[ad_1]

Thanakorn Lappattaranan/iStock through Getty Photos

I have not written a narrative on this hamilton seashore manufacturers ,NYSE: HBB) from March 2021, when Class A shares had been buying and selling at $18. The purchase thesis was based mostly on a selected value breakout sample thought. Thankfully, it elevated 30% in comparison with the subsequent A number of months, and I captured a fast revenue. Actually, till final week, I did not have any overwhelming emotions to purchase this firm once more.

Inventory volatility since 2021 has been a foul information, excellent news state of affairs. The unhealthy information for long-term holders is that the inventory value slowly dropped to $9 in Might, adopted by a bull run again to $12 in early November. The excellent news checklist contains (1) enterprise operations outcomes have improved considerably over the previous 18 months, (2) the outlook for 2023 is healthier than most firms, and (3) Hamilton’s present valuation is the worth of entry. is price.

With the technical image bettering sharply for the reason that summer season, and the worth appears to be breaking out of a transparent downtrend sample once more, I’m planning to re-buy the place ASAP. My pondering is stronger than anticipated in 2023, transferring the bid nearer to $20 per share 9-12 months from now, which might work out to a 70%+ annualized complete return.

The enterprise

Hamilton Seashore is a number one residence small equipment producer, centered on kitchen devices. Enterprise mannequin Items are manufactured abroad (largely in China, with 78 suppliers in 2021) and shipped to North American shoppers. walmart (WMT) and heroine (AMZN) accounted for 50% of 2021 gross sales.

Hamilton Seashore Web site

Hamilton Seashore Web site

The most recent quarterly earnings launch for the September interval contains a number of key updates from the corporate, together with plans to scale back stock, scale back debt and improve money ranges in the course of the Christmas gross sales season. Maybe extra importantly, the corporate is launching new merchandise geared in direction of healthcare/therapeutic leanings for your loved ones’s security and well-being. Combining the Hamilton Seashore model title with exterior trusted model companions can drive speedy development in 2023. Retrieved from press hyperlink:

Over the past yr, the corporate took a number of steps to introduce new merchandise within the air purification, water filtration and residential medical classes. New merchandise in these classes are anticipated to generate income as they’re launched in 2022 and 2023 and are gaining momentum. So far, the corporate has:

Launched the primary product in a brand new line of premium air purifiers beneath the Clorox® model title as a part of an unique MultiAir trademark licensing settlement with The Clorox Firm. The corporate is happy with the buyer acceptance of those new merchandise.

Launched the Sensible Sharp Bin® from Hamilton Seashore Well being®, powered by HealthBeacon®, for at-home injection care administration within the US residence medical market beneath an unique multi-year settlement with HealthBeacon plc. Within the third quarter of 2022, along with being FSA and HSA eligible, the system turned Medicare and Medicaid eligible, which is anticipated to extend adoption.

Entered into an unique multi-year trademark licensing settlement with Brita® and plans to launch a brand new line of countertop water home equipment in early 2023.

Different notable operational achievements embody the dismantling of its core US-defined pension plan, and settlement/funding of associated transfers quickly on its books with constructive overfunding of $12 million. Additionally, a $10 million insurance coverage declare verify was acquired for alterations to Mexican property in early 2022. If the corporate can mitigate the $60 million soar in 2022 stock constructed up resulting from supply-chain issues (a goal in April, in accordance with an earnings name transcript), there’s going to be lots of new money seen in Hamilton financial institution accounts.

I additionally like that the corporate transitions its retail/wholesale enterprise to a licensing mannequin in China and Brazil, efficient on the finish of final yr. Throughout Q3, the quantity attributable to this alteration was $1.9 million, and for the primary 9 months, it was $5.9 million. To me, a royalty design, the place different firms assist manufacture and market objects, ought to improve margins and total profitability for Hamilton, particularly if the companions are nicely funded and aggressive. One last bullish working spotlight to contemplate is on-line gross sales which now account for 35% of income. The bodily retailer ought to assist margins and total revenue by holding gross sales in-house versus outsourced by way of retail channels.

loopy low cost appraisal

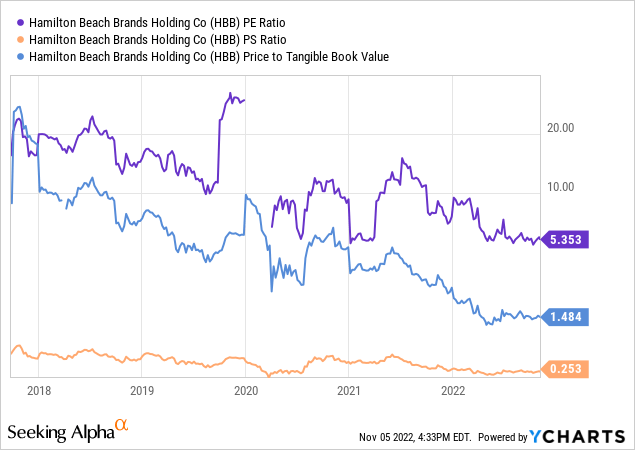

As I write this abstract, Hamilton Seashore is buying and selling close to its lowest valuation since going public in 2017. Naco Industries (NC). Beneath is a graph of the essential elementary ratio fluctuations on ongoing working outcomes. Worth-to-earnings, gross sales and precise guide worth are actually buying and selling decrease than half They’re nicely above their 6-year common (the whole public historical past for this firm), and Might’s extraordinarily low ranges.

YCharts – Hamilton Seashore, Previous Earnings by Worth, Gross sales, Tangible Ebook Worth, since 2017

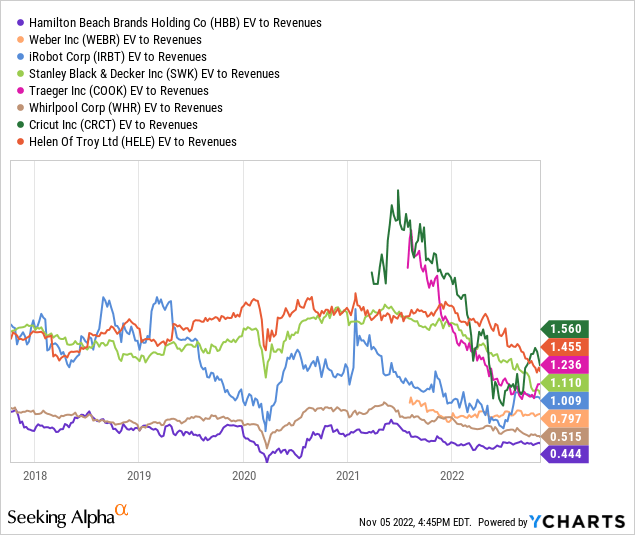

In comparison with rivals and counterparts within the residence equipment sector, the enterprise worth (fairness + debt – money)-to-revenue ratio usually trades at a bigger low cost than others. Right this moment’s 0.44x multiplier is 50% off the peer imply, and 30% off its 6-year historical past. This ratio highlights a stable basis for worth share positive aspects in 2023, particularly if gross sales climb quickly. be a part of peer group weber (WebR), i robotic (IRBT), Stanley Black & Decker (SWK), treasure (the Prepare dinner), whirlpool (WHR), Cricut (CRCT), and Helen of Troy (hell).

YCharts – House Equipment Agency, Previous Income from EVs, Since 2017

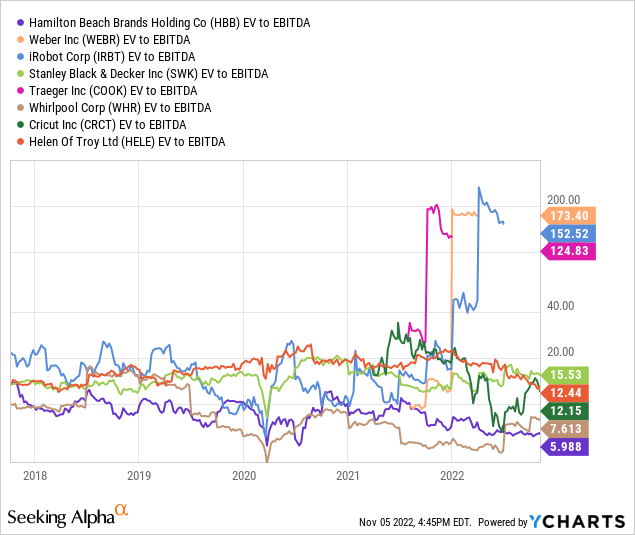

As well as, EV to EBITDA is the most affordable within the group at 6x, buying and selling at lower than half the typical.

YCharts – House Equipment Agency, Trailing EBITDA from EV, as of 2017

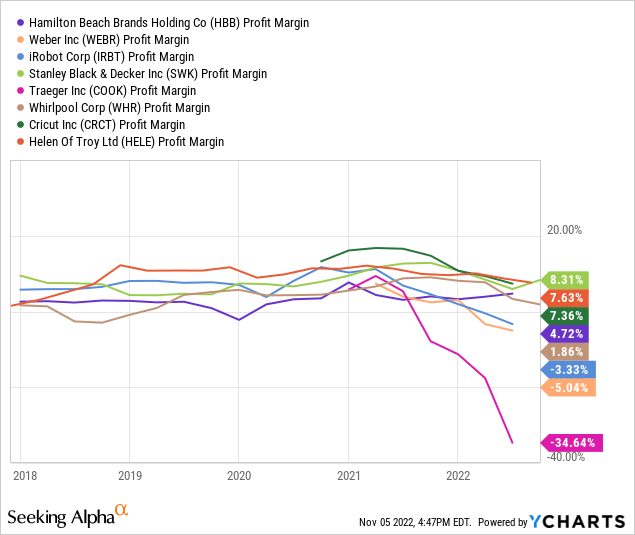

The corporate is making nice progress with revenue margins. The most recent 4.7% internet revenue fee on gross sales is nearer to the typical than that seen prior to now few years. double The revenue fee appeared earlier than the pandemic. With the corporate’s steering, administration expects margins to strengthen once more in 2023.

YCharts – House Equipment Agency, Internet Revenue Margins, Behind Since 2017

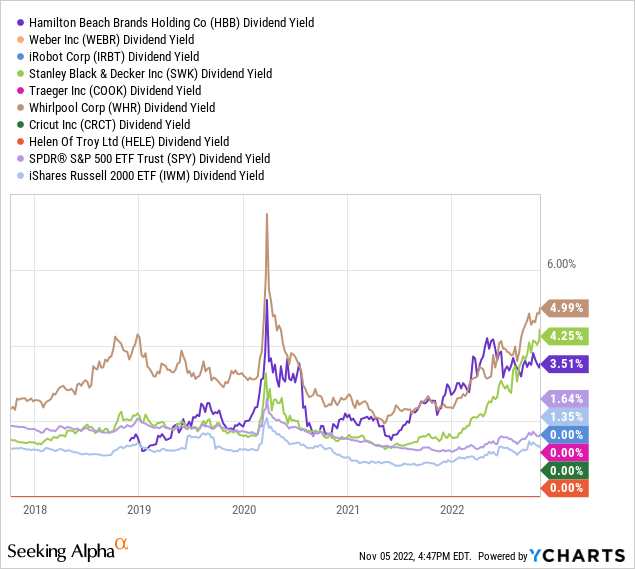

Administration is assured that money circulate and earnings are on observe. Capital’s money return by way of a dividend of $0.42 yearly works out to a pleasant 3.5% yield, which is nearly the highest studying for the peer group. In opposition to the S&P 500’s trailing yield of 1.7% or the small-cap Russell 2000’s 1.4% degree, revenue buyers could also be considering additional analysis into the inventory.

YCharts – House Equipment Agency, Previous Dividend Yield from 2017

Prepared to interrupt the basking sample once more?

Once more, the set off or catalyst for my shopping for curiosity revolves round a momentum image that appears poised to assist a significant value improve. The 15-month chart beneath (adjusted for dividends) exhibits a bunch of overhead resistance converging in early November from the $11.50 to $12.00 space. The 200-day transferring common, 50-day transferring common formation, and a inexperienced development line drawn from the November highs are all sitting round Friday’s closing value.

Right this moment’s minimal 14 days Common Directional Index The studying, which highlights a balanced inventory provide/demand and volatility setup, typically seems at short-term bottoms (circled in blue) within the value. An excellent-strong . Included storage/distribution line And on stability quantity quantity. All informed, a bullish and extended value advance might start if the worth can break above $12 within the coming days.

StockCharts.com – Hamilton Seashore, creator adjustments day by day with reference factors, from August 2021

last ideas

Insiders and administration management 33% of the inventory possession (together with Class B shares with 10 votes versus 1 for Class A). Their pursuits are clearly aligned with these of retail buyers, the place the aim is to entertain accretive and conservative selections to extend shareholder worth.

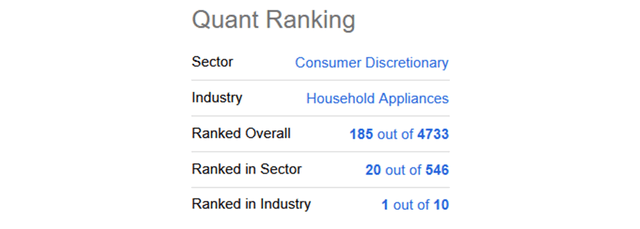

Looking for Alpha’s quant computer-sorting system ranked Hamilton Seashore as the highest 4% selection out of 4,733 inventory choices as we speak.

Looking for Alpha – Hamilton Seashore Quant Rank, November 6, 2022

what are its risks? Firstly, Hamilton Seashore is a small firm with an fairness market cap of $160 million and an enterprise worth of $300 million. Consequently, this funding carries higher danger than blue-chip shares, from weaker diversification in product strains, gross sales channels, manufacturing sources and shopper urge for food.

There are critical points to be careful for, for instance, issues with the Chinese language provide chain from the COVID-19 shutdown and/or the adoption of future commerce restrictions/tariffs. A weakening US financial system might result in diminished pricing energy and last demand, which might scale back profitability. Additionally, as we speak’s robust shopper rankings and market share in kitchen home equipment don’t assure that product high quality will proceed to deteriorate ceaselessly.

The flip aspect of Hamilton’s higher danger is the possibly greater rewards, provided that its new well being merchandise are more likely to be adopted and wanted by shoppers in 2023. To me, the whole funding equation, together with elementary metrics and technical buying and selling motion, factors to a bullish future. Whereas not assured, I’m keen to danger a few of my capital in HBB shares.

Thanks for studying. Please take into account this text step one in your due diligence course of. It is strongly recommended to seek the advice of a registered and skilled funding advisor earlier than taking any commerce.

[ad_2]

Supply hyperlink