[ad_1]

Mario Tama

Introduction

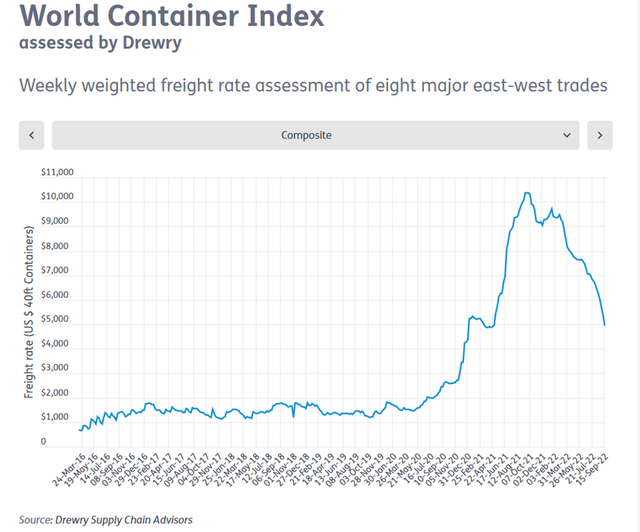

I’ve lined A.P. Møller – Mærsk A/S (OTCPK:AMKBY)(OTCPK:AMKAF) a number of occasions all through the final couple of years, and I’ve been each proper and mistaken in how I seen the inventory would transfer. Initially, I used to be terribly mistaken when it got here to how lengthy the container freight value glut might final, and the consequence for the inventory value, inflicting an enormous upwards surge. Maersk’s personal administration crew has anticipated the freight charges to come back down a number of occasions in the course of the Covid-19 interval, however they’ve remained elevated all through, additionally as China has saved region-wide shutdowns as a software to fight an infection charges, impacting freight operations, as seven of the ten busiest container ports on the planet are positioned in China. The result’s that Maersk has been lining their pockets with gold past the wildest creativeness, to the good thing about not solely shareholders, but additionally Maersk’s long-term strategic outlook. To my astonishment, this impact continues to final to some extent, bolstering Maersk’s coffers to the purpose the place it’s been doable to turn into very energetic within the acquisition market.

Infogram Container Charges 2022 (Infogram.com)

Secondly nevertheless, I ultimately acquired the course proper, because the inventory is down 31.2% since my newest bearish stance on the inventory, whereas the S&P 500 is down 11.9% in the identical interval. In equity, throughout that very same interval, shareholders have acquired a considerable dividend, which means if that’s factored in, the inventory is just down 22.9% for the interval. Because the freight charges gave approach, container firm inventory costs additionally needed to ultimately, with the present macro-outlook not making it higher.

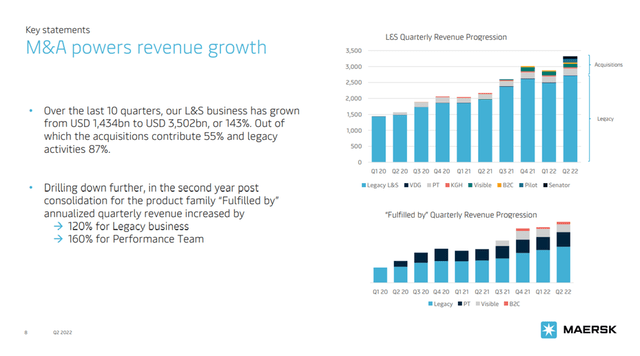

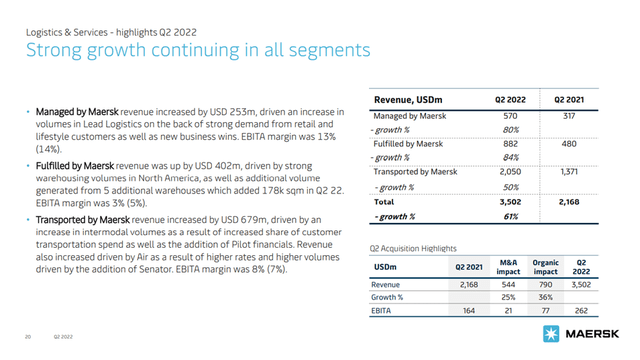

Maersk has been on an acquisition bonanza, strengthening its Logistics & Companies (L&S) division, the focus of turning into an built-in provide chain end-to-end options supplier, exhibiting six consecutive quarters of 30%+ income development for L&S. Curiously, 71% of L&S’s Q2-2022 income development got here from the group’s container freight clients, exhibiting the worth proposition throughout the Maersk group.

Given the robust growth inside the group’s L&S division, and the truth that freight charges will almost certainly proceed to line Maersk’s pockets for an prolonged interval, this firm isn’t just concerning the ocean division going ahead, as L&S is beginning to contribute with an EBITDA in extra of $1 billion when normalized to a full twelve-month interval. I consider that warrants taking a look at Maersk with contemporary eyes, even when L&S continues to be a really small little brother in comparison with the opposite divisions of Maersk.

The Spawn Of Logistics & Companies

Let’s rewind the clock, to September 2016, when Maersk despatched out an announcement regarding an replace on the continued strategic assessment of its present enterprise, a assessment that was initiated that very same summer time. Again then, nonetheless concerned in oil & gasoline, administration communicated the necessity to separate itself from its former enterprise models that had been main earnings contributors for the group for many years; a monetary 12 months that ended with a lack of $1.9 billion for the complete 12 months as a consequence of an impairment cost of $2.9 billion. As such, the underlying enterprise was worthwhile, however not due to the main driver of income, the container freight division, as a substitute, the 2 significant contributors to profitability that 12 months was Maersk Oil and Maersk Drilling with $497 million and $743 million respectively. In actual fact, Maersk had for the previous 4 years straight, secured gross revenue of $9.5 billion or above, however clocked solely $2.4 billion for 2016, as such, it was an organization in a state of disaster.

Nonetheless, administration had the foresight to make a daring transfer to form the Maersk group of the longer term. Maersk Oil was later acquired by Whole (TTE) for $7.45 billion, a deal which was introduced in 2017 and consisted of some money but additionally a considerable quantity of shares in Whole. In November 2021, it was introduced that Maersk Drilling, at this level a stand-alone public firm owned by the household holding firm, would merge with Noble Company (NE).

In June of 2016, the board of administrators tasked administration with reviewing the enterprise, and on September 22nd, 2016, the next was introduced, which was later anchored within the annual report.

Transport & Logistics consists of Maersk Line, APM Terminals, Damco, Svitzer and Maersk Container Business based mostly on a one firm construction with a number of manufacturers. The imaginative and prescient for Transport & Logistics is to turn into the worldwide integrator of container logistics by connecting and simplifying the worldwide provide chain. There are three cornerstones to grasp the imaginative and prescient:

• Offering easy options to clients’ advanced provide chain wants

• Elevating the client expertise via digital innovation

• Providing the business’s best container transport community to each market on the planet.

Managing and working the enterprise actions in Transport & Logistics in a extra built-in method can unlock worthwhile development and synergies via stronger collaboration and disciplined capital allocation.

The worthwhile development will probably be realised from higher buyer expertise throughout the manufacturers in Transport & Logistics. By overlaying the complete worth chain, supported by digitisation, Transport & Logistics can supply clients dependable logistics providers and built-in choices by way of tailored options and expanded merchandise.

Maersk Group, Annual Report, p. 9, ‘Technique part’

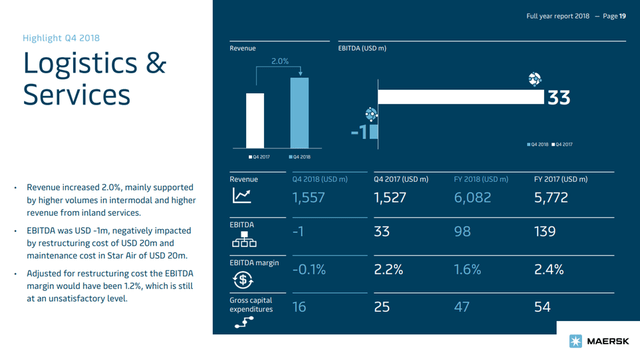

To start with, as might be seen above, the present L&S went below the division identify of Transport & Logistics. The principle distinction being that Maersk Ocean and APM Terminals was a part of the unique umbrella of Transport & Logistics. That modified nevertheless, as 2018 marked the primary 12 months the place L&S was established and reported on a stand-alone foundation.

FY2018 Investor Presentation (Maersk Investor)

FY2018 for L&S resulted in income of $6 billion and an EBITDA margin of 1.6% equivalent to $98 million. Not precisely the hallmark of one thing that just a few years later would exhibit an anticipated rolling twelve-month EBITDA in extra of $1 billion.

Right here is the efficiency for the next years for L&S.

- FY2019 income of $6.3 billion, EBITDA margin of three.4% equivalent to $216 million in EBITDA

- FY2020 income of $6.9 billion, EBITDA margin of 6.5% equivalent to $454 million in EBITDA

- FY2021 income of $9.8 billion, EBITDA margin of 9.2% equivalent to $907 million in EBITDA

- 1H2022 income of $6.3 billion, EBITDA margin of 10.4% equivalent to $656 million in EBITDA

Lately, the EBIT margin has been between 6 – 7.5% with administration anticipating a constant efficiency of >6% in EBIT margin and an natural income development above 10%. The phrase natural is essential right here, as a result of L&S didn’t develop to its present measurement by pure natural development, as a substitute, administration poured billions into acquisitions to broaden each service choices, whereas additionally coming into an entire new enviornment of functionality not beforehand accessible to Maersk.

The Many Acquisitions Supporting L&S

The present invested capital for L&S is available in at $5.9 billion as of Q2-2022, in comparison with $1.8 billion a 12 months in the past at Q2-2021. Going again an extra 12 months, and the invested capital for L&S listed after closing Q2-2020, was $1.3 billion. Rather a lot has occurred in little or no time. Only for comparability, Maersk Ocean has an invested capital of $33.4 billion as per Q2-2022, illustrating the distinction in measurement.

Initially, L&S didn’t make a lot of a fuss, because it wasn’t supported considerably by new capital as a consequence of a necessity for the group as an entire to deleverage. From 2017 to finish of 2018, the group lowered its web interest-bearing debt from $14.8 billion to $8.7 billion, not least due to proceeds from the power separation. Nonetheless, because the group shored up its enterprise, lowered debt and absorbed the latest massive acquisition of Hamburg Süd into its container division, administration acknowledged turning into crisper on the precise technique for L&S.

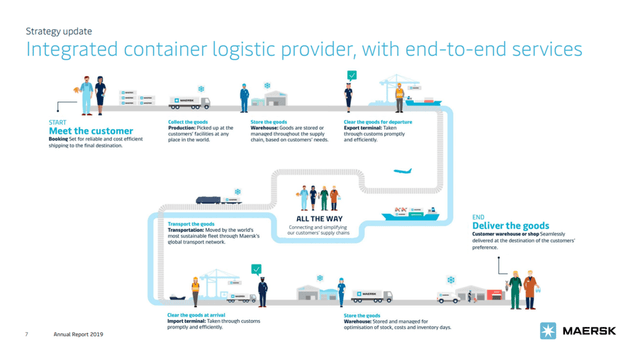

FY2019 Investor Presentation (Maersk Investor)

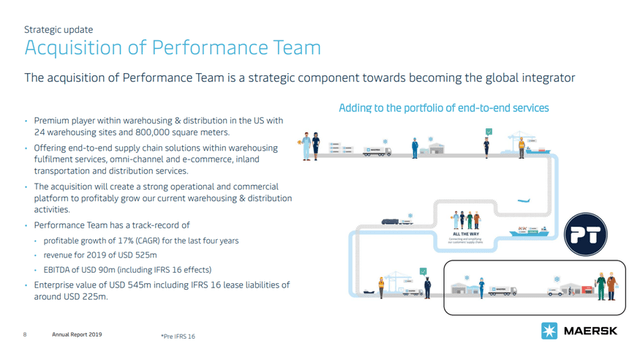

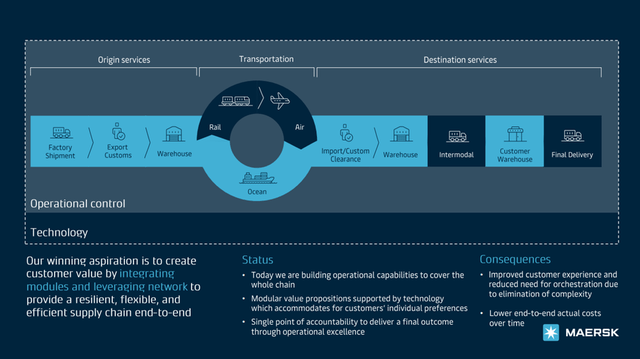

As is obvious from the outlay above, Maersk wished to service the complete worth chain, linking up with clients all the way in which, aiming to create worth in any respect contact factors. Nonetheless, Maersk didn’t have all these choices on the shelf already, and due to this fact landed its first vital acquisition throughout 2019 with Efficiency Workforce, a US-based warehousing and distribution firm, strengthening Maersk’s’ capabilities as an built-in container logistics firm, providing end-to-end provide chain options to its clients. The worth tag, $545 million.

Acquisition Of Efficiency Workforce (Maersk Investor)

As might be seen, this deal aimed toward strengthening the later phases of the worldwide transportation worth chain.

The following huge bounce in L&S’ income befell throughout 2021, which can also be the 12 months of the latest investor day. The investor day befell in Might of 2021 the place administration gave an replace on the strategic outlook for L&S, in addition to the opposite divisions of the group. Being the biggest container freight operator on the planet, there’s restricted development prospects for Maersk on this enviornment, which means administration is placing their consideration elsewhere, to L&S.

The worldwide provide chain up till immediately, has been structured round a mindset of effectivity in a static atmosphere, the place every hyperlink might be relied upon with little interruption. It’s turn into lean to the purpose the place the chain simply breaks in conditions of disruption, as now we have seen plentiful of throughout Covid-19. Maybe by likelihood, however Maersk is hitting the candy spot right here, by aiming to own the complete overview of the transport chain, to supply the wanted flexibility and resilience throughout, for the good thing about clients.

Maersk Provide Chain Finish-To-Finish Technique & Standing (Maersk Investor Day Presentation)

The upset within the international provide and demand stability, has brought on clients to focus extra on long-term worth i.e., reliability, versus conventional procurement with price optimization in focus. Prospects are trying in direction of more and more differentiated options to be able to meet their respective provide chain wants, and that is the place Maersk’s new technique comes into play.

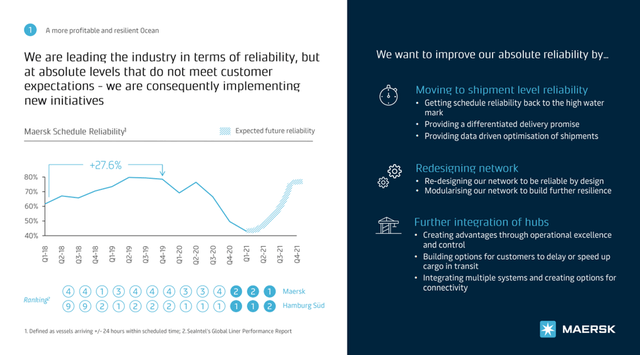

Maersk Business Chief (Maersk Investor Day Presentation)

Maersk views absolute reliability as the largest worth lever for patrons and the muse for the mixing of provide chains, and as such, it’s on this view we should always observe their acquisition technique.

Maersk M&A Roadmap (Maersk Investor Day Presentation)

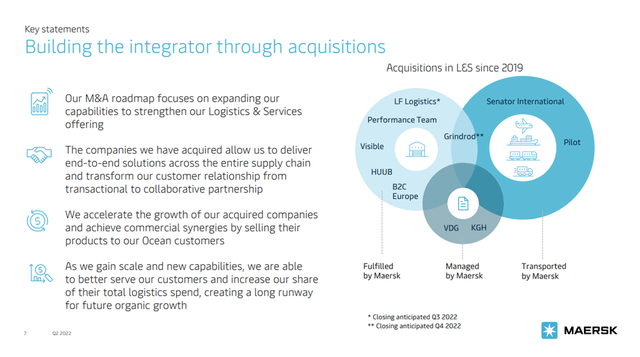

Administration considers L&S as the expansion engine of the longer term, addressing unmet wants amongst clients, as additionally evident by the rising income and EBIT margin all through this era. Up till the investor day in Might, Maersk had accomplished three acquisitions.

- In February 2019, Maersk acquired Vandegrift, a US based mostly customs and commerce compliance knowledgeable enterprise, for an undisclosed value.

- The aforementioned acquisition of Efficiency Workforce for $545 million.

- In September 2020, Maersk acquired KGH Customs Companies, an EU based mostly customs knowledgeable enterprise, for $281 million.

The acquisition bonanza continues:

- In August 2021, Maersk introduced the acquisition of Seen Provide Chain Administration in addition to B2C Europe Holding for $838 million and $86 million respectively. Seen SCM, a US based mostly E-commerce fulfilment firm, with B2C Europe being centered on parcel supply providers.

- In September 2021, Maersk introduced the acquisition of HUUB, a Portugal based mostly cloud logistics start-up, specializing in expertise options for B2C warehousing. Worth is undisclosed, however minor.

- In November 2021, Maersk introduced the acquisition of Senator Worldwide, a German based mostly freight ahead centered on particularly air freight. As well as, Maersk purchases two B777F’s to bolster air freight capability. Acquisition price of $644 million.

- In December 2021, Maersk introduced the acquisition of LF Logistics, a Hong Kong based mostly contract logistics firm with premium capabilities inside omnichannel fulfilment providers. Acquisition price of $3.6 billion.

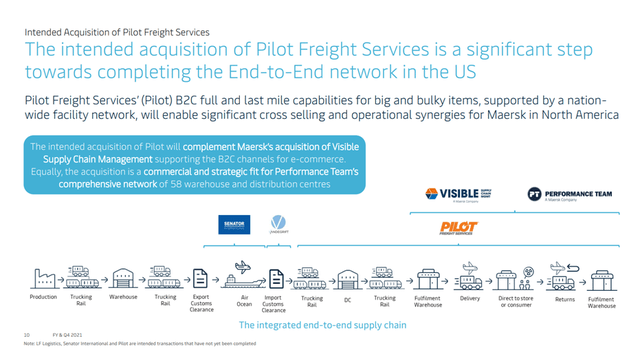

- in February 2022, Maersk introduced the acquisition of Pilot Freight Companies, a US based mostly worldwide and home provide chain supplier with cross-border operations into Canada and Mexico. Acquisition price of $1.68 billion.

Administration labeled the most recent acquisition, as an enormous step in direction of finishing the end-to-end community within the US. The slide beneath, provides a visible illustration of the place Maersk had bolstered its end-to-end choices by way of the numerous latest acquisitions.

Maersk Acquisition Illustration (Maersk Investor, FY2021 Presentation)

The corporate additionally offers one other illustration, the place L&S is damaged down into three sub-parts, fulfilled by Maersk, managed by Maersk and transported by Maersk – right here, it’s proven how the acquisitions tie into the general L&S providing.

Maersk Integrator Technique (Maersk Investor, Q2-2022 Presentation)

All this exercise, financed by the large free money flows from its legacy container operations, is rapidly powering L&S into a considerable enterprise.

Maersk Logistics & Companies Income Improvement (Maersk Investor, Q2-2022 Presentation)

Right here once more, damaged down into the person segments.

Maersk Logistics & Companies Income Breakdown (Maersk Investor, Q2-2022 Presentation)

The place Does This Depart Maersk’s Outlook?

Let’s not get carried away, as of first half of 2022, Maersk Ocean stood for 80.5% of complete income and 91.4% of complete EBITDA, whereas L&S secured 15.5% of complete income and solely 3.4% of complete EBITDA, so there’s a great distance for L&S to turn into the enterprise that makes the needle transfer for Maersk.

Nonetheless, Administration has been placing the free money circulation to good use, nearly eliminating debt, shoring up the stability sheet immensely. Moreover, they’ve constructed the muse for a Maersk that’s supported by a much less risky enterprise within the type of L&S, that can bolster the earnings over the approaching years as Maersk Ocean will most likely have to simply accept a future the place charges come down.

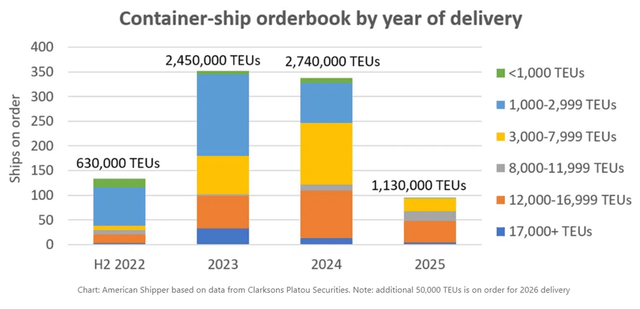

Container Ship Orderbook Outlook (www.freightwaves.com)

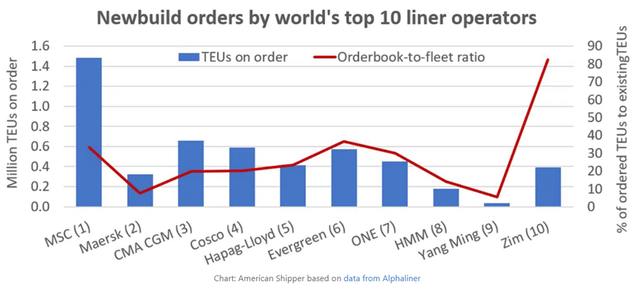

Nobody is aware of the place the brand new equilibrium for container freight charges will probably be, however historical past seems to be repeating itself, as a time of increase in international container freight, all the time results in corporations ordering new builds like there isn’t any tomorrow – with 2022 already being the fifth largest 12 months on file in terms of the rising demand for brand new builds, and we nonetheless have a number of months to go earlier than closing 2022. Naturally, the big gamers can retire present ships inside their fleets, however there’s additionally the chance that provide will as soon as once more begin exceeding demand, inflicting a downwards stress, solely time will inform. As a consequence of the rising order e book, Maersk was additionally unseated as the biggest participant, measured on capability, earlier in 2022. From my vantage level, Maersk is specializing in effectivity in its ocean division, as a substitute of strapping itself with new builds, a course I’m far more supportive of.

Newbuild Orders By Firm (www.freightwaves.com)

For now, nevertheless, I believe Maersk will proceed to safe robust income and equally robust free money flows, that administration will proceed to pour into the rising a part of the enterprise, the L&S division, the place I consider extra acquisitions are to come back, rising the scope in addition to income and income for L&S. I’m happy to see among the volatility being countered in Maersk, and will probably be fascinating to see how far administration can take this.

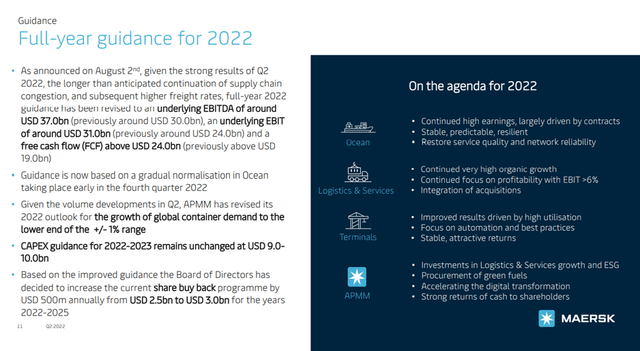

Maersk FY2022 Steering (Maersk Investor, Q2-2022 Presentation)

The complete steering has been up to date, as was anticipated by the market, however Maersk can also be reporting that they’re beginning to witness the rising price stress, one thing that will scale back margins in L&S. Nonetheless, trying to the long-term, this nonetheless seems to be a related and robust strategic transfer by administration.

Wrapping Up

Inside this text, I’ve taken a better take a look at Maersk’s rising division, Logistics & Companies. A division aimed toward providing tailor-made provide chain options to clients, at a precise time the place international provide chains require resilience and the place clients are prepared to pay for such resilience, versus the normal hardcore procurement price financial savings focus. Having earned a ton of cash on the container freight price surge in recent times, administration has allotted a considerable a part of that into L&S, versus doing what shippers all the time do in nice occasions – order loads of new builds. As such, whilst freight charges inevitably come all the way down to discover a new equilibrium, Maersk will possible have a rising enterprise offering earnings apart from its legacy container freight. I consider administration has achieved effectively on this state of affairs, because it removes among the volatility related to container freight charges, a market characterised by robust competitors and little differentiation. Lastly, Maersk additionally has a a lot stronger stability sheet than simply a few years in the past, and in complete a extra significant outlook.

[ad_2]

Supply hyperlink