[ad_1]

The lifetime of Center Japanese nationwide oil corporations was simply too good to proceed as beforehand, raking in unbridled earnings amidst triple-digit oil costs. September 2022 is unlikely to vary something within the grand scheme of issues, nevertheless now greater than ever this yr, fears of demand destruction have been plaguing macroeconomic forecasts and consumption algorithms. With the US already in technical recession and the European Union set to affix it as soon as Q3 ends, there’s not a lot prospect for progress globally, as China, too, struggles to kick-start financial progress once more. Falling outright costs have coincided with flattening futures curves, all of the whereas Libya has come again (even when it seems to be a brief comeback) and Iran is drawing nearer to some semblance of a deal breakthrough. Therefore, September pricing is probably set to be the final month when Center Japanese NOCs can nonetheless be assertive.

Chart 1. Saudi Aramco’s Official Promoting Costs for Asian Cargoes (vs Oman/Dubai common).

Supply: Saudi Aramco.

Saudi Aramco lifted all its Asian costs for September 2022 but confirmed an excessive amount of warning while doing so. Because the Dubai front-to-third-month unfold added one other $1.75 per barrel in July, the expectation was that the will increase could be round that degree, too. After all, with recession fears turning into a staple of the worldwide narrative and with Chinese language demand taking its time to rebound from its lockdown woes, there have been plentiful causes pointing in direction of a possible draw back. To which one would naturally object that Aramco is of course assertive in its pricing, why would it not deprive itself of potential income? Nevertheless, it’s precisely what the world’s largest NOC did, with month-on-month will increase constrained at $0.30-0.80 per barrel, with the most important stream – Arab Gentle – solely being hiked by $0.50 per barrel. Regardless of the warning, the September OSPs mark the best formulation costs on report for many grades offered into Asia, surpassing earlier highs from Might 2022.

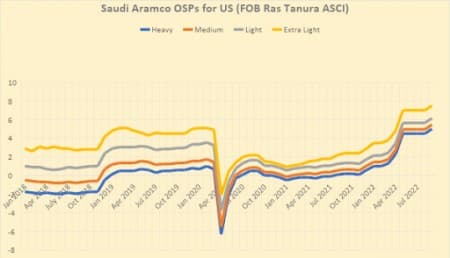

Chart 2. Saudi Aramco’s Official Promoting Costs for US-bound cargoes (vs ICE Brent).

Supply: Saudi Aramco.

European costs turned out to be fairly complicated as by far the most important stream going into Europe, that of Arab Gentle, will see a lower of $0.60 and $0.40 per barrel for NW Europe and the Mediterranean, respectively. This stands in distinction with Arab Medium or Arab Heavy, each of which have been hiked throughout the continent vs August 2022, regardless of being in a lot decrease demand in Europe typically. Maybe much more fascinating have been modifications in costs for US-bound cargoes, with Saudi Aramco bucking the pattern of rolling over the identical differentials since Might 2022 and elevated all formulation costs by $0.50 per barrel. Insinuating that this may be one other micro-episode within the ill-feeling between MBS and the Biden Administration, the ratcheting up of costs comes amid report lows in whole Saudi flows in direction of US patrons, half of what they have been in spring months at roughly 250,000 b/d. Associated: Two Oil Value Crashes Later, Shale Buyers Are Lastly Being Paid

Chart 3. ADNOC Official Promoting Costs for July 2022 (set outright, right here vs Oman/Dubai common).

Supply: ADNOC.

Following the marked sell-out of crude contracts and the concurrent drop in flat costs, the IFAD-set official promoting value for Murban, the UAE benchmark, in September 2022 moved to $105.96 per barrel, nearly $12 per barrel down month-on-month. Above and past recession fears, Emirati pricing is subjected to varied pressures. On the one hand, exports have began to stagnate after nearly a yr of surprisingly constant increments, solely barely under the three million b/d mark in response to Kpler information, testifying to ADNOC’s stellar efficiency in protecting its OPEC+ commitments. However, the enchantment of sunshine candy grades corresponding to Murban is slowly waning in Asia, with the Murban-Dubai unfold dropping some $1.5 per barrel over July, an indication that tough crudes are again in vogue as the sunshine distillates lose steam. This can be seen in a marginal reversal in medium bitter Higher Zakum costs, which have been elevated $0.20 per barrel to a $3 per barrel low cost to Murban.

Chart 4. Iraqi Official Promoting Costs for Europe-bound cargoes (vs Dated Brent).

Supply: SOMO.

The Iraqi state oil marketer SOMO has saved its Asian pricing coverage in step with the Saudis, mountaineering the September OSP of Basrah Medium by $0.60 per barrel, taking it to a premium of $5.10 per barrel over the Oman/Dubai common. The Iraqi grade’s quick peer Arab Medium noticed an equal month-on-month enhance, protecting the unfold between the 2 at a hefty $2.65 per barrel. Actually, even heavier Arab Heavy is having a formulation value larger than Basrah Medium, indicating that Baghdad seeks to construct up a repute of a extra buyer-friendly Center Japanese exporter. In the meantime, Iraqi manufacturing continues to extend. Based on SOMO self-reported figures, output rose to 4.584 million b/d in July, up 70,000 b/d in comparison with June figures. Regardless of the uptick in manufacturing, exports have gone down over the summer season months, likely because of larger crude burn charges just lately because the nation is attempting to keep away from aggravating its energy cuts in peak summer season demand.

Chart 5. Comparability of Center Japanese Medium Bitter Grades, to Europe (ICE Bwave/Brent Dated).

Supply: SOMO.

Arguably probably the most notable deviation from the region-specific pattern of replicating Saudi Aramco strikes, Iraqi pricing into Europe continues to observe a separate path. The low cost of Basrah Medium into Europe stands at $8.10 per barrel to Dated Brent, up $0.25/barrel from August – for reference, Arab Medium into the Mediterranean shall be set at a $2.30 per barrel premium to ICE Brent. Now the distinction within the pricing bases might need been important in instances of runaway backwardation – we had months when Dated was above the front-month of Brent futures by some $5 per barrel – but the current flattening of all curves places Iraq in a far more useful gentle within the eyes of European refiners. Dated-to-frontline under $0.5 per barrel and a whopping $10 per barrel discrepancy between same-quality Iraqi and Saudi is a transparent sign that Iraq is able to tackle formidable objectives.

Chart 6. Iranian Official Promoting Costs for Asia-bound cargoes (vs Oman/Dubai common).

Supply: NIOC.

Iran has turn out to be probably the most talked-about Center Japanese nation currently because the probability of an Iranian nuclear deal breakthrough turned considerably larger after the newest spherical of negotiations. As issues stand proper now, all the problems linked to the lifting of oil sanctions are largely settled while non-energy-related political dilemmas dominate the narrative of the negotiations. Ought to the IRGC be scrapped from the US checklist of Overseas Terrorist Organizations, ought to Iranian property held in different international locations be unlocked (the $7 billion held in South Korean banks), ought to sanctions on Iranian banks be eased? These are all questions on the agenda, if they’re to be settled inside a brand new deal, both Washington or Tehran has to cede. Maybe a mirrored image of an more and more assertive Iran, the month-on-month modifications of the Iranian state oil firm NIOC see it going for greater hikes than Saudi Aramco.

Chart 7. KEB Official Promoting costs for Asian cargoes, in contrast with regional friends (vs Oman/Dubai common).

Supply: KPC.

Kuwaiti nationwide oil firm KPC has had a comparatively simple activity for its two marketed grades, KEC and KSLC, and it has heeded the decision of Saudi Aramco to train warning. The September OSP of KEC was elevated by 65 cents per barrel to a $7.80 per barrel premium to Oman/Dubai, a barely bigger hike than its Arab Medium peer grade, most likely as a result of the bodily availability of Kuwaiti exports is ready to shrink as refinery operations of the Al-Zour refinery are ramping up. Regardless that China stays the most important purchaser of Kuwaiti oil, refiners within the East Asian powerhouse are nonetheless but to renew shopping for the way in which they did it earlier than the virtually endless streak of lockdowns began. The opposite Kuwaiti grade, Kuwait Tremendous Gentle, was hiked by an extra 30 cents per barrel to a $11.05 per barrel premium to Oman/Dubai, although with the flows themselves being lower than 100,000 b/d in quantity, the market influence of it seeing a report excessive, too, will stay roughly restricted.

By Gerald Jansen for Oilprice.com

Extra High Reads From Oilprice.com:

[ad_2]

Supply hyperlink