[ad_1]

Oil costs dropped in a sudden transfer on Wednesday, giving again among the rally this month amid provide disruptions stemming from Russia’s invasion of Ukraine.

WTI crude oil tumbled greater than 12%, or $15, to settle at $108.7 per barrel, registering its worst day since Nov. 26. Earlier this week, WTI topped $130 per barrel briefly — a 13-year excessive — throughout escalated geopolitical tensions.

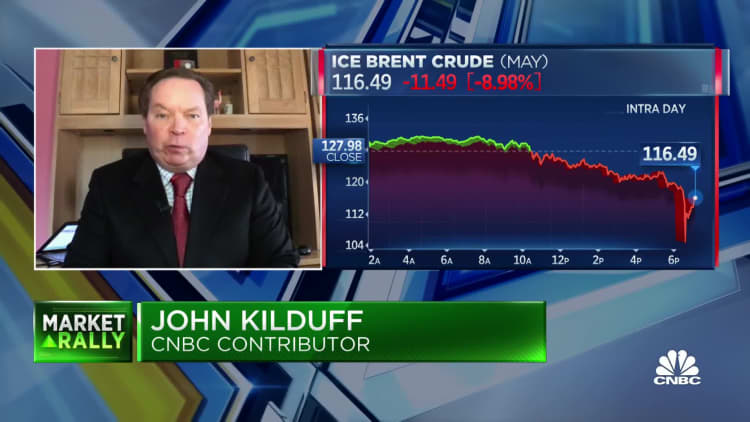

Brent crude oil, the worldwide benchmark, fell the same 13%, or $16.8 to $111.1, for its greatest one-day drop since April 2020. Brent has simply hit $139 on Monday, its highest since 2008.

The transfer in oil decrease got here amid indications of attainable progress by the U.S. in encouraging extra oil manufacturing from different sources. Reuters reported that Iraq mentioned it may improve output if OPEC+ asks. Secretary of State Antony Blinken additionally signaled that UAE would help elevated manufacturing by OPEC+.

A common view of oil tanks within the Transneft-Kozmino Port close to the far jap city of Nakhodka, Russia.

Yuri Maltsev | Reuters

“That $130 value level was factoring within the absolute siege mentality within the oil market, the place we have been staring down probably shedding all Russian output, OPEC not budging and the Ukraine state of affairs simply worsening,” John Kilduff of Once more Capital mentioned on CNBC’s “The Change.” “Now we have reversed all of that, seemingly, to a level no less than. I do not need to get forward of myself.”

Final week, the Worldwide Power Company launched 60 million barrels of oil reserves to compensate for provide disruptions following Russia’s invasion, and the company referred to as the transfer “an preliminary response” and mentioned extra may very well be launched if wanted.

Nonetheless, oil costs have surged this month with WTI crude oil up roughly 15% as Russia, the world’s second-largest crude exporter, invaded Ukraine.

“The world is working collectively to deal with surging oil costs and that has put a short-term prime for crude,” Ed Moya, senior market analyst at Oanda, mentioned in a word.

The UK introduced its personal restrictions on shopping for Russian oil imports, saying it is going to section out the nation’s imports by the top of the 12 months. The European Union additionally unveiled a plan to wean itself off of Russian fossil fuels.

— CNBC’s Jesse Pound contributed reporting.

[ad_2]

Supply hyperlink