[ad_1]

Scott Olson/Getty Photos Information

Whirlpool Company (NYSE:WHR) is a number one supplier of dwelling home equipment to shoppers everywhere in the world. In 2021, the corporate reported file outcomes and elevated its dividend for the ninth consecutive 12 months. Furthermore, the 25% enhance within the dividend was paired with the announcement of additional buybacks. Moreover, earlier in March 2022, the scores outlook was revised to optimistic by Fitch to replicate the corporate’s conservative capital allocation technique.

Regardless of the optimistic outlook, shares in WHR have considerably underperformed and are at the moment buying and selling close to their lows. The liquidity profile, money circulate power, and earnings potential of the corporate current buyers with a horny entry level to an organization that may profit from continued alternative demand and eventual will increase of recent dwelling provide that may must be furnished with new home equipment. For brand spanking new buyers, shares in WHR current a possibility for continued dividend progress and share value appreciation of practically 20%.

Enterprise

WHR is a worldwide equipment firm that manufactures and markets its merchandise everywhere in the world. Its notable manufacturers embody Whirlpool, KitchenAid, and Maytag, amongst others. Its enterprise is performed via 4 working segments: North America; Europe, Center East, and Africa (EMEA); Latin America; and Asia.

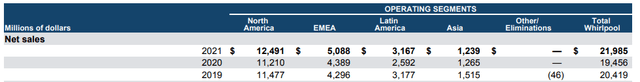

In 2021, WHR reported +$22B in web gross sales. The disaggregation of revenues by section, out there throughout the annual 10-Okay submitting, is beneath. Traditionally, simply over 55% of whole web gross sales are generated in North America. The following largest section is EMEA, which accounts for about 25%. Revenues in all segments have traditionally been affected by quite a lot of seasonal components. Every year, the corporate’s revenues and margins are usually highest within the third and fourth quarter. These seasonal patterns are anticipated to proceed in 2022.

Geographical Gross sales Breakout – Kind 10-Okay

Over its lengthy historical past, WHR has been answerable for quite a few first-to-market improvements. This core competency has allowed the corporate to seize main market share positions in lots of the international locations served by the corporate.

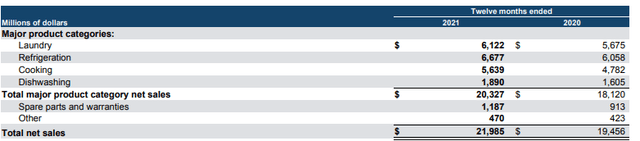

At current, WHR manufactures and markets a full line of dwelling home equipment and associated merchandise. Its main choices embody laundry home equipment, fridges and freezers, cooking home equipment, and dishwashers. Moreover, the corporate’s KitchenAid stand mixer is a number one small home equipment unit. Beneath is a disaggregation of revenues primarily based on product classes. As seen, gross sales are evenly break up between laundry, refrigeration, and cooking.

Particular person Product Gross sales Breakout – Kind 10-Okay

Concerning uncooked supplies, the corporate just isn’t depending on anybody supply for uncooked supplies or bought elements. Regardless of this, the general trade has been impacted by provide constraints, inflationary pressures, and different macroeconomic uncertainties. These challenges are anticipated to proceed in 2022.

Competitors

Every working section operates in a extremely aggressive surroundings. Effectively-known rivals reminiscent of LG, Panasonic, and Samsung compete immediately with WHR on a number of main dwelling equipment merchandise. Competitors within the trade relies on promoting value, product options, and shopper style, amongst others. For WHR, it’s at a drawback when competing towards a couple of international names since a few of these rivals have low-cost sources of provide, vertically built-in enterprise fashions and/or extremely protected dwelling international locations exterior the US.

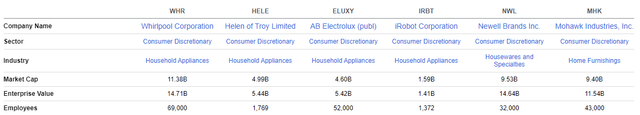

Most of the direct rivals for WHR are overseas and never listed in main U.S. exchanges. Beneath are a number of associated firms throughout the dwelling and equipment industries. Whereas it might have differing product choices, it’s nonetheless useful to know the corporate’s efficiency towards the broader trade. Every competitor within the trade has a market cap of lower than +$15B. WHR, although, does have a slight benefit on dimension and scale. It has practically 70K workers and a market cap that’s virtually twice as excessive as three out of 5 friends.

Searching for Alpha Peer Comparability Software – Market Cap

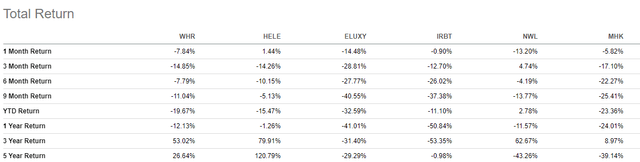

Whereas efficiency has been robust over an extended timeframe, all friends have considerably underperformed over the previous 12 months. WHR is down 12% for the 12 months, whereas the S&P is up 14%. Equally, the corporate is down practically 8% within the month alone, whereas the S&P is up about 4%.

Searching for Alpha Peer Comparability Software – Whole Returns

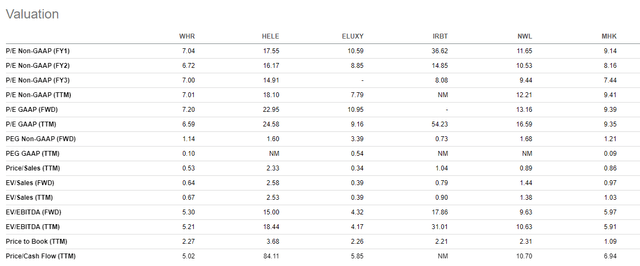

On valuation, WHR seems to commerce at a reduction to its friends on a number of measures. For instance, the corporate trades at a ahead pricing a number of of between 7 and 8x, whereas most of its rivals are above 10x. Extra help for worth is implied within the firm’s low EV/EBITDA a number of of 5x. Traditionally, the corporate has traded at a ahead a number of of 10x and an EV/EBITDA of 9x. In comparison with its friends and its personal historic common, the corporate seems undervalued.

Searching for Alpha Peer Comparability Software – Valuation

Although the corporate has underperformed towards the broader market, WHR’s efficiency has been typically on-par with the trade. Moreover, the corporate has a dimension, scale, and model recognition and loyalty benefit compared towards its direct foreign-based rivals and different publicly traded equipment manufacturers. Moreover, the present valuation signifies the corporate is undervalued.

Earnings and Outlook

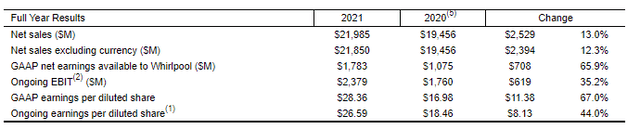

WHR reported file year-end ends in 2021. This was the fourth consecutive 12 months that the corporate delivered file outcomes. For the 12 months, all measures of efficiency have been up by double-digits. GAAP EPS was up 67%, ongoing EBIT was up 35%, and web gross sales have been up 13%.

Q4FY21 Earnings Launch

All year long, the corporate skilled provide constraints and important inflationary pressures. However early actions taken to protect margins supplied important advantages that offset +$1B in uncooked materials inflation. This resulted in file margins of 10.8% on the double-digit gross sales progress. Moreover, adjusted free money circulate (FCF) got here in at a file +$2B. This allowed the corporate to return +$1.4B to shareholders within the type of buybacks and dividends. From a person regional perspective, features have been robust throughout the board, with revenues in all areas up double-digits from the prior 12 months.

Waiting for 2022, the corporate is anticipating the difficult enterprise surroundings to proceed, particularly within the first half of the 12 months. Buyer demand, nonetheless, stays robust, pushed by nesting developments and a robust alternative cycle, which accounts for over 50% of gross sales within the North American area. General gross sales are anticipated to extend 5-6% with EBIT margins of 10.5%. Moreover, FCF is projected to be about +$1.5B. Lastly, the damaging impression of uncooked materials inflation is anticipated to be between +$1B-+$1.25B.

The first issues for the enterprise in 2022 are on the availability facet versus buyer demand. Whereas it has been speculated that there was a pull-forward impact in appliance-related demand as a consequence of COVID, the corporate’s information says in any other case. Within the final two years, there was accelerated use and consumption of home equipment, which drives sooner and stronger alternative going ahead. For instance, within the fourth quarter, utilization in home equipment have been up 150% from pre-COVID ranges.

Thus, as extra individuals spend time at dwelling for work or different causes, utilization will proceed to extend, which is able to in flip speed up alternative charges. Whereas demand is anticipated to stay robust, the flexibility to fulfill this demand is a matter that may proceed to problem the corporate. Constraints within the provide chain are anticipated to alleviate however not till the later half of the 12 months. Within the close to time period, this could negatively impression operations. Nonetheless, the corporate continues to be forecasting one other 12 months of strong gross sales and earnings.

Liquidity Evaluation

Creator’s Evaluation of Liquidity Power

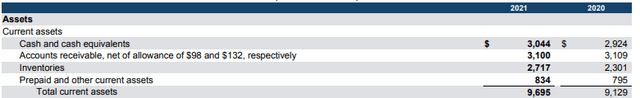

On the finish of December 31, 2021, WHR reported whole present belongings of +$9.7B and whole present liabilities of +$8.5B. This represents a present ratio of 1.14x. Present belongings included money available of +$3B, which represented 30% of the full. Inventories and A/R, however, accounted for 60% of the full.

Stability Sheet – Kind 10-Okay

Stability Sheet – Kind 10-Okay

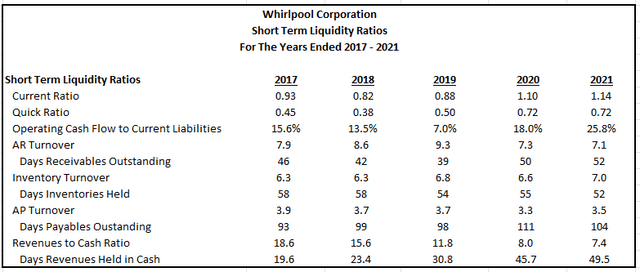

The seven liquidity ratios beneath present additional perception into the short-term monetary efficiency of the corporate. Each the present ratio and the fast ratio have improved from ranges previous to 2019. This was as a consequence of enhancements within the firm’s money place, as evidenced by the rise within the variety of days of money available. Previous to 2019, WHR was holding about 20 days of gross sales in money. That has since gone as much as 50 days.

Creator’s Calculation of Quick-Time period Liquidity Ratios

A ratio of 1x or higher is preferable for the present and fast ratio. Whereas the present ratio is sufficient, the fast ratio may gain advantage from elevated ranges of money and/or elevated gross sales. The A/R arising out of elevated gross sales, nonetheless, must be collected upon on a well timed foundation. A rise in A/R would enhance the fast ratio. But when the corporate is unable to gather on the A/R in a well timed method, then that will be a web damaging.

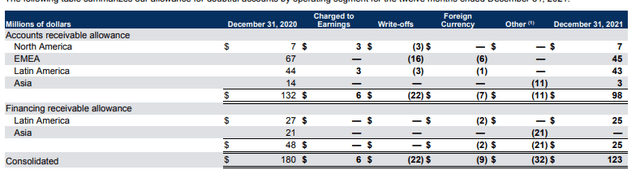

Up to now two years, assortment occasions have elevated from 40 days in 2019 to 52 days in 2021. This may very well be a sign of decay within the well being of the buyer, or it may very well be associated to different benign components. The allowance on receivables, which measures collectability, was insignificant, as seen beneath, so the rise within the variety of days to assortment is unlikely to be associated to monetary deterioration.

Additionally of observe is that web gross sales to Lowe’s (LOW) is roughly 13% of whole web gross sales. Moreover, the retailer accounted for 21% of whole A/R on the finish of 2021. There aren’t any indications of financial misery with Lowe’s, so it is vitally doubtless the delay in collections is said to benign components. Nonetheless, it’s a metric price monitoring transferring ahead.

A/R Allowance Abstract – Kind 10-Okay

Whereas the times to gather on A/R have gone up, the corporate continues to be promoting its stock in the identical period of time as in prior years. That is regardless of the availability disruptions of the previous two years. The consistency is also associated to the contracts the corporate has with its prospects. In GAAP accounting, reductions in stock are reported both when the products are loaded onto the provider or when the client receives the products, relying on the contract.

WHR discloses throughout the notes to its monetary statements that it makes use of each varieties of contracts. Nevertheless, if extra of its contracts are structured to report gross sales when items are loaded onto the provider, then the impacts of provide disruption are extra muted on the stability sheet. Up to now two years, it has been the receipt of products that has been the first situation, not essentially the transport of them.

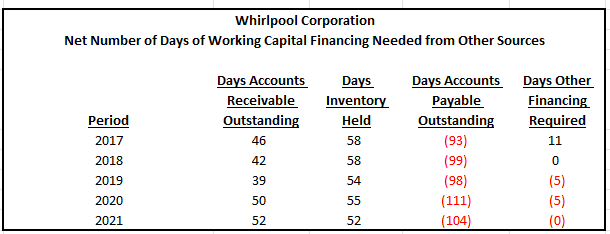

The abstract beneath supplies a abstract of the variety of days of different financing required by the corporate after accounting for the variety of days it takes to promote stock, acquire on the sale, and pay suppliers. In 2021, for instance, it took 52 days for WHR to promote its stock. It then took one other 52 days to gather on that sale. Thus, there have been 104 whole days of pending money conversion. In that timeframe, the corporate held off cost to its suppliers for precisely 104 days.

In different phrases, the corporate acquired 104 days of noninterest-bearing, supplier-provided financing. Due to this fact, there have been no further days the place the corporate required financing from different sources, reminiscent of money or different longer-term preparations. This means prudent working capital administration on the a part of the corporate. Because the time to gather on A/R has elevated, the corporate has in flip delayed its funds to suppliers. The delays have but to be a difficulty on any celebration concerned within the chain of enterprise.

Creator’s Calculations of Days of Different Financing

General, the corporate is in a robust liquidity place. It has a sizeable money stability, and there aren’t any obvious issues concerning its working capital administration. The time to gather on A/R has elevated, and that must be monitored transferring ahead. However the present allowances don’t point out shopper deterioration. So, this isn’t a right away concern. As such, it’s acceptable to use an above common score to short-term liquidity.

Lengthy-Time period Solvency Evaluation

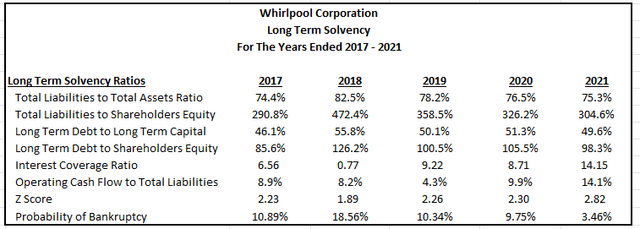

Creator’s Evaluation of Lengthy-Time period Solvency

WHR reported +$15.3B in whole liabilities on the finish of 2021. This represented a complete debt to belongings ratio of 75%, which is in-line with prior intervals. Upon additional evaluation of the opposite solvency ratios beneath, one can see that the corporate has lowered leverage over time. In 2018 and 2019, for instance, whole debt was over 3.5x fairness. That ratio has since dropped to about 3x. Moreover, the corporate’s capability to cowl its curiosity obligations has considerably elevated into the double-digits. In 2017, its protection was 6.6x versus 14x in 2021. A part of that is associated to the decrease rate of interest surroundings, however additionally it is as a consequence of important earnings progress.

Creator’s Calculations of Lengthy-Time period Solvency Ratios

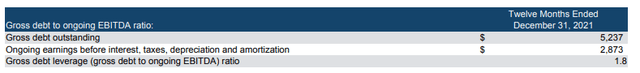

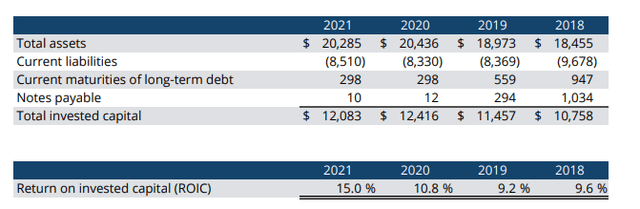

One non-GAAP measure the corporate makes use of to trace leverage is its gross debt leverage ratio. It’s a operate of gross debt excellent, which consists of whole long-term debt and their present maturities, along with notes payable and ongoing EBITDA. The corporate’s goal on this metric is 2x. As seen beneath, WHR is assembly this aim. This measure can be essential as a result of it’s referenced by the credit standing businesses when assessing the scores outlook. In early March, Fitch upgraded the corporate’s outlook to optimistic from steady, partially due to the corporate’s conservative capital allocation technique.

WHR Inner Metric – Gross Leverage

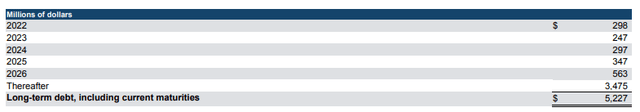

Beneath is a abstract of the upcoming debt maturities on WHR’s long-term debt. Over 60% of the full is due after 2026, and the portion due previous to then are unfold out evenly every year. Thus, there aren’t any issues concerning compensation danger.

Debt Maturities – Kind 10-Okay

WHR’s long-term solvency outlook is optimistic. The corporate not too long ago acquired a scores improve, and the evaluation above affirms the conclusion of the scores company. WHR’s curiosity obligations are nicely lined, and it doesn’t have any near-term debt maturities. As well as, the corporate is assembly its inside debt targets and expects to proceed doing so transferring ahead. Due to this fact, a robust score on long-term solvency is suitable.

Profitability Evaluation

Creator’s Evaluation of Profitability Power

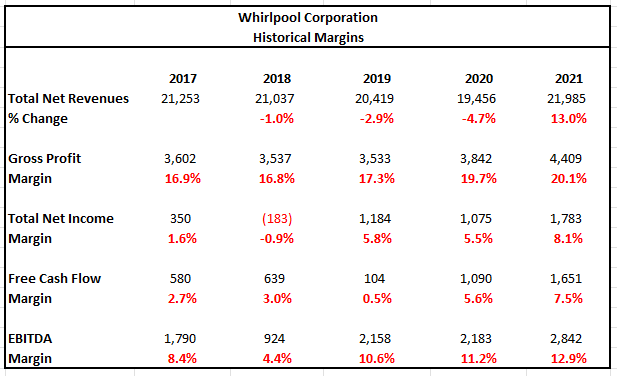

WHR had a file 12 months in 2021 that was accompanied by file margins in each measurable class. As seen beneath, gross revenue and EBITDA margins have been each within the double-digits. The corporate additionally reported important enchancment in each web earnings and FCF margins. This comes on prime of a 13% enhance in gross sales for the 12 months.

Creator’s Calculation of Numerous Profitability Measures

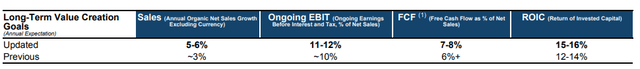

For long-term worth creation, WHR focuses on 4 metrics: gross sales progress, ongoing EBIT, FCF, and ROIC. The targets of every are proven beneath. As proven earlier, the corporate is assembly these targets.

WHR Inner Metrics

A abstract of ROIC efficiency is proven beneath. Whereas there was a dip from 2018 to 2019, efficiency has improved considerably from the 9.6% reported in 2018 to the 15% reported in 2021. ROIC is essential as a result of it represents an essential measure of capital effectivity, which is a key driver of sustainable shareholder worth creation.

WHR Inner Metric – ROIC

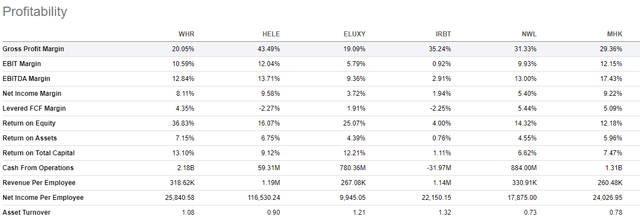

In comparison towards associated friends, WHR additionally seems to be performing in-line or higher on varied metrics. The corporate is lagging Helen of Troy (HELE) on margins, however WHR has a bonus when contemplating return on fairness, belongings, and capital. Moreover, the corporate is without doubt one of the solely names, moreover Mohawk Industries (MHK), to be producing over +$1B in working money circulate. That is essential for total progress and shareholder returns.

Searching for Alpha Peer Comparability Software – Profitability

WHR is performing strongly on profitability. It had a file 12 months in 2021, and it expects to have one other robust 12 months in 2022. As well as, it’s outperforming its personal inside metrics and several other of its friends on varied profitability measures. Due to this fact, it’s protected to evaluate a robust score on profitability.

Money Stream Evaluation

Creator’s Evaluation of Money Stream Power

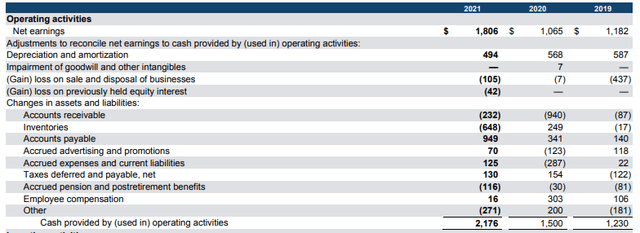

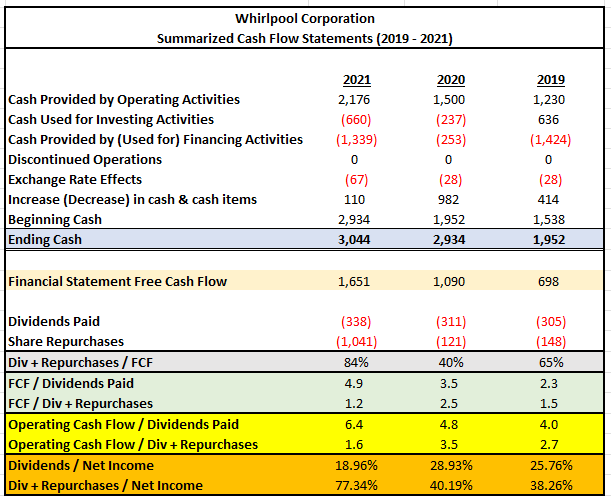

WHR generated +$2.2B in money from operations in 2021. This was 45% higher than in 2020 and 77% greater than 2019. The features have been primarily attributable to earnings progress. The first working capital changes throughout the 12 months have been web modifications in inventories and AP. Uncooked materials inflation drove AP greater throughout the 12 months, however this enhance was offset by a rise in stock. Will increase in stock have been as a consequence of a mix of upper enter prices and purchases.

Money Stream Assertion – Kind 10-Okay

The abstract additional beneath was ready utilizing the information out there throughout the money circulate assertion. In 2021, the corporate’s money stability elevated from +$2.9B to +$3B. As could be seen, the +$110M enhance was primarily all as a consequence of robust earnings progress. Moreover, WHR additionally acquired +$341M from the divestiture of Whirlpool China. The receipt of those proceeds is netted throughout the investing line merchandise.

Exercise inside financing actions have been associated principally to shareholder returns. In 2021, the corporate returned +$1.4B to shareholders within the type of buybacks and dividend payouts.

Numerous measures have been calculated to find out the protection of the shareholder payouts. The outcomes of those calculations are included within the abstract beneath. For the final three years, WHR has been producing robust FCFs and returning a modest portion of it again to shareholders. The protection on all measures could be very robust. For instance, dividends are lower than 20% of web earnings and are being lined by working and FCFs by greater than 4x. When together with share repurchases, the protection falls however continues to be sufficient. General protection is clearly robust and future payouts seem protected and are prone to develop additional on earnings progress.

Creator’s Abstract of Money Stream Assertion

A robust score on money flows is suitable as a result of robust earnings energy of the corporate and its conservative allocation of money. Moreover, shareholder payouts are nicely lined and are prone to develop greater in future intervals.

Intrinsic Share Worth

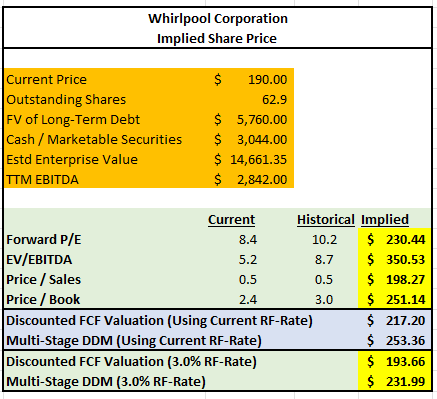

Numerous methodologies have been utilized to acquire a sign of the intrinsic share value of WHR. The outcomes are supplied within the chart beneath. The quickest strategies concerned merely making use of the historic multiples to present pricing. Doing so yielded goal costs with a low of $198 to a excessive of $251. The $351 value level indicated by the EV/EBITDA a number of was an outlier, in order that was eradicated from consideration.

When making use of fashions involving future money flows, outcomes got here in at a low of $194 and a excessive of $253. With these fashions, the speed on 10-YR U.S. Treasuries is a important variable within the computations. Since charges are projected to extend, the mannequin included the present fee, which was 2.3% on the time of study, as reported in The Wall Road Journal. And for hypothetical functions, the evaluation additionally utilized a fee of three%.

When contemplating the outcomes of all strategies, the common goal value labored out to be $225.

Creator’s Abstract of Numerous Valuation Strategies

For illustrative functions, what follows is an enlargement of the outcomes of the FCF valuation technique.

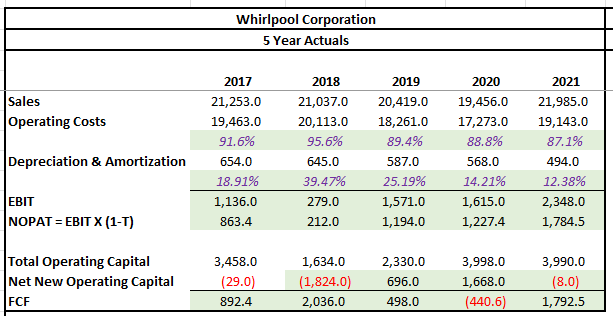

Step one within the mannequin was to enter the historic information from the previous 5 years. For simplicity, a hard and fast tax fee of 24% was used for all intervals in arriving at NOPAT. This tax fee is per present charges. Moreover, whole working capital was outlined as the mixture of whole present belongings and web PP&E, much less whole present liabilities. The web new working capital was merely the year-over-year change. FCF, then, was the distinction between NOPAT and web new working capital.

Creator’s Calculations of Historic FCFs

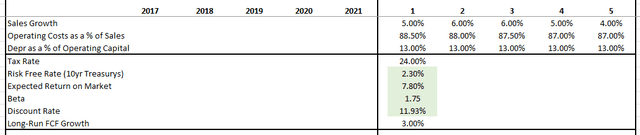

The following step within the mannequin was to enter the assorted assumptions required to calculate the long run money flows to the corporate. The expansion fee of gross sales for this mannequin was anticipated to be within the mid-single digits with long term FCF progress settling in at 3%. The gross sales figures are typically in-line with administration’s outlook. The long-run FCF progress fee, however, was meant to trace long-run GDP progress, which is projected to be within the low-single digits.

Working prices as a share of gross sales have traditionally been within the higher 80s, whereas depreciation and amortization as a share of working capital has been round 12% over the previous two years. For this mannequin, greater percentages for working prices have been used for near-term intervals earlier than returning to extra regular ranges within the later years. Depreciation was stored at 13% for all intervals.

Lastly, the low cost fee was obtained by making use of the CAPM system. This system incorporates the inventory beta, the risk-free fee, and an anticipated danger premium. The beta of WHR is 1.75, as reported in Morningstar. The danger-free fee was 2.30%, as acknowledged earlier. The historic danger premium is 5.5%. Thus, the anticipated return on market is 7.80%. The results of the CAPM upon inputting these variables is 11.93%.

Creator’s Mannequin Assumptions

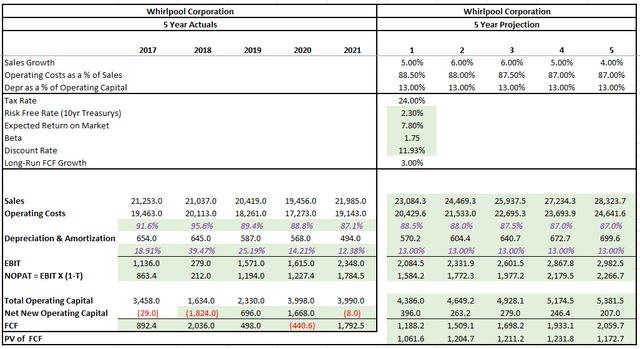

The abstract beneath supplies the projected FCFs over the subsequent 5 years. The outcomes of this mannequin are on the conservative facet to account for the danger of deviations and setbacks from administration’s outlook.

Creator’s Accomplished Projections

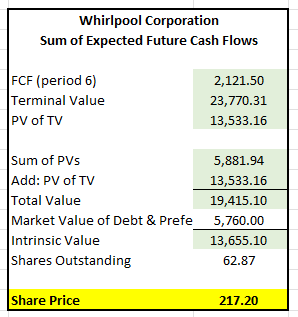

The ultimate step within the mannequin was to calculate the terminal worth utilizing the long-run FCF progress fee and mix that end result with the sum of the current worth of the long run FCFs above. Moreover, the market worth of debt wanted to be deducted from the totals to reach on the intrinsic worth to widespread shareholders. Within the notes to the monetary statements, it was disclosed that the market worth of debt was +$5.7B. Due to this fact, that’s what was used within the calculation.

Creator’s Intrinsic Share Worth Calculation

As seen above, the intrinsic share value utilizing this mannequin is $217. Taken along with the opposite strategies, this additional helps a goal value of $225.

Main Dangers

WHR is a serious provider of dwelling home equipment to Lowe’s. Web gross sales to this retailer accounted for 13% of web gross sales in 2021. Lowe’s additionally represented 21% of the corporate’s A/R on the finish of 2021. The loss or substantial decline within the quantity of gross sales to this retailer or any substantial deterioration within the financial place of the corporate would lead to a fabric impression to WHR’s operations.

In 2021, gross sales exterior of the North American area accounted for about 43% of whole gross sales. Publicity to worldwide markets topics the corporate to the danger of potential financial/political instability within the host nation. Moreover, the corporate could also be negatively impacted by geopolitical conflicts which will come up between the U.S. or their allies and any of the international locations that the corporate operates in. Tariffs and counter-tariffs, elevated regulation, boycotts, and long-winded lawsuits are potential complexities that would increase the price of doing enterprise for the corporate.

The corporate makes use of a variety of supplies and elements within the manufacturing of its merchandise. These elements come from quite a few suppliers everywhere in the world. An incapability to obtain the required elements might impression WHR’s manufacturing processes. Moreover, continued disruptions within the provide chain that arose over the previous two years might additional impede the corporate’s capability to fulfill demand. If WHR is unable to satisfy the orders of its shoppers, it’s vulnerable to model impairment and the lack of future gross sales.

Conclusion

WHR reported file ends in 2021, and the robust efficiency is anticipated to proceed in 2022. The robust efficiency and talent to fulfill its inside targets resulted in a credit score improve from Fitch earlier this month. Regardless of the outperformance, shares within the inventory are down considerably over the previous month and are at the moment buying and selling close to their lows.

The liquidity place is powerful and contains +$3B of money available. Administration can be prudent in sustaining the optimum stage of working capital that minimizes the quantity of funds tied up in operational actions. The robust stability sheet supplies the pliability wanted to put money into progress and to return extra money to shareholders.

With earnings anticipated to proceed rising, shareholders must be rewarded with additional dividend payouts and share value appreciation. At present pricing, the inventory is almost 20% undervalued. As such, a horny alternative exists for brand new buyers who search progress at affordable danger ranges.

[ad_2]

Supply hyperlink