[ad_1]

jhwephoto

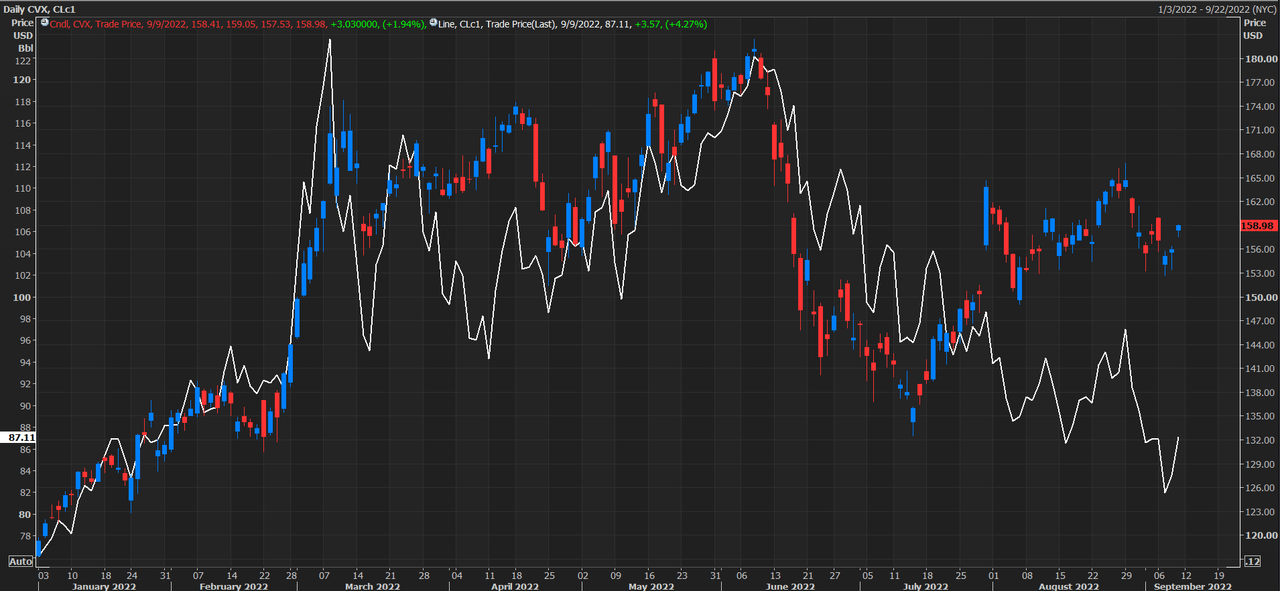

Chevron (NYSE: CVX) accelerated in early 2022 resulting from an uptick in oil (CL1:COM) costs. Nonetheless, crude has lately recovered a big a part of these positive factors, coming nicely from its June peak. In consequence, CVX has slipped greater than 10% from its June excessive.

Does the latest fall in crude oil costs present a shopping for alternative for oil group shares?

fall in oil costs

Oil costs are down almost 30% from mid-June highs, as considerations about financial development have led traders to query medium-term demand. Because of this retreat, CVX has additionally slipped throughout that interval.

Oil now sits beneath its 200-day transferring common and is buying and selling close to $88 a barrel, a far cry from its stage in June, when it traded above $120 a barrel.

Final week, oil costs hit their lowest ranges since earlier than the Russian invasion of Ukraine, which triggered an enormous leap in crude costs beginning in February.

On the availability/demand entrance, the most recent information exhibits crude stock buildup. The Vitality Data Administration reported that crude inventories had been +8.8M barrels, in comparison with the -0.250M consensus, and final week’s figures had been -3.326M.

Beneath is an overlapping chart evaluating the latest worth motion of CVX and Oil:

Nonetheless, regardless of latest ups and downs, Chevron stays climbing excessive on the yr 36% for 2022. For comparability, the Nasdaq Composite (COMP.IND), the S&P 500 (SP500), and the Dow (DJI) are every down. 22.5%, 14.3%And 11.4% respectively.

Wanting on the sector as a complete, opponents resembling ExxonMobil (XOM), Occidental Petroleum (OXY), Marathon Oil (MRO), Devon Vitality (DVN) and ConocoPhillips (COP) have outperformed CVX in 2022. 12 months-to-12 months Efficiency: XOM +53.5%oxy +115.6%MRO +60.9%dvn +59.2%and COP +56.5%,

Is CVX a Purchase?

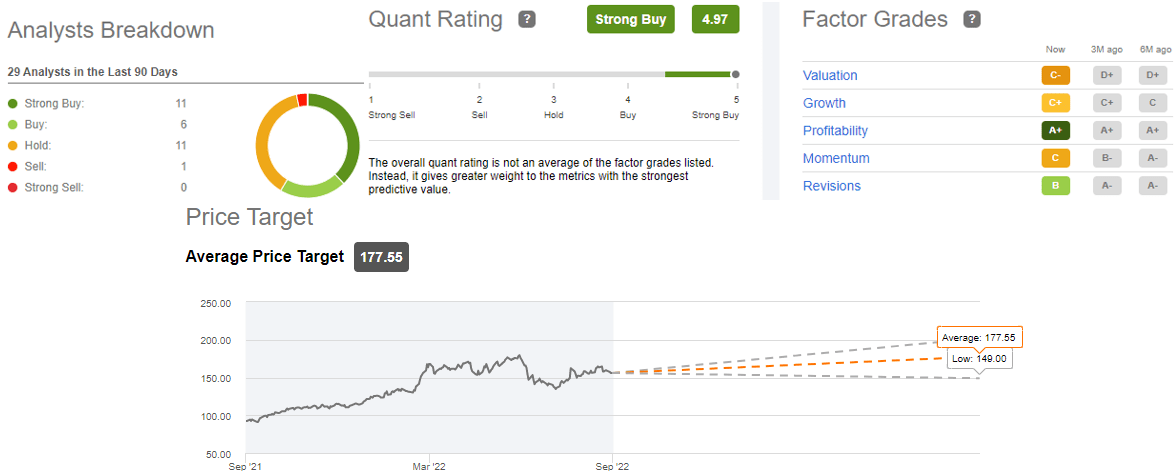

Wall Road shows many opinions on the near-term prospects of Chevron (CVX), though analysts usually present a bullish bias. 17 out of 29 analysts surveyed by Searching for Alpha issued bullish rankings. It comprises 11 robust Purchase Opinions and 6 Purchase Suggestions.

Elsewhere, 11 analysts have issued maintain analysts, whereas one has given promote rankings.

Chevron was buying and selling close to $162 in Monday afternoon buying and selling. In the meantime, analysts have a mean worth goal of $177.55 per share.

Tagging CVX as a powerful purchase, Alpha’s Quant rankings tilted in the direction of the upside. The vitality large receives an A+ for profitability, a C for pace, a C+ for development, and a C- for valuation.

See a breakdown beneath:

Whereas Wall Road and Searching for Alpha’s Quant Rankings have a positive view on Chevron, not everybody shares that opinion. Searching for Alpha contributor JR Analysis sees the corporate as a promote, arguing that CVX’s momentum has stalled following its second-quarter earnings launch.

Then again, SA contributor, Leo Nellison, thinks CVX is a powerful purchase, stating: “The corporate has a powerful stability sheet, constantly falling working bills, and sky-high anticipated free money for years to return.” stream.”

[ad_2]

Supply hyperlink