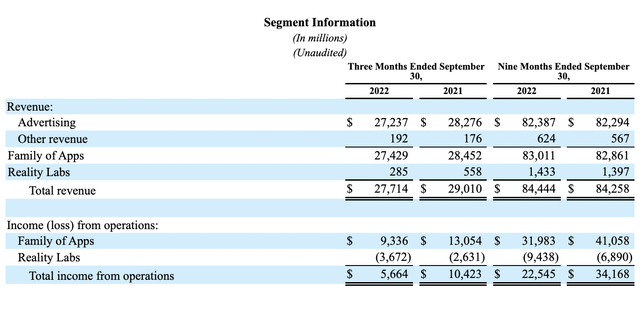

Some extension-related actions involving the Meta Platform are nearly assured to bear fruit. For instance, the corporate continues to take a position extra on knowledge heart operations. It can’t be denied that the corporate is experiencing ache throughout the board on account of this expense and different investments similar to technical infrastructure. For instance, in the course of the quarter, the share of Household of Apps’ enterprise, which incorporates the vast majority of its operations, noticed a decline of about 28% in revenue to $13.05 billion to $9.34 billion. Because the agency continues its progress, it’s anticipated that it’s going to ultimately push income and earnings increased. However on the finish of the day, administration at all times has the choice of curbing these efforts to chop prices.

I do not imagine this facet of the enterprise is something that traders have any specific grasp of. As an alternative, I feel many of the worry is centered round Actuality Labs. Through the newest quarter, this portion of the enterprise generated income of solely $285 million. This was down from the $558 million reported in the identical interval final 12 months. This was largely pushed by a discount within the quantity of client {hardware} merchandise offered. If that weren’t dangerous sufficient, it is also price noting that earnings for this unit are negligible. In actual fact, in the course of the quarter, the enterprise misplaced $3.67 billion on Realty Labs. That is up from a lack of $2.63 billion in the identical interval final 12 months. And general for the primary 9 months of 2022, the deficit widened to $9.44 billion from $6.89 billion a 12 months earlier.

To make issues worse, administration expects the scenario to worsen subsequent 12 months. You see, general for 2022, administration is forecasting whole spending between $85 billion and $87 billion. However spending for subsequent 12 months must be between $96 billion and $101 billion. And sadly, we do not know what to anticipate in terms of income. We all know that administration is forecasting income within the fourth quarter between $30 billion and $32.5 billion. Both method, that is down from the $33.67 billion the corporate generated within the final quarter of 2021. So the weak point the corporate is experiencing on the highest line is predicted to persist for at the very least the remainder of this 12 months. And most definitely, it should proceed subsequent 12 months.

meta platform

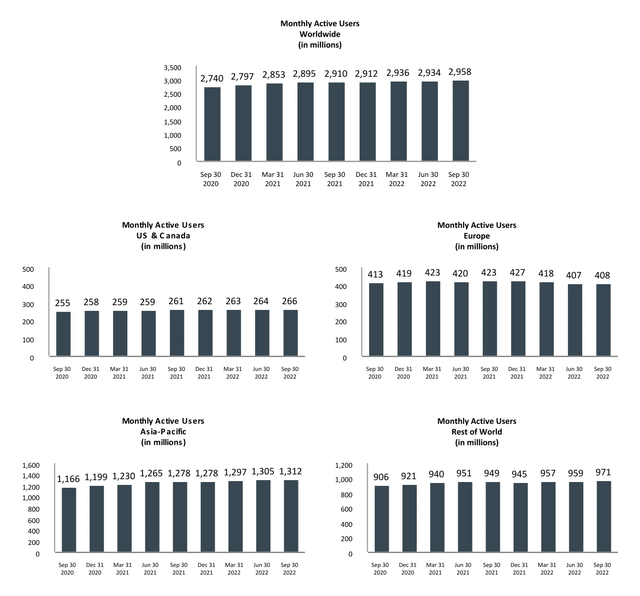

If this was all dangerous information I needed to work on, I might keep distant from the meta platform. However what modified my thoughts is that the underlying enterprise seems to be fairly strong. For instance, take into account the variety of customers on its platform. Month-to-month energetic customers totaled 2.958 billion on the finish of the third quarter. That is the very best on document and represents a rise of 0.8%, or 24 million, in comparison with the quarter beforehand reported. The year-on-year progress is 1.6%, in comparison with the identical time two years in the past, the expansion charge has been 8%. Throughout the US and Canada, the corporate continues to develop, with month-to-month energetic customers growing sequentially to 2 million. Throughout Europe, the corporate grew from 407 million month-to-month energetic customers within the second quarter of this 12 months to 408 million within the third quarter. That being stated, the consumer depend remains to be down from the height time of the fourth quarter of 2021 when the corporate had 427 million customers. Within the Asia-Pacific area, progress continues, reaching 1.312 billion month-to-month energetic customers in comparison with 1.305 billion seen on the finish of the second quarter. And in all different components of the world mixed, the corporate grew from 959 million customers to 971 million.

meta platform

That is to not say that the whole lot is grand for the corporate from a consumer viewpoint. We’ve got seen some weak point in terms of monetization. Through the newest quarter, the worldwide ARPU for the corporate got here in at $9.41. That is down from $9.82 1 / 4 in the past and represents a decline from the $10 skilled a 12 months in the past. Such a decline might be seen within the operational areas of virtually all firms. However administration stated that general, fast-moving places may negatively influence the metrics for the corporate as they’re the place ARPUs are lowest. This does not actually concern me although, as a result of as the remainder of the world continues to develop, on-line markets and apps ought to grow to be extra worthwhile, ultimately serving to firms like Meta Platform. Within the close to future, the ache skilled in additional developed components of the world might be attributed to decrease promoting spend on account of varied components. For instance, for the newest quarter, administration attributed decrease promoting income to a mixture of issues similar to a rise within the variety of advertisements that monetize at decrease charges, the best way they’re delivered, an unfavorable overseas trade. impact, and a discount in promoting demand. This final level is probably going because of the difficult macroeconomic surroundings and different associated issues.

With the economic system lastly recovering, promoting spending ought to rise once more. And, as I already talked about, the corporate is making some investments that, whereas painful immediately, need not happen. The corporate’s continued progress from a consumer perspective makes its operations extremely viable for the lengthy haul, the place administration can ease lots of ache in a single day and considerably enhance money movement in consequence. I do not imagine administration is probably going to take action within the foreseeable future. As an alternative, some continued funding will possible happen as deliberate, ensuing within the eventual abandonment of stated funding upon vital monetary success or substantial loss for the corporate.

Creator – SEC Edgar Knowledge

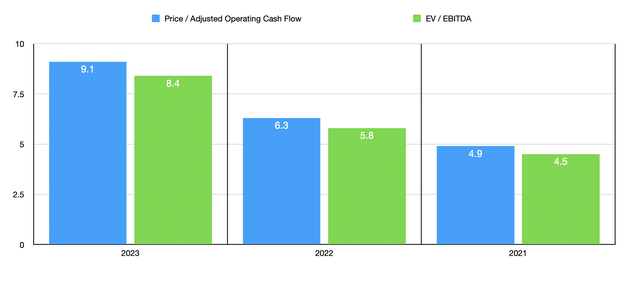

If the shares of the enterprise had been nonetheless buying and selling increased, I might not have been prepared to take a position on such uncertainty. It’s the actual cash that the administration is placing in the direction of what could in the end be perceived as some pricey mistake. But when it continues, I feel the shares are low cost sufficient to be thought of. For instance, proper now, utilizing projected knowledge for the 2022 fiscal 12 months, the corporate is buying and selling on the expense of an adjusted working money movement a number of of solely 6.3 and a ahead EV to EBITDA a number of of 5.8. These numbers are increased than the 4.9 and 4.5, respectively, that we get for utilizing knowledge from 2021. Nevertheless, as a part of my evaluation, I took administration’s personal steerage for prices for subsequent 12 months, assuming income subsequent 12 months is what the corporate ought to see this 12 months, and the tax charge factored in that administration. adopted for 2023. On the finish of the day, this gave me working money movement of $30.71 billion and EBITDA of $29.49 billion. These numbers will translate into an working money movement a number of of 9.1 and an EV to EBITDA a number of of 8.4 in value. For a money cow and a market chief that continues to develop its footprint globally, whereas nonetheless being thought of a really dangerous gamble, I see this pricing as a no brainer.

take away

For me to face right here and inform you that the whole lot is nice concerning the meta platform, shall I misinform you. Personally, I need administration to considerably reduce on its Metaverse operations. I see little worth there, with out the corporate in the end spending way more capital than anybody can think about. I additionally acknowledge that there’s some weak point on the promoting facet, pushed by the Firm’s lopsided progress and weak financial situations. However in these instances, I see the image clearing up by itself ultimately. Add on prime of the truth that the corporate’s footprint continues to develop and that shares look low cost, regardless that present projections are for subsequent 12 months, and I see little or no draw back with the potential for vital upside, to the image. should change bodily.

[ad_2]

Supply hyperlink