[ad_1]

World shares offered for the second week in a row on greater rates of interest and issues over the well being of the economic system, whereas oil costs fell to ranges pre-Russia’s invasion of Ukraine.

The FTSE All-World Index of worldwide shares fell 2.1 per cent on Friday, lowering its loss to five per cent within the week, its worst since June.

Wall Road’s benchmark S&P 500 inventory index ended 4.6 per cent decrease, whereas the tech-dominated Nasdaq Composite misplaced 4.16 per cent. Europe’s Stokes 600 posted a day by day lack of 2.3 % on Friday to formally enter “bear market” territory – often outlined as a drop of 20 % or extra from its latest peak.

The transfer comes on the finish of a tumultuous week, dominated by a flurry of central financial institution updates as policymakers attempt to stamp out rising inflation.

The US Federal Reserve led the cost on Wednesday, extending its most aggressive marketing campaign to tighten financial coverage since 1981, with an rate of interest hike of 0.75 % for the third time in a row, threatening additional development within the coming months. indicated.

The Financial institution of England responded to its personal inflation disaster by elevating charges by half some extent on Thursday to 2.25, however much less aggressive motion than central financial institution friends helped weaken sterling. Switzerland’s central financial institution took a cue from the Fed and opted for a extra aggressive 0.75 proportion level choice, ending an period of unfavourable charges in Europe.

Central bankers in Indonesia, the Philippines, Taiwan, South Africa and Norway additionally adopted go well with this week, underscoring the broadness of the worldwide pivot in direction of tighter financial coverage.

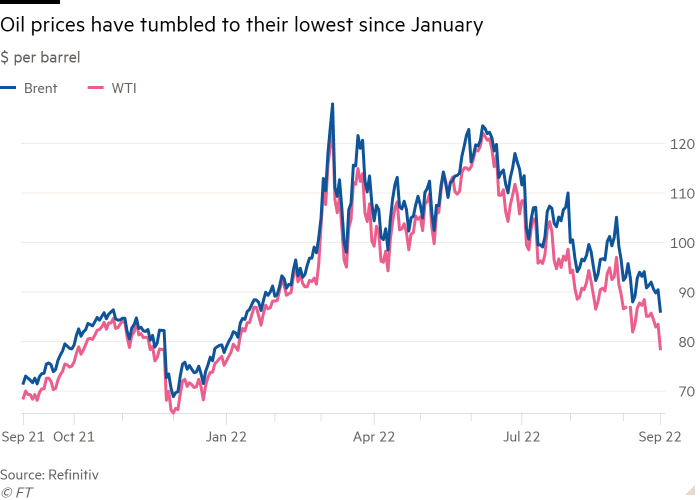

Oil costs additionally raised issues concerning the financial outlook with worldwide benchmark Brent crude falling 4.8 % to $86.15 a barrel – its lowest degree since January.

Yields on short-dated authorities bonds rose sharply in response to greater charge forecasts, with the two-year Treasury rising 0.07 proportion factors to 4.2 % on Friday. Yields improve when costs fall.

Futures markets at the moment are pricing in a peak fed funds charge of 4.7 per cent as of subsequent Could, as towards the present vary of three per cent to three.25 per cent. Nevertheless, many traders proceed to query the predictions of central bankers that there shall be no rate of interest reduce earlier than the tip of 2023.

“The concept that the Fed might rise to a plateau and maintain it there for an extended time frame is debatable,” mentioned David Rossmiller, head of portfolio administration at Bessemer Belief. “The Fed is indicating that they will meet a full touchdown . . . however there are numerous dangers round that state of affairs.”

The dedication of policymakers to convey down inflation in any respect prices has given rise to rising issues that their aggressive strategy will result in a world recession.

Goldman Sachs on Thursday lowered its year-end forecast for the S&P 500 index to three,600, which means an extra decline of about 2.5 % from Friday’s closing degree.

Goldman fairness strategist David Kostin mentioned that “most fairness traders have adopted the view {that a} hard-landing state of affairs is inevitable for the US economic system”, whereas Citi’s asset allocation group mentioned the Fed had “promised a US recession”. .

The greenback, which strengthens in instances of uncertainty, prolonged its latest rally to a brand new two-decade excessive. The greenback index, which measures the foreign money towards a basket of friends, rose 1.5 %.

The greenback’s power has raised fears about an financial slowdown in some creating economies that will battle to service dollar-denominated debt.

Ayan Koss, Appearing Vice President for Equitable Improvement, Finance and Establishments on the World Financial institution, mentioned rising and creating markets confronted an ideal storm with “weak development, very excessive rates of interest and a particularly difficult exterior surroundings when commerce and overseas alternate.” In relation to direct funding. That is why we’re fearful.”

He added: “It is a international funding blow to them, and it’ll include a really extreme drop in demand for his or her items. The mix of those might be moderately deadly.”

Within the UK, international market turmoil was triggered by the response to the brand new Chancellor Quasi Quarteng’s mini-budget. The conservative authorities’s plan to stimulate development with £45bn of debt-funded tax cuts despatched the pound down 3.5 per cent towards the greenback to a 37-year low of $1.09.

Gilt yields jumped by historic magnitude, with the 10-year yield rising 0.32 % to three.81 %. The policy-sensitive two-year yield rose 0.41 per cent to three.91 per cent.

Extra reporting by Kate Duguid in New York

[ad_2]

Supply hyperlink