[ad_1]

urfinguss/iStock through Getty Photos

Shares of Whirlpool Company (NYSE:NYSE: WHR) has taken a success this 12 months as traders worry a 42% decline this 12 months throughout all housing-related sectors. Whereas enterprise definitely faces adversity, it additionally has downsides. steep. Whirlpool is producing vital money circulate, rising its enterprise, and making a sensible acquisition. These strikes will shield the agency from draw back, and it’s now a compelling entry level.

To be clear, Whirlpool is certainly uncovered to the downturn in housing. Shopping for new home equipment is an exercise related to dwelling shopping for, and so if fewer houses are constructed, the demand for home equipment will drop. Moreover, demand for sturdy items elevated within the quick aftermath of the COVID pandemic as hundreds of thousands of individuals had been caught at dwelling and used stimulus checks to make enhancements. A few of this tailwind is of course reversing. Navigating by this normalization is essential for home sustainable producers, and WHR is effectively positioned to take action.

We’re seeing that normalization impacted the monetary outcomes. Income fell 4.3% to $5.1 billion within the firm’s second quarter. North America was barely higher, with gross sales down 2.3%. This got here whilst trade quantity decreased 6% as an increase in costs helped make up some floor. Europe has been Whirlpool’s downside with low margins and low market penetration, and gross sales right here fell 10.3% on a constant-currency foundation. Whirlpool continues to achieve traction in rising markets, with gross sales up 3% in Latin America and 26% in Asia on a relentless foreign money foundation. These account for about 20% of Whirlpool’s enterprise.

Considerably, Whirlpool has introduced a strategic overview of its European operations, following the sale of its Russia enterprise. With an estimated 0% EBIT margin this 12 months, the enterprise has contributed little or no to free money circulate over time. Nonetheless, the unit generates gross sales of roughly $4 billion per 12 months. At 0.5 occasions gross sales (a 20% low cost to Whirlpool’s general enterprise valuation), the unit ought to yield round $2 billion and could be appropriate for companies akin to LG or Samsung to increase alongside their present operations Huh. unit, cut back prices and enhance money circulate.

The proceeds will likely be particularly helpful for the corporate because it has agreed to purchase the InSinkErator, the nation’s main waste disposal model, from Emerson Electrical Firm (EMR) for $3 billion. This model has a 70% market share in the US and will likely be maintained as a separate model after its discontinuation. The gross sales have additionally been rising at a charge of 4% yearly for the final 10 years. Its massive put in base offers recurring gross sales as substitute components and upkeep work are required. The buyout ought to be roughly $1.25 accretive to EPS and $100 million in free money circulate within the first 12 months.

InSinkErator’s home focus is consistent with administration’s technique to depart Europe and deal with its core North American market. The truth that Whirlpool additionally receives 20% of gross sales from Asia and Lat-Am and is rising there offers a possibility to develop the waste disposal enterprise in these markets, making the transaction much more intense over time. Is. With EMEA operations at the moment below strategic overview, administration is basically attempting to commerce legacy Europe threat for a stable alternative within the US, a technique that is smart to me.

Getting some earnings from Europe can even be necessary as a key driver of Whirlpool’s bull case is a stable steadiness sheet in addition to shareholder returns, with administration dedicated to an funding grade ranking and a 2.0x debt/EBITDA ratio. This 12 months, the corporate expects to generate roughly $1.25 billion in free money circulate, purchase again $1 billion in inventory and pay out roughly $400 million in dividends, a tempo just like final 12 months’s repurchases. The corporate has $2.7 billion remaining on its authorization, and with a market capitalization of $7.5 billion, it would cut back share rely by 10% per 12 months if it continues to purchase again shares at this tempo. That might result in a considerable enhance in EPS development, all else equal.

In 2022, the corporate ought to generate roughly $2.25 billion in EBITDA, which will likely be supported by $4.5 billion in web debt. It at the moment has $5.1 billion in debt and $1.6 billion in money for $3.5 billion in web debt, which supplies it the flexibility to borrow $1 billion, plus $340 million in extra capability from Incinkertor (by 2022). 2x of its $170 million in EBITDA). This leaves $1.66 billion in borrowings that may push it above its leverage goal and doubtlessly result in slower buybacks till leverage normalizes. Nevertheless, with $1.5-2 billion in earnings from its European operations, this shortfall has been made up for, enabling buybacks to proceed at a robust tempo into 2023, whereas leaving leverage round administration’s goal.

With a 16.7% free money circulate yield and a P/E of simply 6.1x utilizing the low-end of the $22-24 EPS steering, the valuation definitely screens as very low cost. The markets are clearly discounting a significant decline in Whirlpool’s enterprise as housing development slows (which is definitely taking place). Be mindful, nevertheless, that InSinkErator will add $1.25 to EPS. On the identical time, the variety of shares of the corporate is falling quickly resulting from massive buybacks. Its share rely has declined to 59.7 million from 62.9 million on the finish of the 12 months (a decline of 5%) and 77.2 million on the finish of 2016 (a decline of twenty-two%). Extra shares are more likely to be purchased again than the steadiness this 12 months and one other 7-10% of the float subsequent 12 months, resulting in a decline in EPS of over 12% in web earnings. Together with the InSinkErator’s advantages, legacy Whirlpool’s earnings ought to decline by about 20% earlier than EPS shrinks in any respect.

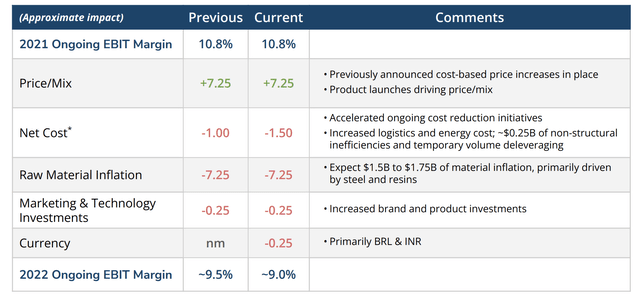

Moreover, it ought to be famous that it’s anticipated to earn $22 WHR this 12 months regardless of vital value pressures. As you possibly can see beneath, uncooked materials inflation is a 7.25% hit to EBIT margin this 12 months. Nevertheless, commodity costs, transportation prices and provide chain points have improved in latest months. What was a headwind that pressed 2022 earnings all the way down to $28 in 2021 EPS will likely be a tailwind subsequent 12 months.

whirlpool

If subsequent 12 months’s value/combine is simply 2% higher than uncooked materials inflation, a really cheap benchmark given the drop in commodity costs, that $400 million tailwind, or $7 per share. Once we think about tailwinds from M&A, decrease share rely, and decrease commodity costs, the optimistic elements whole about $11 per share, so the underlying earnings earlier than EPS fall from the projected $22 in 2022. Should fall in half. That might be a $660 million year-over-year decline in profitability, and up to now 10 years, web earnings has by no means declined by greater than $550 million in a single 12 months, excluding distinctive objects.

Consequently, traders ought to really feel snug in WHR’s capacity to generate $20+ in earnings subsequent 12 months, even when the financial system slows. And the excellent news is with the inventory so low, share repurchases are much more highly effective, making it much more troublesome to stave off a decline in EPS and provides remaining shareholders a much bigger piece of the corporate. As traders turn out to be extra snug with WHR’s potential to generate $20 in earnings, I imagine shares might return to $200, or a 10x a number of. In the meantime, traders gather dividends in extra of 5%, making for a compelling whole return bundle.

[ad_2]

Supply hyperlink