[ad_1]

jewhyte

Introduction

London-based BP p.l.c. (NYSE:BP) launched its second quarter of 2022 outcomes on August 2, 2022.

Word: I’ve adopted BP quarterly since 2014 with 38 articles and counting. This new article is a quarterly replace of my article revealed on June 8, 2022.

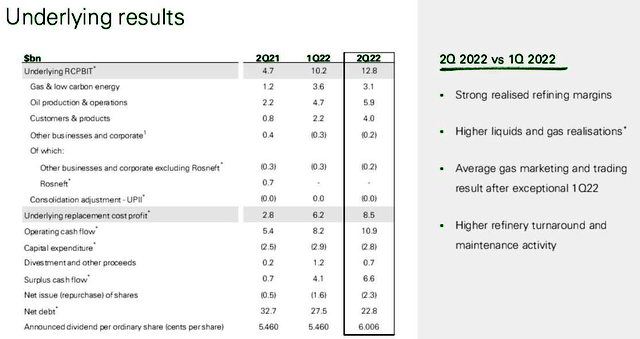

1 – 2Q22 outcomes Snapshot

BP reported second-quarter adjusted earnings of $2.61 per American Depositary Share (“ADS”) on a alternative value foundation beating analysts’ expectations ($0.83 per share in the identical interval a 12 months in the past). The strong quarterly outcomes have been pushed by larger commodity costs and a extra substantial refining enterprise. BP additionally posted robust refinery outcomes.

Complete revenues (together with different investments) have been $69.506 Billion, additionally beating analysts’ expectations. Here’s a 2Q22 snapshot:

BP 2Q22 Underlying outcomes (BP Presentation)

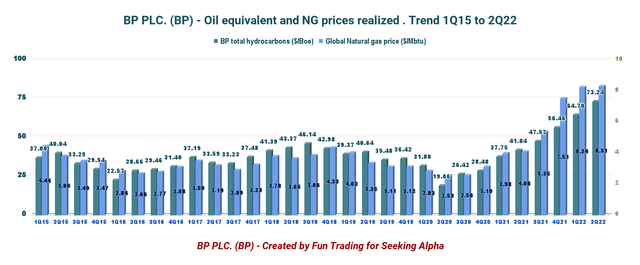

Hydrocarbon worth per $/Boe was up 75% from final 12 months and up 13.2% sequentially.

Word: The value of hydrocarbons acquired by BP this quarter was $73.24 per Boe, and the pure fuel worth was $8.31 per MMBtu.

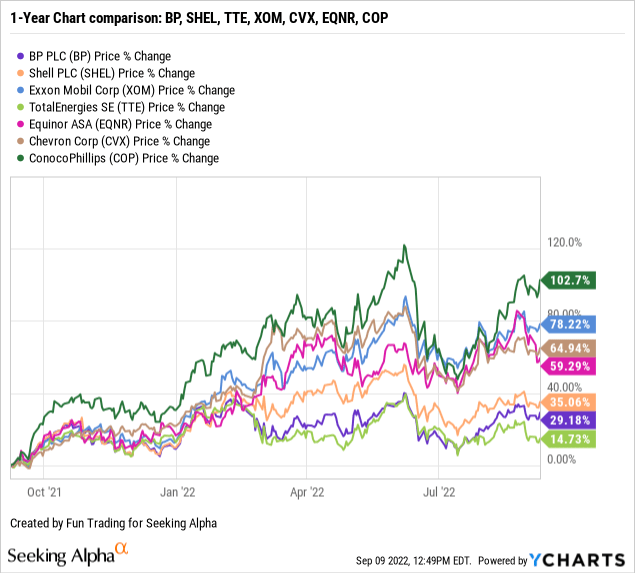

2 – Inventory efficiency

BP is a part of my “seven oil majors” group, together with Exxon Mobil (NYSE: XOM) and Shell Plc (SHEL), Equinor (NYSE: EQNR), TotalEnergies SE (NYSE: TTE), Chevron (NYSE: CVX), and the E&P ConocoPhillips (NYSE: COP). ConocoPhillips just isn’t thought of an oil supermajor, however I consider it is a robust oil firm that belongs to the group.

BP is up 24% on a one-year foundation and has underperformed its friends considerably.

The corporate pays a quarterly dividend of $0.36036 per share, up 10% sequentially, and is again to an almost 4% yield.

CEO Bernard Looney mentioned within the convention name:

At this time’s outcomes present our portfolio doing what it’s purported to do, capturing the upside from larger costs. And because the first chart reveals, over the last decade, we anticipate our oil and fuel EBITDA to stay extremely leveraged to cost as we high-grade our portfolio and cut back manufacturing. That is enabled by EBITDA development coming from simply six materials areas.

3 – Funding thesis

BP is considered one of my long-term investments within the oil business, nevertheless it has been a problematic inventory to handle appropriately with technical points and weaknesses. It is likely one of the world’s main oil corporations that I contemplate protected to maintain for the long run, however provided that you mix a long-term funding with some short-term buying and selling.

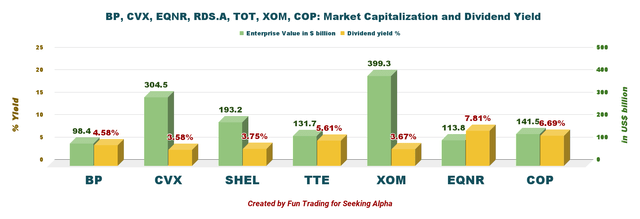

BP Dividend comparability (Enjoyable Buying and selling)

The inventory efficiency has not been stellar in comparison with lots of its friends, and if we have a look at the long run, BP is vastly underperforming the final market.

Thus, I consider long-term buyers ought to proceed accumulating this cyclical inventory on any vital weak point. However, as a result of excessive volatility within the oil business, I like to recommend short-term buying and selling LIFO. About 30% to 40% ought to be allotted for this job to attenuate the dangers of a sudden extreme retracement recurring like clockwork.

BP Plc – Monetary Desk 2Q22: The Uncooked Numbers

Word: Every BP ADS represents six “atypical shares” of BP. Odd shares are the English equal of widespread inventory in a U.S. company.

| BP | 2Q21 | 3Q21 | 4Q21 | 1Q22 | 2Q22 |

| Revenues in $ Billion | 36.47 | 36.17 | 50.55 | 49.26 | 67.87 |

| Complete Revenues and others in $ Billion | 37.60 | 37.87 | 52.24 | 51.22 | 69.51 |

| Internet earnings in $ Billion | 3.12 | -2.54 | 2.33 | -20.38 | 9.26 |

| EBITDA $ Billion | 9.48 | 4.17 | 8.40 | -13.20 | 18.21 |

| EPS diluted in $/share | 0.92 | -0.76 | 0.70 | -6.27 | 2.83 |

| Money from working actions in $ Billion | 5.41 | 5.98 | 6.12 | 8.21 | 10.86 |

| Capital Expenditure Quarterly in $ Billion |

2.44 |

2.67 |

2.77 |

2.60 |

2.67 |

| Free Money Move in $ Billion | 2.98 | 3.31 | 3.34 | 5.61 | 8.20 |

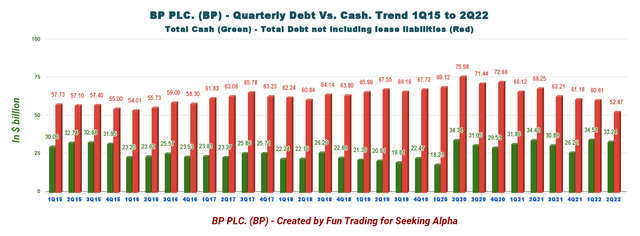

| Complete money (+different investments) $ Billion | 34.42 | 30.89 | 26.22 | 34.51 | 33.24 |

| Gross Debt in $ Billion (not together with lease) | 68.25 | 63.21 | 61.18 | 60.61 | 52.87 |

| Dividend per share in $ | 0.3276 | 0.3276 | 0.3276 | 0.3276 | 0.36036 |

| Shares excellent (diluted) in Billion | 3.394 | 3.358 | 3.327 | 3.252 | 3.270 |

| Oil Manufacturing element and Renewable | 2Q21 | 3Q21 | 4Q21 | 1Q22 | 2Q22 |

| Oil Equal Manufacturing in Okay Boep/d | 2,120 | 2,202 | 2,332 | 2,252 | 2,198* |

| Manufacturing Rosneft in Okay Boep/d | 1,095 | 1,120 | 1,126 | 750 | 0 |

| World liquid worth ($/Boe) | 41.84 | 47.57 | 56.46 | 64.70 | 73.24 |

| World Pure fuel worth ($/M BTU) | 4.08 | 5.35 | 7.41 | 8.24 | 8.31 |

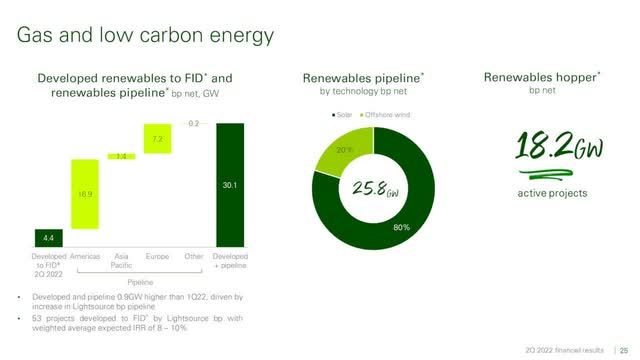

| Complete Developed renewables to FID and Renewables pipeline in web GW | – | – | 27.5 | 29.5 | 30.1 |

Sources: Firm launch

* The whole equal Manufacturing represents the fuel manufacturing operations for 924K Boep/d and oil manufacturing operations for 1,274K Boep/d.

Evaluation: Revenues, Earnings Particulars, Free Money Move, And Upstream Manufacturing

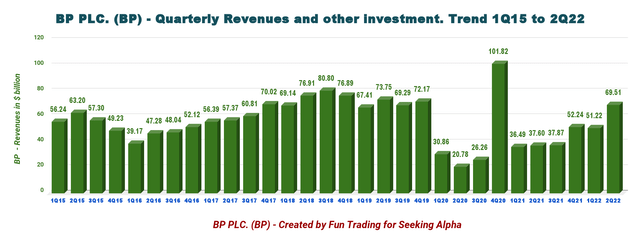

1 – Quarterly whole revenues and different investments have been $69.51 billion in 2Q22

Word: The 4 quarters of 2020 have been restated, which is complicated traditionally.

BP Quarterly Revenues historical past (Enjoyable Buying and selling)

Word: In 2020, revenues from bodily settled spinoff contracts have been reclassified as different working revenues and have been now not offered with revenues from clients’ contracts. It explains the leap in revenues seen in 4Q20.

BP had whole revenues of $69.51 billion for the quarter (oil revenues are $67.87 billion). CapEx within the second quarter of 2022 was $2.67 billion, in contrast with $2.44 billion within the second quarter of 2021.

The earnings attributable to BP’s shareholders within the second quarter was $9.257 billion in comparison with $3.116 billion final 12 months.

Working money movement within the quarter of $10.863 billion consists of $1.2 billion of Gulf of Mexico oil spill funds of $2.9 billion.

Complete divestment and different proceeds for the second quarter have been $0.7 billion, in contrast with $0.2 billion for a similar interval in 2021.

Word in regards to the new tax levy:

On 11 July 2022 the UK authorities launched laws which imposes a brand new levy on the earnings of UK oil and fuel corporations. The brand new levy will enhance the headline price of tax from 40% to 65% on earnings from bp’s North Sea enterprise made out of 26 Might 2022 till 31 December 2025.

2 – Free Money Move (not together with divestitures)

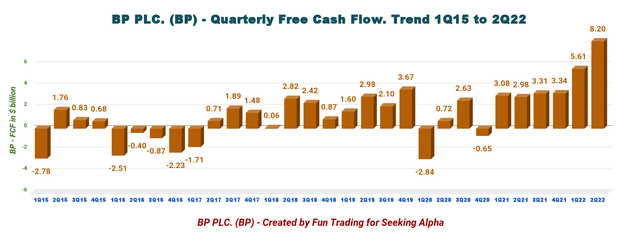

BP Quarterly Free money movement historical past (Enjoyable Buying and selling)

Trailing 12-month free money movement (“ttm”) was $20.459 billion, with a second-quarter of 2022 of $8.197 billion.

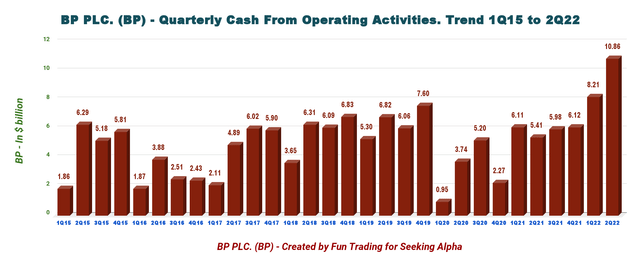

Money movement from operations elevated sequentially to a document of $10.863 billion.

BP Quarterly Money movement from operations historical past (Enjoyable Buying and selling)

Furthermore, the corporate revealed plans to execute a $3.5 billion share buyback, which is predicted to be accomplished earlier than reporting the third-quarter outcomes. BP anticipates shopping for again $1 billion of shares each quarter, primarily based on Brent crude worth at $60 per barrel.

3 – Oil manufacturing (Upstream and now Rosneft out)

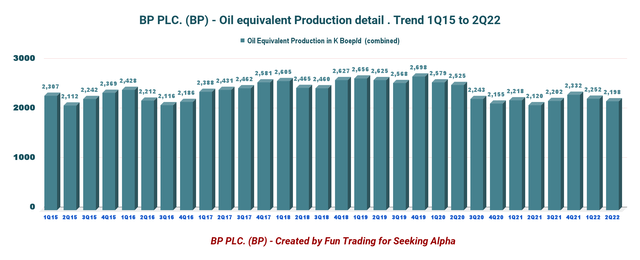

BP Quarterly oil equal manufacturing historical past (Enjoyable Buying and selling)

- Upstream: The quarter’s manufacturing was 2,198K Boep/d, up 3.7% in comparison with final 12 months and down 2.4% sequentially. Oil manufacturing and operations signify 1,274K Boep/d, and fuel and low carbon vitality signify 935K Boep/d.

Costs for oil and pure fuel are actually at a multi-year excessive. The corporate offered its whole hydrocarbon per Boe at $73.24 throughout the second quarter in contrast with $37.75 in the identical interval final 12 months. The pure fuel worth was $8.24 per thousand cubic toes in contrast with $4.08 within the year-ago quarter.

BP Quarterly oil and NG costs historical past (Enjoyable Buying and selling)

- Gasoline and low carbon vitality

Income elevated to $3,080 million in 2Q22 from a revenue of $1,240 million final 12 months, primarily as a result of elevated oil equal manufacturing and worth.

Within the second quarter, whole manufacturing was 924K Boep/d, up from 875K Boep/d final 12 months. Key venture ramp-ups helped once more this quarter.

Additionally, on this class, the corporate signifies the whole developed renewables to FID and renewables pipeline at 29.2 GW, up from 17.1 GW final 12 months.

BP Low carbon 2Q22 (BP Presentation)

-

Oil manufacturing and operations

For the second quarter, the whole manufacturing of 1,274K Boep/d was barely up from 1,245K Boep/d within the year-ago quarter.

After adjusting for non-operating gadgets, underlying alternative value earnings earlier than curiosity and tax for the phase have been $5,902 million. It compares to $2,242 million within the year-ago quarter.

- Buyer & merchandise

Underlying RC earnings earlier than curiosity and tax have been $4,006 million in 2Q22, up from $827 million final 12 months.

BP-operated refining availability on the June-end quarter was 94.4%, rising from 94.1% within the year-ago quarter.

Complete refinery throughputs from the second quarter have been reported at 1,480 thousand barrels per day (MBbl/D), declining from 1,507 MBbl/D within the prior-year quarter.

4 – Internet debt is $27.46 billion in 2Q22 (or $36.13 billion, together with lease liabilities).

“Below IFRS 16, we now acknowledge leases on the stability sheet as proper of use property. This leads to a corresponding lease legal responsibility on the stability sheet, which we’ve disclosed individually to finance debt. Indicated within the convention name.”

BP Quarterly money versus debt historical past (Enjoyable Buying and selling)

BP’s web debt is now $22.82 billion or $30.89 billion, together with lease liabilities. Gearing is 21.9% (27.5% together with leases).

The debt to fairness ratio has dropped to 0.793, which continues to be excessive, however this phase has improved considerably.

5 – Outlook for 2022

For 2022, BP expects a CapEx of $14-15 billion and $14-16 billion every year by means of 2025.

The corporate anticipates upstream manufacturing to stay flat in 2022.

It additionally expects oil and fuel costs to stay excessive within the third quarter as a result of ongoing provide disruptions ensuing from the Russia-Ukraine battle. Therefore, business refining margins shall be elevated within the third quarter.

BP expects to obtain $2-3 billion of divestment and different proceeds this 12 months. BP has acquired $14.7 billion of proceeds from the $25 billion scheduled till 2025.

CEO Bernard Looney defined within the convention name:

Our technique in oil and fuel is to maximise returns and money movement, creating resilience by means of decrease prices, larger margins and decrease working emissions, specializing in the very best barrels, and high-grading by means of divestments and on the proper time and for the proper worth.

Technical Evaluation and commentary

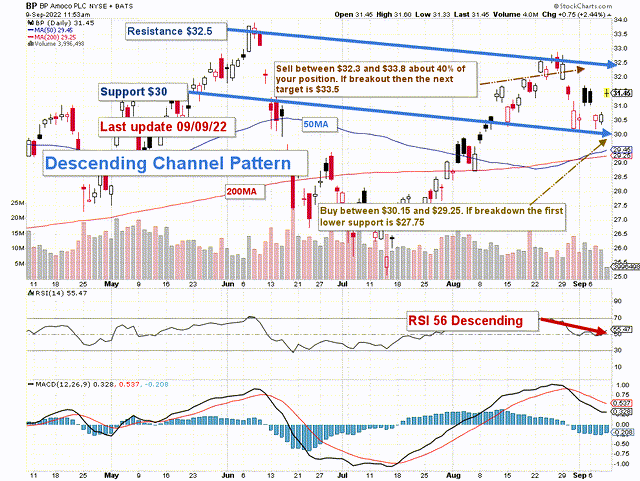

BP TA Chart short-term (Enjoyable Buying and selling StockCharts)

Word: The chart has been adjusted for the dividend.

BP kinds a descending channel sample with resistance at $32.5 and assist at $30.

The buying and selling technique is to promote about 30-40% of your lengthy place, partially between $32.3 and $33.8. If BP crosses the resistance (breakout) as a result of bullish oil costs, the next resistance vary is between $35 and $35.50. Nevertheless, I don’t contemplate this attainable occasion as very seemingly, with oil costs weakening beneath $90 per barrel and a attainable recession materializing by the tip of 2022.

However, if oil costs proceed to weaken, I like to recommend shopping for BP between $30.15 and $29.25 with attainable decrease assist at $27.75.

Word: The LIFO methodology is prohibited underneath Worldwide Monetary Reporting Requirements (IFRS), although it’s permitted in the USA by Usually Accepted Accounting Rules (GAAP). Due to this fact, solely US merchants can apply this methodology. Those that can not commerce LIFO can use another by setting two totally different accounts for a similar inventory, one for the long run and one for short-term buying and selling.

Warning: The TA chart should be up to date regularly to be related. It’s what I’m doing in my inventory tracker. The chart above has a attainable validity of a couple of week. Bear in mind, the TA chart is a instrument solely that will help you undertake the proper technique. It isn’t a strategy to foresee the longer term. Nobody and nothing can.

Writer’s word: In the event you discover worth on this article and want to encourage such continued efforts, please click on the “Like” button beneath to vote of assist. Thanks.

[ad_2]

Supply hyperlink